Get the free Arizona Form 323 Credit for Contributions to Private School Tuition Organizations 2015

Instructions and Help about arizona form 323 credit

How to edit arizona form 323 credit

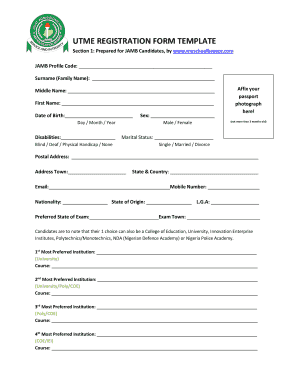

How to fill out arizona form 323 credit

Latest updates to arizona form 323 credit

All You Need to Know About arizona form 323 credit

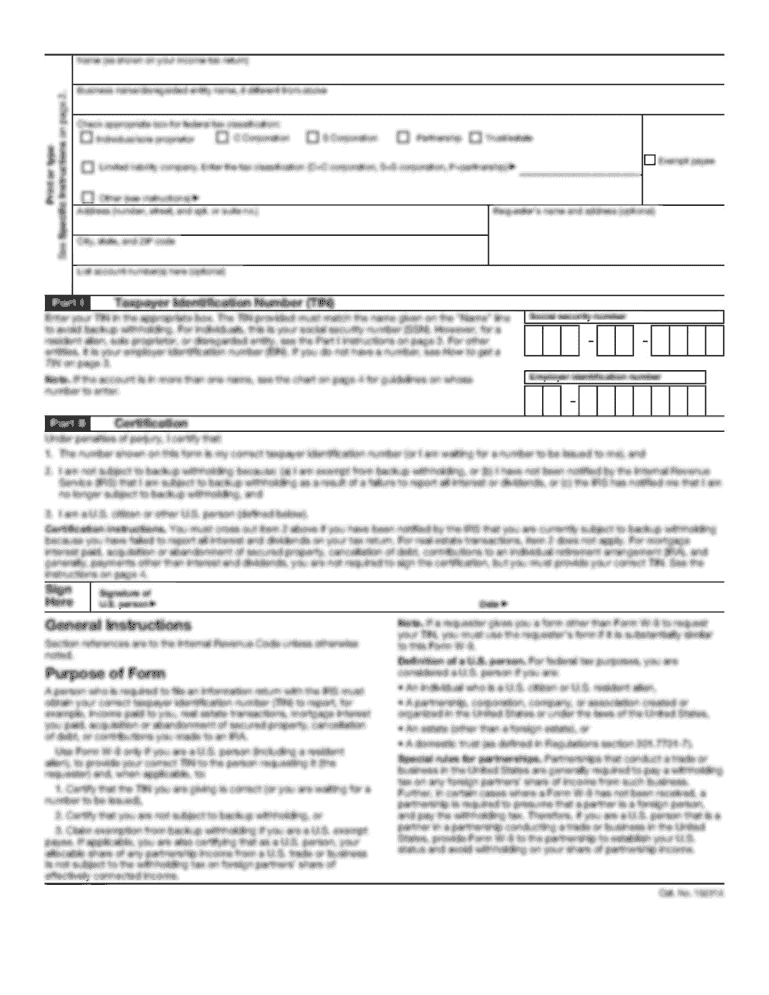

What is arizona form 323 credit?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about arizona form 323 credit

What should I do if I need to correct a mistake on my Arizona Form 323 credit?

If you need to amend your Arizona Form 323 credit, you can submit a corrected version noting the changes. Make sure to clearly mark it as an amended form. Keep in mind that the Arizona Department of Revenue requires specific instructions for corrections, so reviewing their guidelines is essential.

How can I check the status of my submitted Arizona Form 323 credit?

To verify the receipt and processing status of your Arizona Form 323 credit, you can use the online tracking tools provided by the Arizona Department of Revenue. Ensure to have your submission details handy for quick access. This can help identify any potential issues or delays with your submission.

What should I do if my e-filed Arizona Form 323 credit is rejected?

In case your e-filed Arizona Form 323 credit is rejected, review the rejection codes provided in the notification. Correct any issues indicated, and resubmit the form. It's important to address any errors promptly to avoid potential penalties or issues with your filings.

Are there specific service fees associated with e-filing the Arizona Form 323 credit?

Yes, some e-filing platforms may charge service fees to file the Arizona Form 323 credit electronically. It's advisable to compare different e-filing services to find one that meets your needs, including potential costs associated with filing.

What should I prepare if I receive a notice regarding my Arizona Form 323 credit?

If you receive a notice related to your Arizona Form 323 credit, prepare any relevant documentation such as your original submission, supporting documents, and any responses requested in the notice. Timely and complete responses can help resolve any issues efficiently.