CA FTB 540 2EZ 2015 free printable template

Show details

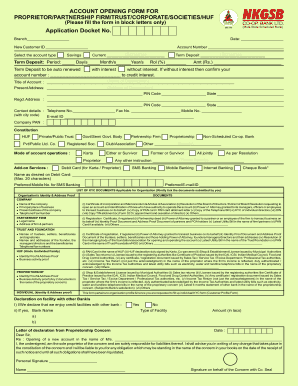

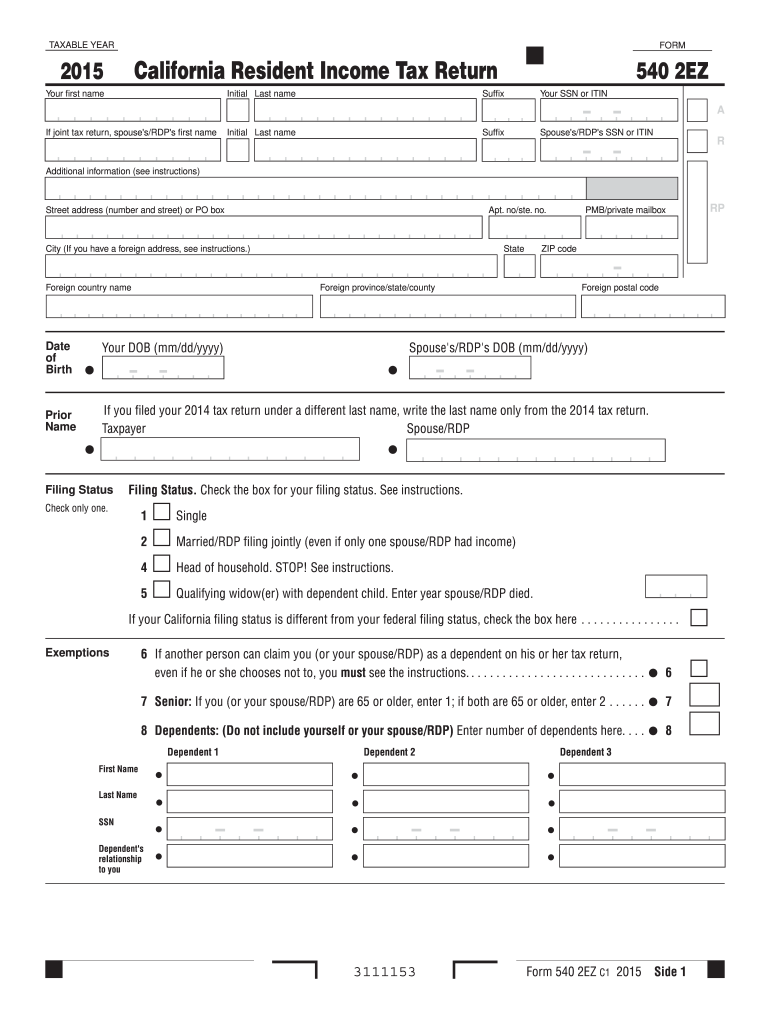

See instructions. This space reserved for 2D barcode Side 2 Form 540 2EZ C1 2015 Voluntary Contributions Code Amount California Seniors Special Fund. See instructions. Exemptions First Name Last Name SSN Dependent s relationship to you 3111153 Form 540 2EZ C1 2015 Side 1 Your name Whole dollars only Taxable Income and Credits 10 Total interest income Form 1099-INT box 1. Check for Errors Help Reset Form Print Form TAXABLE YEAR FORM California Resident Income Tax Return Your first name Initial...Last name 540 2EZ Suffix Your SSN or ITIN A If joint tax return spouse s/RDP s first name Initial Last name Spouse s/RDP s SSN or ITIN R Additional information see instructions Street address number and street or PO box Apt. no/ste. no. City If you have a foreign address see instructions. Foreign country name Date of Birth State ZIP code Foreign province/state/county Your DOB mm/dd/yyyy RP PMB/private mailbox Foreign postal code Spouse s/RDP s DOB mm/dd/yyyy Prior If you filed your 2014 tax...return under a different last name write the last name only from the 2014 tax return* Name Taxpayer Spouse/RDP Filing Status Check only one. m Single 2 m Married/RDP filing jointly even if only one spouse/RDP had income 4 m Head of household. STOP See instructions. 5 m Qualifying widow er with dependent child. Enter year spouse/RDP died* If your California filing status is different from your federal filing status check the box here. 6 If another person can claim you or your spouse/RDP as a...dependent on his or her tax return even if he or she chooses not to you must see the instructions. m 7 Senior If you or your spouse/RDP are 65 or older enter 1 if both are 65 or older enter 2. 8 Dependents Do not include yourself or your spouse/RDP Enter number of dependents here. See instructions. 10 11 Total dividend income Form 1099-DIV box 1a. See instructions. 11 12 Total pension income. See instructions. Taxable amount. 12 Enclose but do not staple any payment. 9 Total wages federal Form...W-2 box 16. See instructions. 9 13 Total capital gains distributions from mutual funds Form 1099-DIV box 2a. See instructions. 13 16 Add line 9 line 10 line 11 line 12 and line 13. 16 17 Using the 2EZ Table for your filing status enter the tax for the amount on line 16. Caution If you checked the box on line 6 STOP. See instructions for completing the Dependent Tax Worksheet. 17 18 Senior exemption See instructions. If you are 65 or older and entered 1 in the box on line 7 enter 109. If you...entered 2 in the box on line 7 enter 218. 18 19 Nonrefundable renter s credit. See instructions. 19 20 Credits. Add line 18 and line 19. 20 21 Tax. Subtract line 20 from line 17. If zero or less enter -0-. 21 23 Earned Income Tax Credit EITC. See instructions for FTB 3514. 23 24 Total payments. Add line 22 and line 23. 24 26 Payments balance. If line 24 is more than line 25 subtract line 25 from line 24. 26 27 Use Tax balance. If line 25 is more than line 24 subtract line 24 from line 25. 27...Overpaid Tax/ Tax Due. 22 Total tax withheld federal Form W-2 box 17 or Form 1099-R box 12.

