SC WH-1601 2017 free printable template

Show details

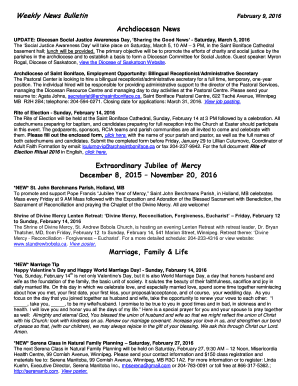

1350STATE OF SOUTH CAROLINADEPARTMENT OF REVENUEWH1601Withholding Tax Coupon(Rev. 6/13/17) 3127Pay WH1601 electronically at freeway.for.SC.gov. Click on Freeway and pay with VISA or MasterCard or

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC WH-1601

Edit your SC WH-1601 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC WH-1601 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

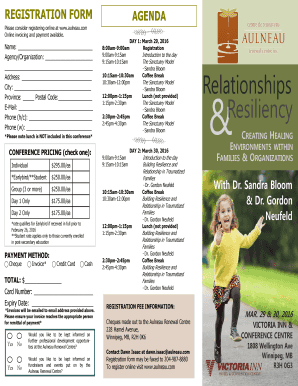

Editing SC WH-1601 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SC WH-1601. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC WH-1601 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC WH-1601

How to fill out SC WH-1601

01

Begin by downloading the SC WH-1601 form from the official website.

02

Fill in your personal information including your name, contact details, and address in the designated sections.

03

Indicate the reason for your claim by providing a brief description.

04

Carefully read the instructions provided on the form to ensure you complete all required fields.

05

Attach any necessary documentation that supports your claim as specified in the form guidelines.

06

Review the completed form for any errors or missing information.

07

Sign and date the form at the bottom.

08

Submit the form according to the instructions provided; this may involve mailing it to a specific address or submitting it online.

Who needs SC WH-1601?

01

Individuals applying for wage recovery or payment owed under South Carolina employment laws.

02

Employees who believe they have not received their wages as per their employment agreements.

03

Workers seeking to file a complaint regarding unpaid wages with the South Carolina Department of Employment and Workforce.

Fill

form

: Try Risk Free

People Also Ask about

Can you opt out of tax withholding?

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

What is a WH 1605 form?

Businesses operating in South Carolina can use a form WH-1605 to document state taxes withheld from worker wages on a quarterly basis. This form is found on the website of the South Carolina Department of Revenue. SC Withholding Quarterly Tax Return WH-1605 Step 1: Enter your business name and address where indicated.

Does South Carolina have a withholding form?

Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

What does it mean to be exempt from North Carolina withholding?

Withholdings. The exemption from income tax withholding does not change the amount of taxable income reported to the IRS or the NC Department of Revenue/state taxing authority, but it does ensure that no income tax is withheld from an employee's pay.

What is the withholding tax for sc?

Withholding Formula (Effective Pay Period 04, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $2,9800.2%Over $2,980 but not over $5,960$5.96 plus 3.0% of excess over $2,980Over $5,960 but not over $8,940$95.36 plus 4.0% of excess over $5,9603 more rows • Mar 7, 2022

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my SC WH-1601 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your SC WH-1601 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send SC WH-1601 to be eSigned by others?

When you're ready to share your SC WH-1601, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for the SC WH-1601 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your SC WH-1601 and you'll be done in minutes.

What is SC WH-1601?

SC WH-1601 is a tax form used in South Carolina for reporting withholding tax for certain types of payments.

Who is required to file SC WH-1601?

Employers and payers who withhold South Carolina income tax from wages or other types of payments are required to file SC WH-1601.

How to fill out SC WH-1601?

To fill out SC WH-1601, you need to provide details such as your business information, the total amount of withholding, and any other required information as specified in the form's instructions.

What is the purpose of SC WH-1601?

The purpose of SC WH-1601 is to report and remit the state income tax withheld from employees' wages or payments made to non-employees.

What information must be reported on SC WH-1601?

The information that must be reported on SC WH-1601 includes the payee's name, address, Social Security Number or Employer Identification Number, total amount paid, and total amount of state income tax withheld.

Fill out your SC WH-1601 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC WH-1601 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.