Get the free 2015 Optional Tax Tables

Show details

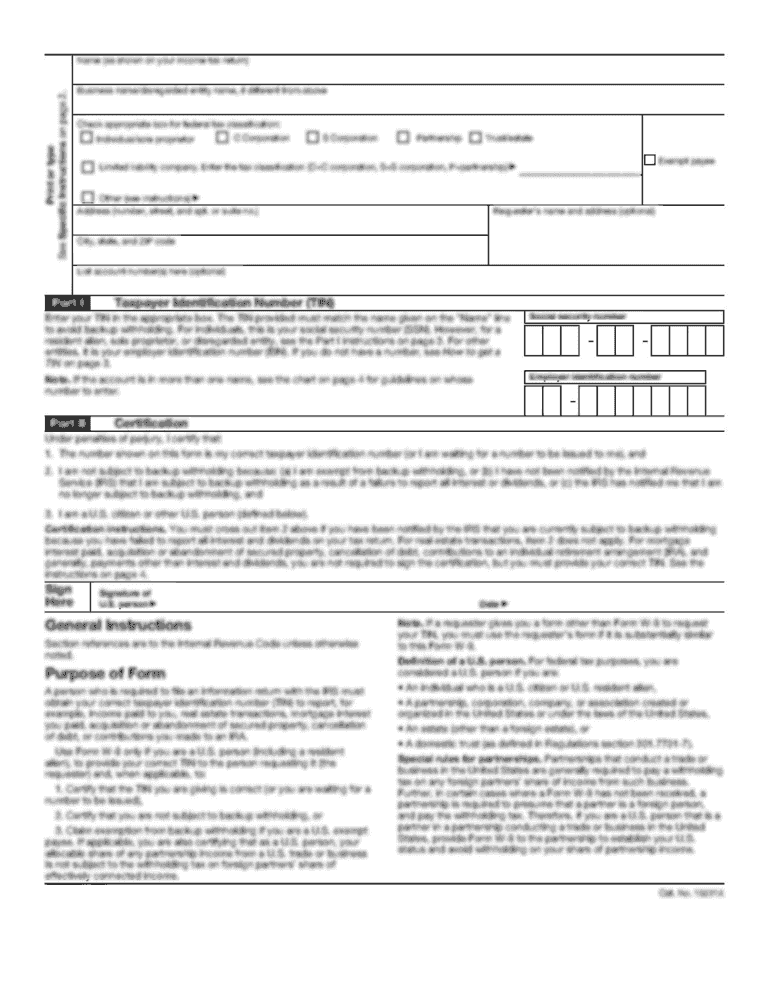

Arizona Form 140 2015 Optional Tax Tables If your taxable income is less than $50,000, use the Optional Tax Tables. If your taxable income is $50,000 or more, use Tax Table X or Y. Also, if your taxable

We are not affiliated with any brand or entity on this form

Instructions and Help about 2015 optional tax tables

How to edit 2015 optional tax tables

How to fill out 2015 optional tax tables

Instructions and Help about 2015 optional tax tables

How to edit 2015 optional tax tables

To edit the 2015 optional tax tables, use tools that allow for form customization and data entry. With pdfFiller, users can easily input their information and make necessary adjustments directly on the form. This feature ensures that all details are accurate before submission.

How to fill out 2015 optional tax tables

Filling out the 2015 optional tax tables involves providing specific financial information and selecting applicable filing statuses. First, gather all necessary financial documentation, such as income statements and deduction proofs. Then, follow these steps:

01

Identify your filing status.

02

Refer to the tax table to locate the appropriate category based on your income range.

03

Record any eligible credits and deductions as indicated.

Ensure that all figures are accurate to avoid penalties and delays in processing.

Latest updates to 2015 optional tax tables

Latest updates to 2015 optional tax tables

No significant updates have been made to the 2015 optional tax tables since their release, but it is crucial to stay informed about changes to related tax laws that might affect filing. Always check IRS announcements for any adjustments or recommendations.

All You Need to Know About 2015 optional tax tables

What is 2015 optional tax tables?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2015 optional tax tables

What is 2015 optional tax tables?

The 2015 optional tax tables are designed by the IRS to assist taxpayers in calculating their tax liability based on their income and filing status. This form provides a simplified approach to determining taxes owed without needing to compute a detailed calculation manually.

What is the purpose of this form?

The primary purpose of the optional tax tables is to streamline the tax filing process for individual filers. By allowing taxpayers to quickly reference their income against a set of predefined amounts, the form promotes ease and efficiency during tax season.

Who needs the form?

Any taxpayer who is required to file an income tax return for the year 2015 may use the optional tax tables to determine their tax liability. This includes individuals, joint filers, and those who qualify for certain credits or deductions.

When am I exempt from filling out this form?

Taxpayers are generally exempt from using the optional tax tables if their income falls below a certain threshold or if they meet specific criteria that eliminate their tax obligation. Additionally, individuals claiming certain types of income or deductions may be advised to use different methods for tax calculations.

Components of the form

The components of the 2015 optional tax tables include various income brackets, corresponding tax rates, and information regarding available deductions. Each section is well-structured to facilitate quick reference for taxpayers during the completion of their tax returns.

What are the penalties for not issuing the form?

Failure to use the 2015 optional tax tables properly could result in incorrect tax calculations, leading to potential penalties or interest on underpayments. Additionally, if taxpayers omit essential tax information due to not referencing these tables, they may face audits or further scrutiny from the IRS.

What information do you need when you file the form?

When filing using the optional tax tables, gather the following information:

01

Your total income for the year

02

Filing status (single, married filing jointly, etc.)

03

Documented credits and deductions claimed

This information will help determine your taxable income and the taxes owed accurately.

Is the form accompanied by other forms?

The 2015 optional tax tables may not need to be filed on their own but rather complement the main tax return forms, such as Form 1040 or Form 1040A. Ensure all associated forms are accurately completed and submitted together for compliance.

Where do I send the form?

The completed optional tax tables, along with the main tax return form, should be mailed to the address specified by the IRS based on your filing location and any additional instructions provided in official documentation. Check the IRS website for the latest mailing guidelines.

See what our users say