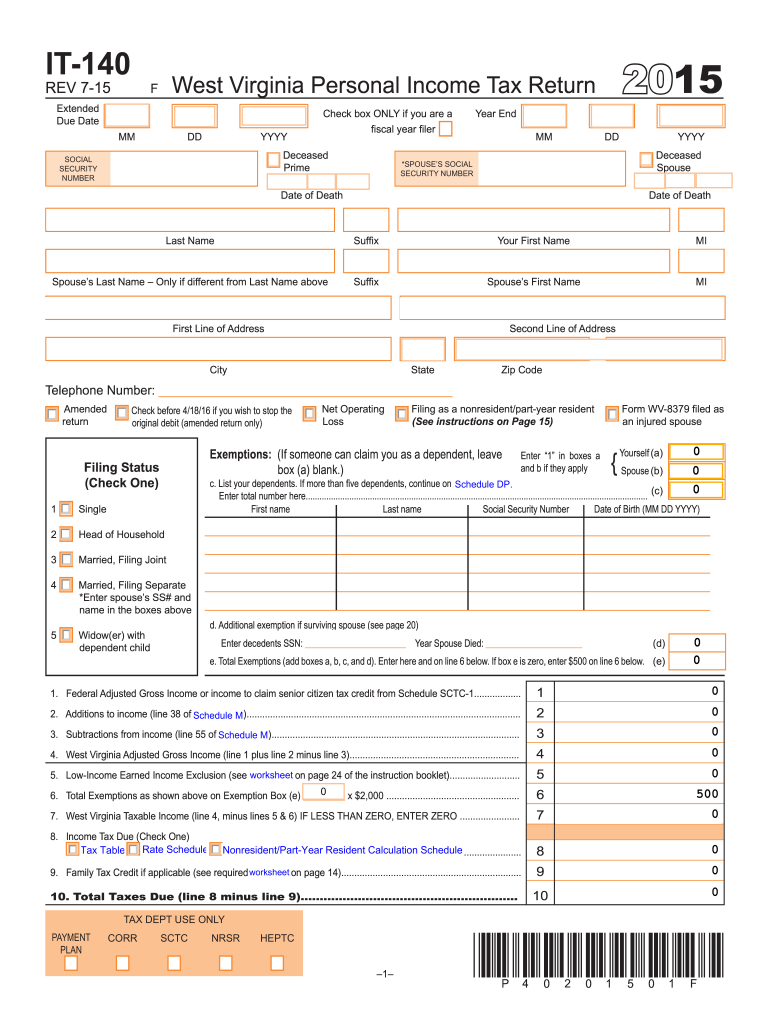

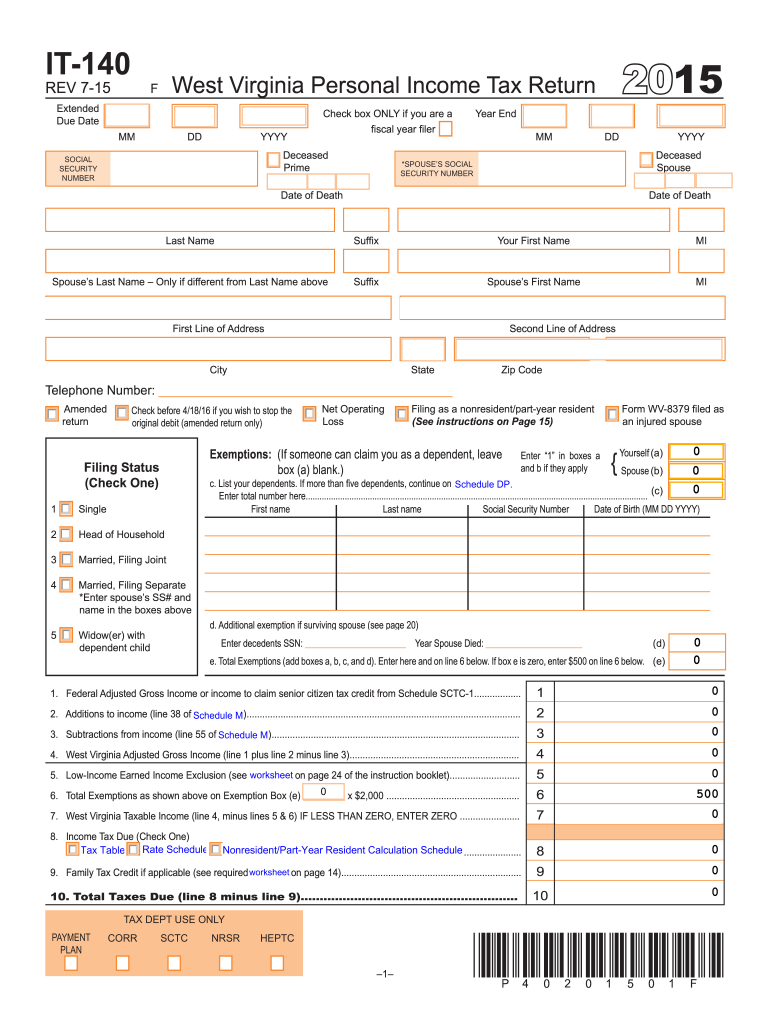

WV DoR IT-140 2015 free printable template

Get, Create, Make and Sign WV DoR IT-140

How to edit WV DoR IT-140 online

Uncompromising security for your PDF editing and eSignature needs

WV DoR IT-140 Form Versions

How to fill out WV DoR IT-140

How to fill out WV DoR IT-140

Who needs WV DoR IT-140?

Instructions and Help about WV DoR IT-140

Laws dot-com legal forms guide petition for alien workers form I 144 my one forty is a form issued by the Department of Homeland Services or DHS employers must complete and submit this form in order to obtain a visa for any foreign citizen they wish to employ the form can be obtained directly from the website of the Department of Homeland Services a ×580 submission fee must be included with the application step 1 in part 1 enter your full name address the name of the business you are completing the form on behalf of and your IRS tax number step 2 in part 2 check the box next to the line that describes the type of worker you are trying to bring over be sure to consult the instructions provided by the DHS for what kind of additional evidence must be attached to substantiate the status of the employee in question step 3 in part 3 provide the name address and contact information of the person you are filling out the form on behalf of including their current nationality if they are already in the United States note their date of entry into the country current status and information about their i-94 status this is the visa that must be produced on arrival and departure in the United States step 4 indicate whether the worker in question will apply for a visa at an embassy abroad or will be adjusting their status within the United States provide