Get the free pa rev 775

Get, Create, Make and Sign pa rev 775

How to edit pa rev 775 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pa rev 775

Steps to fill out PA Rev 775:

Who needs PA Rev 775?

Instructions and Help about pa rev 775

Hey Zack release you master here this is our new ad u7 Autosport, so you're probably familiar with our ad you liner displays we've got the ad u5 and the ATU 7 which are both full color displays functionally they're exactly the same they have the same screen resolution just different screen size this is the 7-inch behind me about twice as big in terms of actual screen area than the 7, but they have the same number of inputs same number of outputs etc the AEU 7 Autosport is a new version that has aptly named an auto sport connector this is a connector made by Deutsche these are used in most of your highest and tiers of racing, so this is a machined aluminum housing it's extremely compact this is a leave a 30-7 terminal connector, and it's got these tiny little size 22 gold-plated contacts its just extremely high-end stuff, so it's very nice it's weatherproof the connector is and this is kind of our high-end version of the 87 — so some basic features of the — it is full-color it's got a great brightness it has 8 analog inputs and log inputs are 4 pressures temperatures you can use rotary switch inputs to change pages so anything that's you know 0 to 5 volts or even 0 to 12 volts is an analog input really they read 0 to 5 volts it's got eight digital inputs which would be four switches wheel speed inputs etc it has two outputs, so they're low side outputs meaning you can trigger a couple of relays let's say you want to define some outputs and control you know fuel pump coolant pump water math whatever you can trigger that from the ad you — it also has an analog voltage output meaning in program a voltage output from 0 to 5 volts from that terminal on the dash it has two can bus networks you can operate those at different speeds so let's say you're integrating with other devices you can set them up to whatever speed those devices need so let's say you've got all the stuff on here everything's set to one megabit per second you could have it all on one can bus if you have some devices that have a fixed speed like 500 kilobits per second or 250 you could set the second bus to that anyway so the Autosport version again it's just got this gorgeous connector on the back of it identical to the 87 otherwise the connector is the only difference the same brightness same screen same how on the front just an upgrade on the connector that's a quick rundown it's got a ton of other features I'll make a longer video about all the features, but I don't know if you can see enough detail here, but you can use our thermal cameras you can watch your tire temps in the real time you can watch all of your current in a real time from a PM u16 or any other device you can create pages to your liking to put any information you want on them, you can set automatic warnings to pop up if something gets out of spec one of these pages here people ask all the time if you have a street version or a race version you only have one version of the dash be using create your own custom icons...

People Also Ask about

Do I have to file a nonresident PA return?

Can I claim union dues on my PA state taxes?

Do I need to file a nonresident state tax return Pennsylvania?

Do I need to file a NJ nonresident tax return if I live in PA?

What forms must be attached to PA tax return?

What is the form for unreimbursed employee expenses?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pa rev 775 in Chrome?

Can I create an eSignature for the pa rev 775 in Gmail?

How can I fill out pa rev 775 on an iOS device?

