Get the free MORTGAGE WEST

Show details

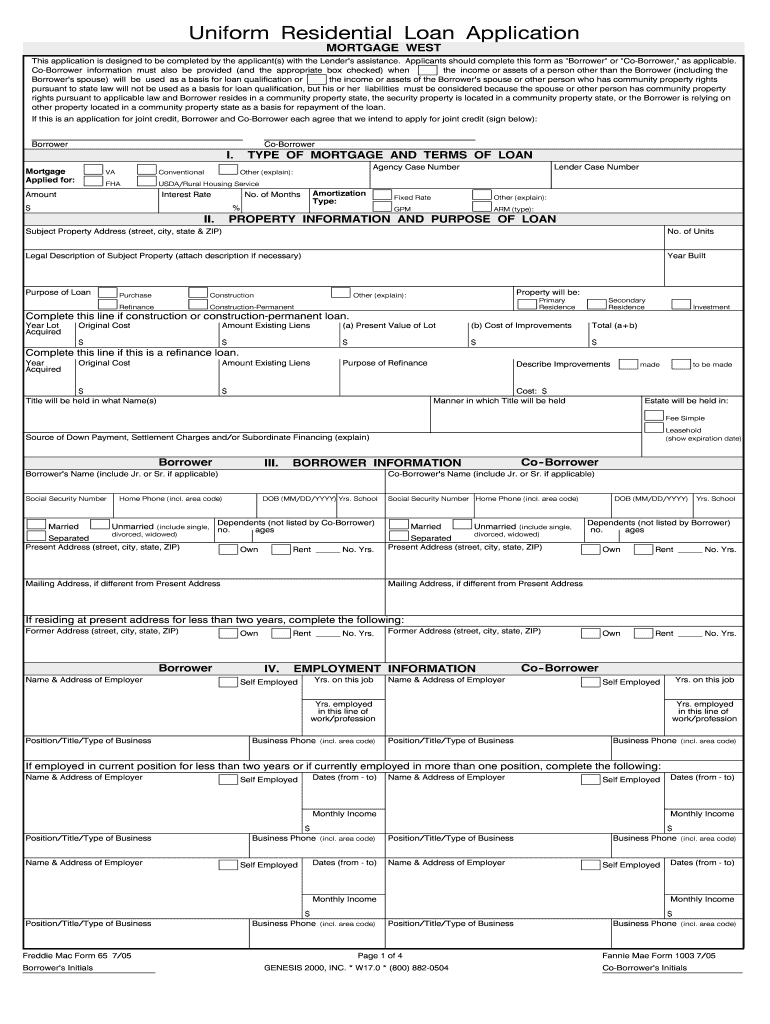

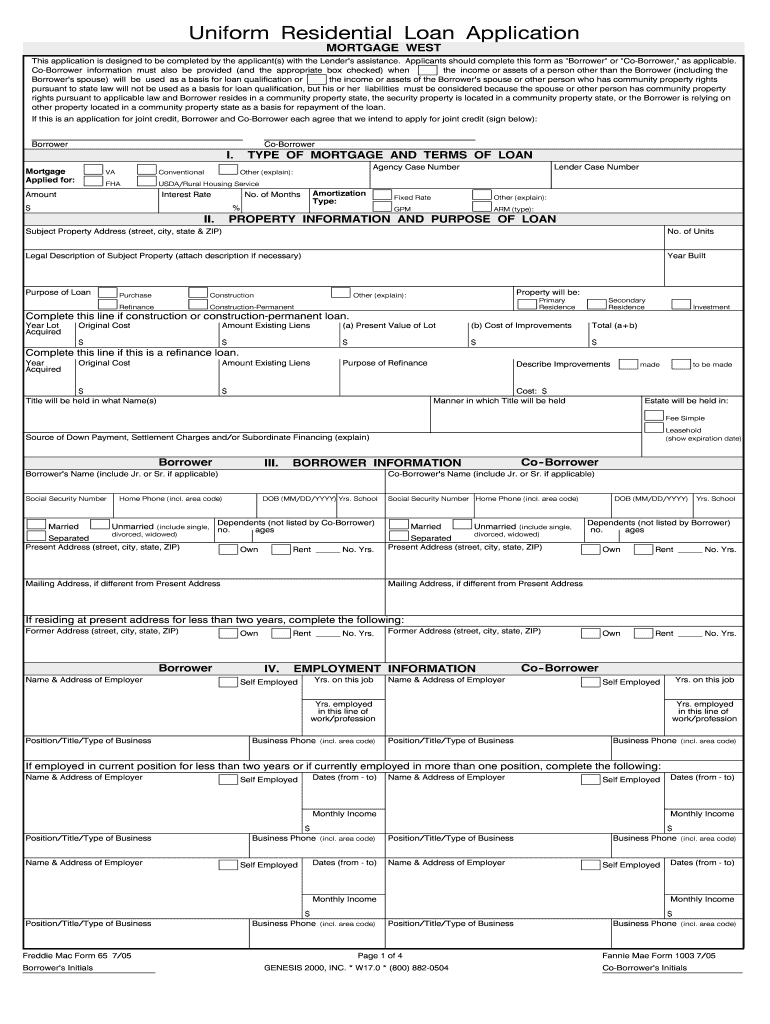

Uniform Residential Loan Application MORTGAGE WEST This application is designed to be completed by the applicant(s) with the Lender's assistance. Applicants should complete this form as Borrower or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage west

