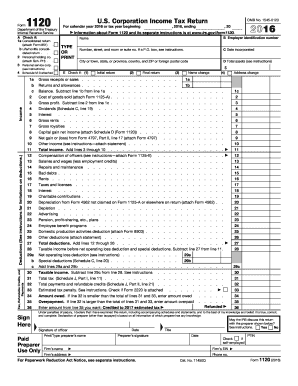

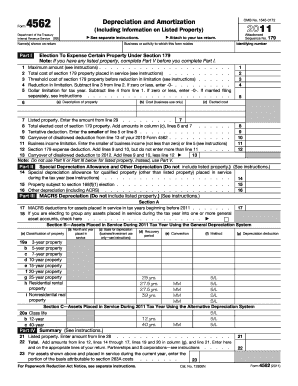

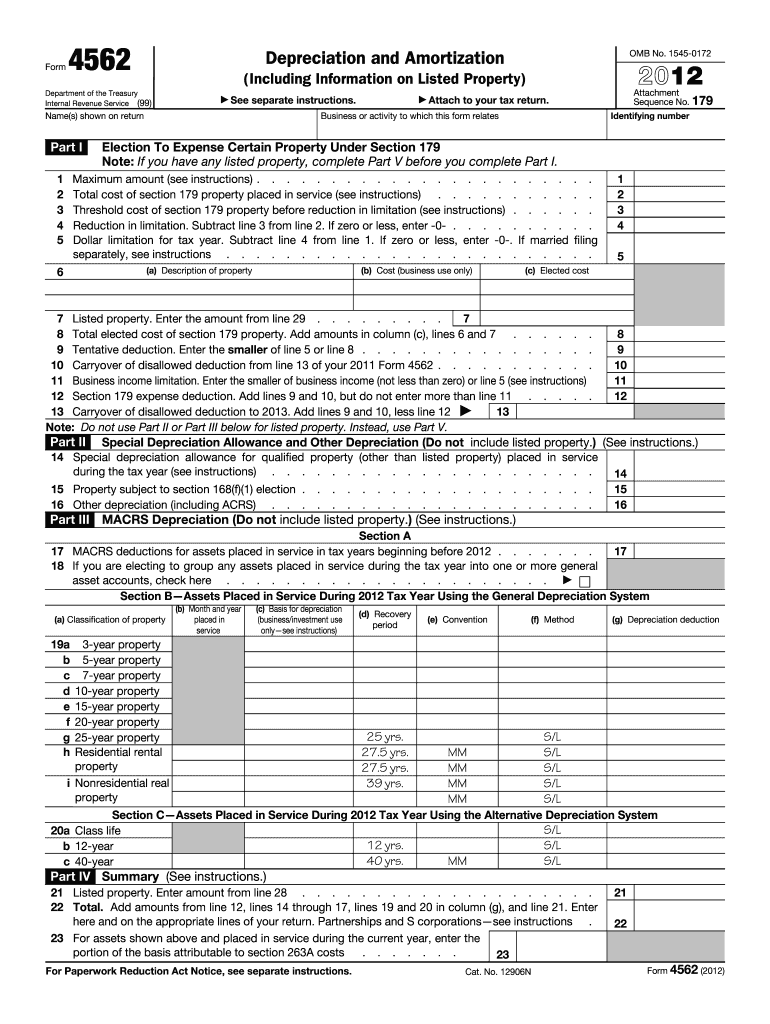

IRS 4562 2012 free printable template

Instructions and Help about IRS 4562

How to edit IRS 4562

How to fill out IRS 4562

About IRS 4 previous version

What is IRS 4562?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 4562

How do I edit [SKS] online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your [SKS] to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out [SKS] using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign [SKS] and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit [SKS] on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign [SKS] right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is IRS 4562?

IRS Form 4562 is used to report the depreciation of property and to claim a deduction for the cost of certain property that is placed in service during the tax year.

Who is required to file IRS 4562?

Taxpayers who claim depreciation or a Section 179 deduction, or who report certain types of income or loss from business property are required to file IRS Form 4562.

How to fill out IRS 4562?

To fill out Form 4562, taxpayers must provide information about the business property, its cost, the date it was placed in service, and the method of depreciation chosen. Each section has specific instructions detailing what information is required.

What is the purpose of IRS 4562?

The purpose of IRS Form 4562 is to allow taxpayers to claim depreciation and to report the allowable deduction for the acquisition of eligible property, which can help reduce taxable income.

What information must be reported on IRS 4562?

Information that must be reported on Form 4562 includes the description of the property, date it was placed in service, the cost of the property, any Section 179 deduction, and the method of depreciation used.

See what our users say