Get the free OGE Form 450, Confidential Financial Disclosure Report

Show details

This document provides guidelines and requirements for filing the OGE Form 450, a Confidential Financial Disclosure Report for government employees, aimed at identifying potential conflicts of interest.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oge form 450 confidential

Edit your oge form 450 confidential form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oge form 450 confidential form via URL. You can also download, print, or export forms to your preferred cloud storage service.

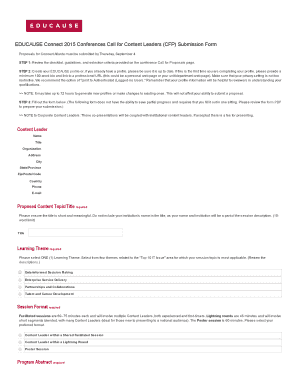

Editing oge form 450 confidential online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit oge form 450 confidential. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

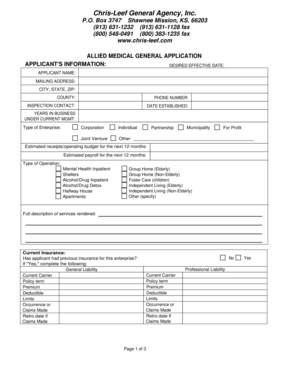

How to fill out oge form 450 confidential

How to fill out OGE Form 450, Confidential Financial Disclosure Report

01

Obtain the OGE Form 450 from the Office of Government Ethics website or your agency's ethics office.

02

Begin by filling out your personal information, including your name, title, position, and agency.

03

Complete the section on financial interests, including any assets, income, and liabilities.

04

Report any transactions you have made, including the sale or purchase of stocks, bonds, or real estate.

05

Disclose any gifts received over a certain value, as dictated by the guidelines.

06

Include any outside positions held, such as board memberships or consultancies.

07

Review the form thoroughly to ensure all sections are filled out correctly.

08

Sign and date the form before submitting it to your agency's ethics office or designated official.

Who needs OGE Form 450, Confidential Financial Disclosure Report?

01

Federal employees who hold a position classified as a ‘covered position’ under the Ethics in Government Act.

02

Employees in positions that may involve significant decision-making authority affecting finances or resource allocations.

03

Certain political appointees and senior officials within federal agencies.

04

Anyone required to disclose potential conflicts of interest to ensure transparency and ethical conduct.

Fill

form

: Try Risk Free

People Also Ask about

What is a confidential financial disclosure report (OGE) form 450?

The purpose of this report is to assist employees and their agencies in avoiding conflicts between official duties and private financial interests or affiliations. The information you provide will only be used for legitimate purposes, and will not be disclosed to any requesting person unless authorized by law.

What is the difference between OGE Form 450 and 278?

Schedule A, Assets and Income. Reportable information for an OGE Form 278 is more detailed than a 450. It requires reporting the value of the asset by range, as well as the type and range of income. Also, more information is reportable on the OGE Form 278.

What is a financial disclosure report?

Account balance information, payment history, overdraft history, and credit or debit card purchase information. The fact that an individual is or has been a consumer of a financial institution or has obtained a financial product or service from a financial institution.

Which of the following assets is not required to be reported on an OGE 450 financial disclosure?

Do Not Report: Federal Government retirement benefits, Thrift Savings Plan, certificates of deposit, savings or checking accounts, term life insurance, money market mutual funds and money market accounts, personal residence (unless rented), diversified mutual funds (e.g., ABC Equity Value Fund), US Government Treasury

What is standard form 450?

The standard form of 450 is 4.50 * 10^2. To get this answer first change 450 to a number between 1 and 10. Then multiply be a multiple of 10. Finally, change the multiple of 10 to an exponent.

What is an OGE 450 confidential financial disclosure report?

The purpose of this report is to assist employees and their agencies in avoiding conflicts between official duties and private financial interests or affiliations. The information you provide will only be used for legitimate purposes, and will not be disclosed to any requesting person unless authorized by law.

What is considered confidential financial information?

Reporting assets that need not be reported. Do not report on your OGE Form 450 bank deposits, money market accounts and funds, and U.S. Government securities. 6. Not providing your or your spouse's non-Federal Government pension or retirement plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is OGE Form 450, Confidential Financial Disclosure Report?

OGE Form 450 is a document that federal employees must complete to disclose their financial interests and outside activities that could create potential conflicts of interest.

Who is required to file OGE Form 450, Confidential Financial Disclosure Report?

Federal employees in certain positions, particularly those in the executive branch and some non-career positions, are required to file OGE Form 450.

How to fill out OGE Form 450, Confidential Financial Disclosure Report?

To fill out OGE Form 450, individuals must provide information about their financial interests, including details about assets, liabilities, and outside positions, as well as sign and submit the form as directed by their agency.

What is the purpose of OGE Form 450, Confidential Financial Disclosure Report?

The purpose of OGE Form 450 is to help ensure that federal employees are in compliance with ethics laws by disclosing financial interests that might conflict with their official duties.

What information must be reported on OGE Form 450, Confidential Financial Disclosure Report?

Reportable information on OGE Form 450 includes details about personal assets, liabilities, outside employment, business relationships, gifts, and any affiliations with outside organizations.

Fill out your oge form 450 confidential online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oge Form 450 Confidential is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.