Who needs a personal property return?

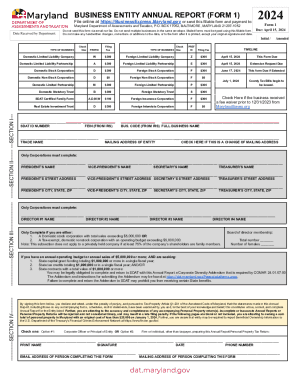

Department of Assessments and Taxation in Maryland issues this package of documents for corporations, limited liability companies, limited liability partnerships, limited partnerships, business trusts, real estate investment trusts. They must report changes in their personal property over the last year.

What is a personal property return for?

It serves to keep track of business personal property taxes, count them correctly, pay them and report payments on time. This particular package is designed for business taxpayers in the State of Maryland.

Is it accompanied by other forms?

This particular form contains a personal property return and addenda — Form 4A, or a Balance Sheet, Form 4B — Depreciation Schedule, Form 4C — Disposal and Transfer Reconciliation. It also contains detailed instruction for filling out every section. Manufacturing/R&D application deadline is September, 1st.

When is personal property return due?

It must be filed annually, at the end of tax year, which usually falls on April, 16.

How do I fill out a personal property return?

Use the instructions on pages 7 through 14 to determine what sections you should fill out depending on the type of business that reports to the Department of Taxation. There are also mailing instructions and important reminders about the due dates and other issues on page 6. There is a filing fee of $300. Remove the cover sheet and instructions on page 7-14 before you send this return. Don’t pay any late filing fees before you receive confirmation from the Department of Taxation about accepting this return.

Where do I send it?

This return can be filed electronically on the SEAT website. The mailing address for paper copies is as follows:

State of Maryland

Department of Assessments and Taxation

Personal Property Division

PO Box 17052

Baltimore MD 21297-1052