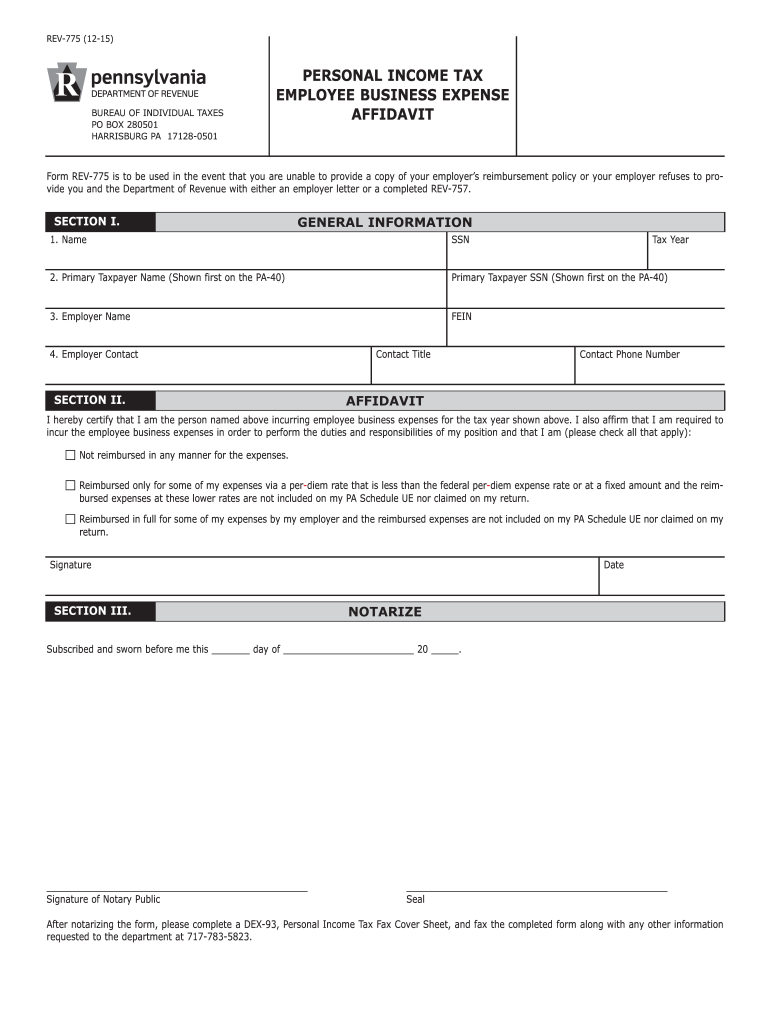

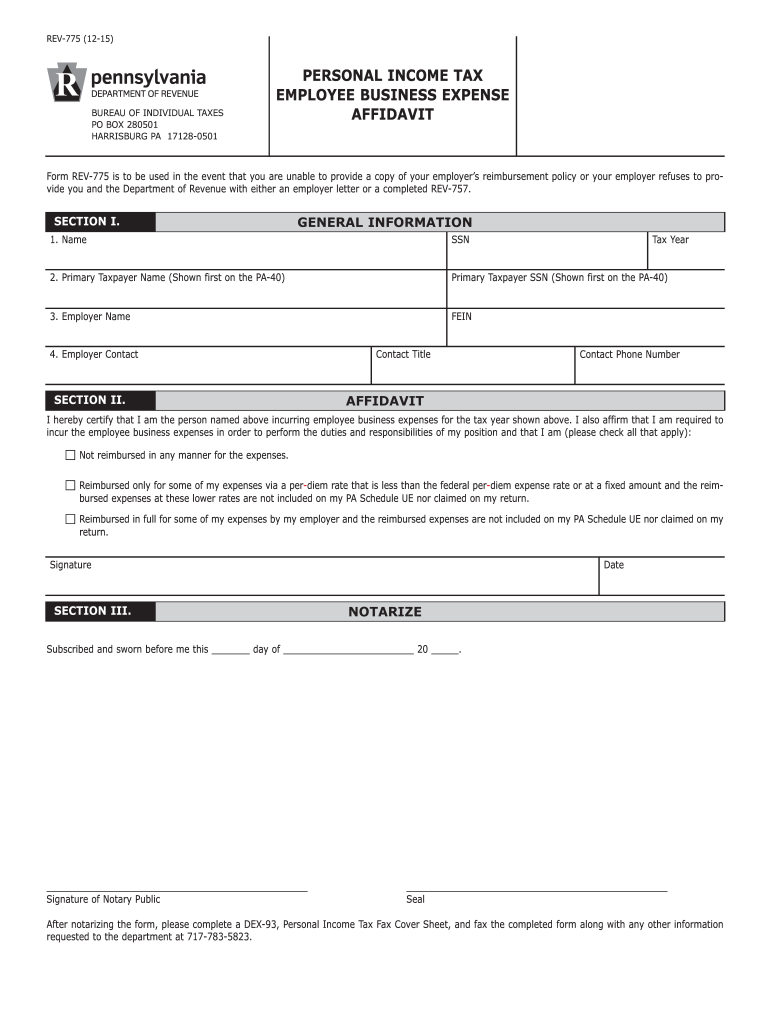

What is pa rev 775?

Who is required to file pa rev 775?

How to fill out pa rev 775?

What is the purpose of pa rev 775?

What information must be reported on pa rev 775?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.