pdfFiller is not affiliated with any government organization

Instructions and Help about CA FTB 540 2EZ

How to edit CA FTB 540 2EZ

How to fill out CA FTB 540 2EZ

Instructions and Help about CA FTB 540 2EZ

How to edit CA FTB 540 2EZ

To edit the CA FTB 540 2EZ tax form, begin by downloading the form from the California Franchise Tax Board (FTB) website or a trusted source like pdfFiller. Use a PDF editor, such as the editing tools provided by pdfFiller, to input all necessary information. Ensure to review the details for accuracy after completing the form.

How to fill out CA FTB 540 2EZ

To fill out the CA FTB 540 2EZ, follow these steps:

01

Gather all required information, including your Social Security number, income details, and deductions.

02

Complete the personal information section at the top of the form.

03

Report your income, adjustments, and deductions in the designated areas.

04

Follow the instructions for calculating your tax owed or refund due.

05

Sign and date the form before submitting it.

About CA FTB 540 2EZ 2015 previous version

What is CA FTB 540 2EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CA FTB 540 2EZ 2015 previous version

What is CA FTB 540 2EZ?

CA FTB 540 2EZ is a simplified tax form designed for California residents with straightforward tax situations. It allows eligible filers to report their income and claim deductions more easily than the standard Form 540. This form streamlines the process for those who qualify, making it a popular choice for individuals with simpler tax filings.

What is the purpose of this form?

The purpose of CA FTB 540 2EZ is to enable eligible residents of California to file their state income taxes efficiently and accurately. This form is intended for individuals who do not need to report complex income sources or claim specific credits requiring additional documentation, thus simplifying the filing process.

Who needs the form?

Individuals who need to use CA FTB 540 2EZ are typically those with a straightforward financial situation. This includes single or married filers with no dependents, total income below a certain threshold, and who do not have special circumstances like rental income, business income, or complex deductions. Review state guidelines to confirm eligibility before filing.

When am I exempt from filling out this form?

You may be exempt from filling out CA FTB 540 2EZ if your total income exceeds the set limit, if you have any dependents, or if you are filing as married filing separately but your spouse is not also filing. Additionally, if you have any claims outside the basic standard deductions or require additional schedules, you will not qualify to use this simplified form.

Components of the form

The key components of CA FTB 540 2EZ include sections for taxpayer information, income reporting, and tax calculations. The form consists of simplified fields for entering income types, such as wages, interest, and dividends, as well as sections for claiming standard deductions. Ensure that all information is accurate to avoid issues with processing.

Due date

The due date for filing CA FTB 540 2EZ coincides with the federal tax deadline, typically April 15th. If this date falls on a weekend or holiday, the due date may be extended to the next business day. It is essential to file by the deadline to avoid penalties and interest on taxes owed.

What are the penalties for not issuing the form?

Failing to file CA FTB 540 2EZ by the due date may result in penalties from the California Franchise Tax Board. Typically, late filing penalties can range from 5% to 25% of the unpaid tax amount. Additionally, interest accrues on any unpaid taxes starting from the due date until the tax is paid in full.

What information do you need when you file the form?

When filing CA FTB 540 2EZ, gather the following information: your Social Security number, income statements (W-2s, 1099s), documentation for any deductions or credits you may claim, and bank account information for direct deposit or payment. Having this information readily available will facilitate accurate and speedy filing.

Is the form accompanied by other forms?

CA FTB 540 2EZ typically does not require accompanying forms if you meet the eligibility criteria. However, if you have specific circumstances, such as income from sources that require separate documentation, additional forms may be necessary. Review the instructions carefully to ensure compliance.

Where do I send the form?

The completed CA FTB 540 2EZ should be mailed to the address specified in the instructions. This address can vary based on whether you are expecting a refund or need to make a payment. Ensure to check the latest guidelines on the California FTB website to confirm the correct mailing address for your submission.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Awesome; just what I needed. Easy to use and the costs is very affordable.

this is way too expensive for how basic it is...

See what our users say