Edit your mortgage west form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage west form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage west online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgage west. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage west

How to fill out Mortgage West:

01

Start by gathering all the necessary documents such as personal identification, proof of income, tax returns, and bank statements.

02

Research Mortgage West's application process and requirements. This will ensure you have a clear understanding of what they are looking for and can provide all the necessary information.

03

Begin filling out the application form provided by Mortgage West. Take your time to carefully read each question and provide accurate and detailed responses.

04

If you come across any terms or questions that you are unsure about, don't hesitate to reach out to Mortgage West for clarification. It's important to provide accurate information to avoid potential issues in the future.

05

Double-check all the information you have entered before submitting the application. Mistakes can delay the approval process or even result in rejection.

06

Review all the terms and conditions associated with the mortgage offer from Mortgage West. If everything looks acceptable, sign the necessary documents and submit them to Mortgage West.

07

Stay in touch with Mortgage West throughout the process. They may need additional information or documentation, so it's essential to be responsive and provide any requested items promptly.

08

Once your application is approved, review the mortgage agreement carefully. Understand the terms, interest rates, repayment schedule, and any additional fees associated with the mortgage.

09

If you have any questions or concerns regarding the mortgage agreement, don't hesitate to seek clarification from Mortgage West before signing.

10

Start making timely monthly payments as per the agreed-upon schedule to ensure a smooth repayment process.

Who needs Mortgage West:

01

Individuals looking to purchase or refinance a property may need Mortgage West. They offer mortgage services to help people obtain the necessary funds for real estate transactions.

02

First-time homebuyers who are in search of a reliable and trusted mortgage provider can consider Mortgage West. They specialize in assisting individuals through the process of obtaining a mortgage for their first home.

03

Those who are looking for competitive interest rates and favorable terms may find Mortgage West to be a suitable option. They strive to provide competitive rates and customizable mortgage solutions tailored to individual needs.

04

People who value personalized customer service and support may prefer Mortgage West. They have a reputation for excellent customer service and a dedicated team to guide applicants through the mortgage application process.

05

Anyone interested in exploring mortgage options can benefit from considering Mortgage West. Even if you are unsure about your eligibility or specific requirements, reaching out to Mortgage West can help provide valuable information and guidance.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of mortgage loan?

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own.

What is a complete mortgage application?

A mortgage application is a document submitted to a lender when you apply for a mortgage to purchase real estate. The application is extensive and contains information about the property being considered for purchase, the borrower's financial situation and employment history, and more.

What is a mortgage vs home loan?

The terms mortgage and home loan are often used interchangeably, but they don't exactly mean the same thing. A mortgage is a loan that's used to buy a piece of property that's secured by the property itself. A home loan is a type of mortgage that's used specifically to purchase a house.

Is a loan application binding?

If you apply for a personal loan and get approved, you're not obligated to accept the offer. This is important to know because not all personal lenders allow you to get preapproved, so you may need to apply just to get an idea of what terms you qualify for.

What is a mortgage example?

Example of Mortgage He takes a loan for $1,00,000 for a tenure of 25 years at an interest rate of 7%. Dave has to pay a monthly amount of $707. This is because the total amount to be payable comes to $2 12,035, spanning 25 years.

What is the phone number for Rocket Mortgage?

How To Access The Automated Phone System. If you're a client currently serviced by Rocket Mortgage®, you can access the system whenever you need it. To do so, simply call 800-508-0944 and follow the prompts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify mortgage west without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your mortgage west into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find mortgage west?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the mortgage west in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I fill out the mortgage west form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign mortgage west and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is mortgage west?

Mortgage west refers to a specific type of mortgage agreement typically used in western regions.

Who is required to file mortgage west?

Individuals or entities involved in a property transaction in the western region are required to file mortgage west.

How to fill out mortgage west?

To fill out mortgage west, one must provide detailed information about the property, parties involved, terms of the agreement, and any other relevant details.

What is the purpose of mortgage west?

The purpose of mortgage west is to establish a legal agreement regarding the financing of property in the western region.

What information must be reported on mortgage west?

Information such as property details, loan amount, interest rates, borrower and lender information, and any conditions or clauses of the agreement must be reported on mortgage west.

Fill out your mortgage west online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage West is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.