their foreign address if you have listed an American address previously now at any other petitions being filed along with this one step 5 provide the name of the business filing the petition along with information about income number of employees and other information requested if an individual provide your name and annual income step 6 describe the job in non-technical terms indicate whether the position is part or full-time and lists what the wages will be step 7 lists the name age gender country of birth and relationship to the worker in question of all children or spouses step 8 sign and date the form including your contact information to watch more videos please make sure to visit laws dot-com

People Also Ask about

What is an IRS Form 140?

What forms do I need to file quarterly taxes?

Where can I get federal tax forms and booklets?

Do you have to make estimated quarterly tax payments?

How do I pay my quarterly taxes 2022?

What is WV it 140 form?

How do I pay my taxes quarterly?

Does the IRS send a form for estimated tax payments?

What form do I use to pay quarterly taxes?

How do I pay quarterly taxes in WV?

How do I pay 2022 quarterly taxes?

Can you print tax forms front and back?

Who has to file a WV tax return?

Can I pay my quarterly taxes all at once?

Does West Virginia require estimated tax payments?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify WV DoR IT-140 without leaving Google Drive?

Can I edit WV DoR IT-140 on an iOS device?

How can I fill out WV DoR IT-140 on an iOS device?

What is WV DoR IT-140?

Who is required to file WV DoR IT-140?

How to fill out WV DoR IT-140?

What is the purpose of WV DoR IT-140?

What information must be reported on WV DoR IT-140?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.