Get the free MORTGAGE LOAN ORIGINATOR APPLICATION - calvet ca

Show details

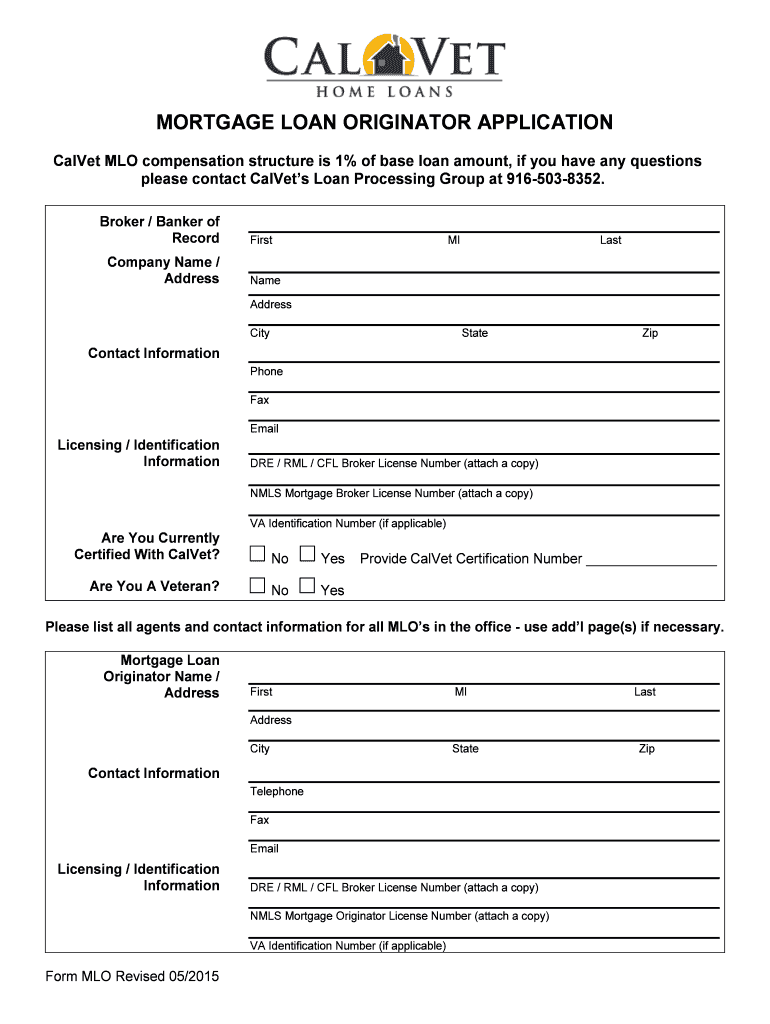

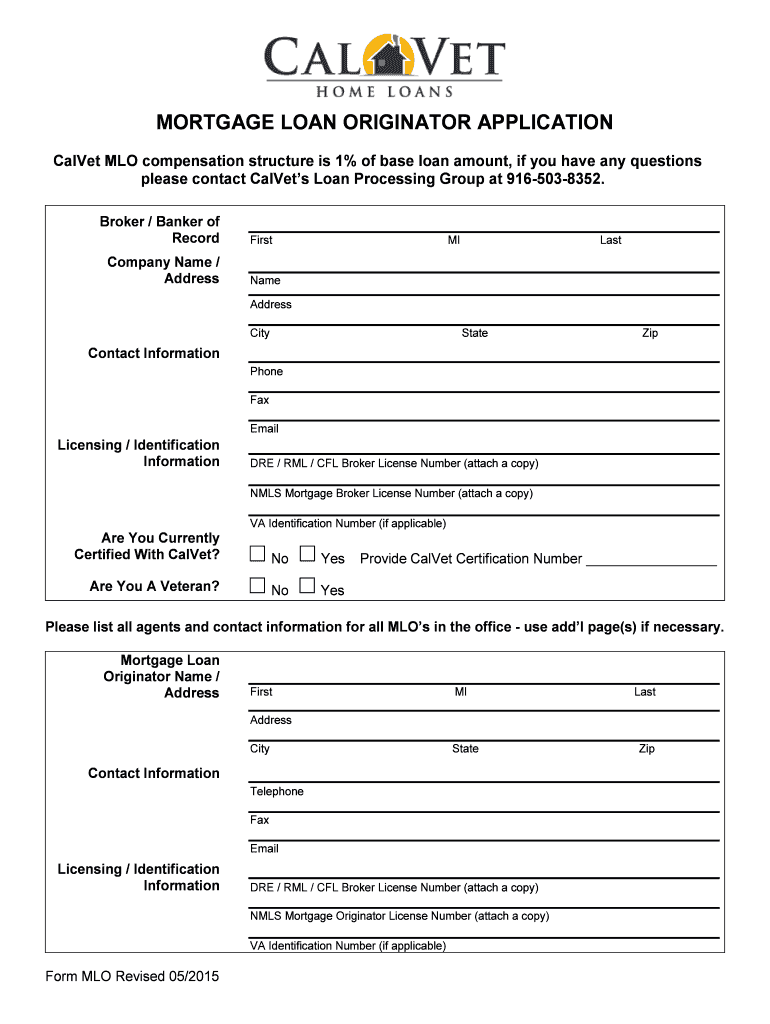

MORTGAGE LOAN ORIGINATOR APPLICATION Calvert MAO compensation structure is 1% of base loan amount, if you have any questions please contact Calves Loan Processing Group at 9165038352. Broker / Banker

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage loan originator application

Edit your mortgage loan originator application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage loan originator application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage loan originator application online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage loan originator application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage loan originator application

How to fill out a mortgage loan originator application:

01

Begin by gathering all the necessary documents and information. This may include your personal identification, employment history, financial statements, credit history, and any other relevant documentation.

02

Carefully review the application form and ensure that you understand each section before filling it out. Take note of any instructions or requirements provided by the lender or regulatory agency.

03

Start with the personal information section, providing details such as your full name, contact information, social security number, and date of birth. Double-check the accuracy of this information as any errors may delay the approval process.

04

Proceed to the employment history section, where you should list all your previous and current employers. Include the dates of employment, job titles, addresses, and supervisor's contact information.

05

If applicable, provide information about your educational background. This may include the name and location of the institution, the degree earned, and the dates of attendance.

06

Next, move on to the financial information section. This typically requires you to disclose details about your income, assets, and liabilities. Be prepared to provide documentation such as pay stubs, tax returns, bank statements, and investment portfolios to support the information provided.

07

The application will also likely request information about your credit history. Be honest and transparent about any previous credit issues or outstanding debts. Providing accurate information will help the lender assess your financial situation more effectively.

08

Once you have completed all the requested information, carefully review the application form to ensure accuracy. Double-check for any missing or incomplete sections and make any necessary corrections.

09

Sign and date the application form, acknowledging that the information provided is true and accurate to the best of your knowledge. Failure to truthfully complete the application may result in serious consequences, including legal penalties.

Who needs a mortgage loan originator application?

Individuals who wish to pursue a career as a mortgage loan originator are typically required to complete a mortgage loan originator application. This application is necessary for obtaining the required licensing and certification to work in the mortgage industry.

Moreover, individuals who are applying for a mortgage loan from a lender will also need to complete an application. In this case, the application plays a vital role in determining the borrower's eligibility for the loan and helps the lender assess the borrower's financial situation and creditworthiness.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete mortgage loan originator application online?

With pdfFiller, you may easily complete and sign mortgage loan originator application online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in mortgage loan originator application?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your mortgage loan originator application to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit mortgage loan originator application straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing mortgage loan originator application.

What is mortgage loan originator application?

The mortgage loan originator application is a form that individuals must submit in order to become licensed as a mortgage loan originator.

Who is required to file mortgage loan originator application?

Anyone who wishes to work as a mortgage loan originator is required to file a mortgage loan originator application.

How to fill out mortgage loan originator application?

To fill out the mortgage loan originator application, individuals must provide personal and professional information, complete required education courses, and pass a licensing exam.

What is the purpose of mortgage loan originator application?

The purpose of the mortgage loan originator application is to ensure that individuals working as mortgage loan originators meet the necessary qualifications and licensing requirements.

What information must be reported on mortgage loan originator application?

The mortgage loan originator application requires information on employment history, education, criminal background, credit history, and any disciplinary actions taken against the individual.

Fill out your mortgage loan originator application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Loan Originator Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.