Get the free 2015 birt tax return - phila

Show details

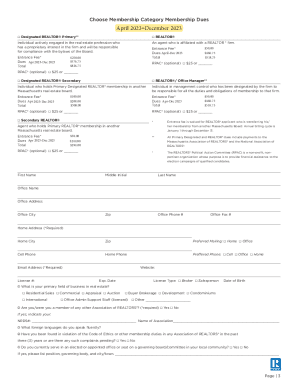

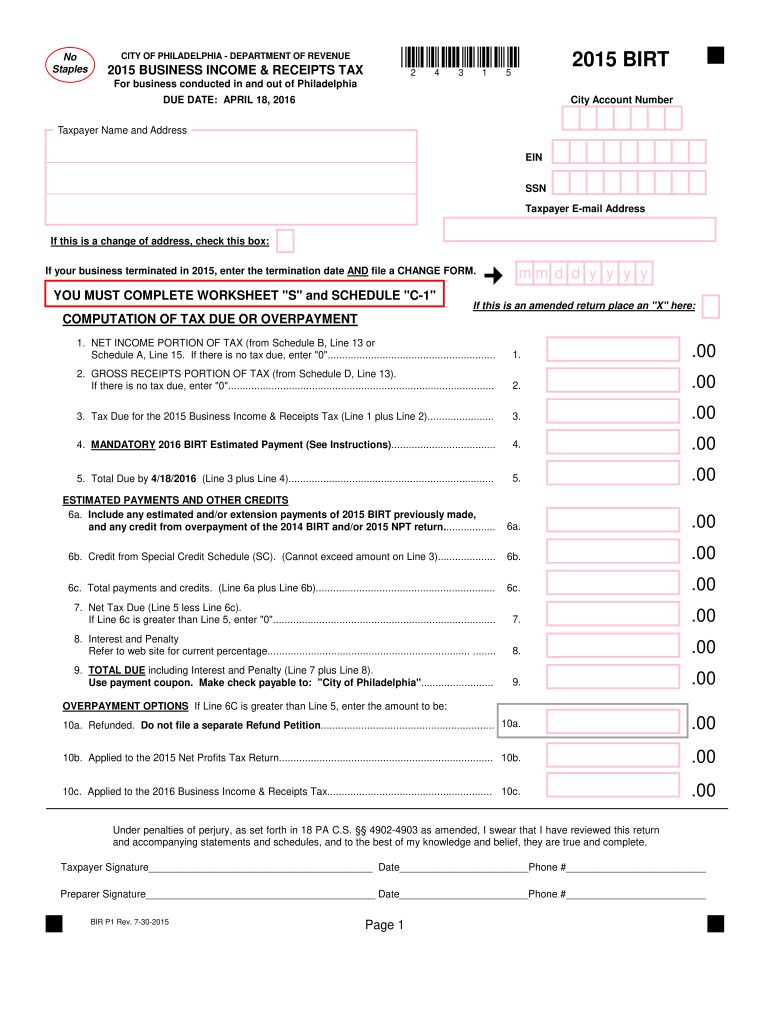

No Staples 2015 BIRD CITY OF PHILADELPHIA DEPARTMENT OF REVENUE 2015 BUSINESS INCOME & RECEIPTS TAX 2 4 3 1 5 For business conducted in and out of Philadelphia DUE DATE: APRIL 18, 2016, City Account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2015 birt tax return

Edit your 2015 birt tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2015 birt tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2015 birt tax return online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2015 birt tax return. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2015 birt tax return

How to fill out a 2015 BIRT tax return:

01

Gather all the necessary documents: Before starting to fill out your 2015 BIRT tax return, make sure you have all the required documents, such as your financial statements, income records, and any relevant tax forms.

02

Review the instructions: Carefully read through the instructions provided with the 2015 BIRT tax return form to familiarize yourself with the process and requirements.

03

Fill in your business information: Start by entering your business's name, address, taxpayer ID number, and other basic details as specified on the form.

04

Calculate gross receipts: Determine your gross receipts for the 2015 tax year. This includes all revenue received from your business activities during that period.

05

Calculate net income: Subtract any allowable deductions, exemptions, or credits from your gross receipts to calculate your business's net income for the 2015 tax year.

06

Determine the BIRT liability: Apply the appropriate tax rate to your net income to calculate the Business Income and Receipts Tax (BIRT) liability for 2015. The tax rates may vary depending on the type of business and other factors, so refer to the instructions or consult a tax professional if needed.

07

Complete the necessary schedules: Fill out any additional schedules or forms required to report specific types of income or deductions. This may include schedules for depreciation, interest expenses, or carryforward loss.

08

Review and double-check: Before submitting your 2015 BIRT tax return, carefully review all the information you have entered to ensure accuracy. Any errors or incomplete information could lead to delays or penalties.

09

Sign and file the tax return: Once you have completed the form, sign and date it as the authorized representative of the business. File the tax return by the due date specified by the tax authorities. Consider filing electronically for faster processing and confirmation of receipt.

Who needs a 2015 BIRT tax return:

01

Businesses operating in Philadelphia: The 2015 BIRT tax return is specifically required for businesses operating in Philadelphia who are subject to the Business Income and Receipts Tax (BIRT).

02

Businesses with gross receipts over a certain threshold: The threshold for filing a BIRT tax return in 2015 was $100,000. If your business's gross receipts exceeded this threshold during the tax year, you are required to file a 2015 BIRT tax return.

03

Partnerships and corporations: Both partnerships and corporations are generally required to file a 2015 BIRT tax return, regardless of the total gross receipts.

Note: This information is provided as a general guide and may not cover all specific circumstances. It is advisable to consult with a tax professional or refer to the relevant tax authorities for personalized guidance regarding your particular situation.

Fill

form

: Try Risk Free

People Also Ask about

Who is subject to Philadelphia BIRT?

Every individual, partnership, association, limited liability company (LLC), and corporation engaged in a business, profession, or other activity for profit within the City of Philadelphia must file a Business Income & Receipts Tax (BIRT) return.

Who must file Philadelphia school tax?

Any person residing in the School District of Philadelphia for a full tax year or for a period less than a full tax year, shall be liable for the tax on income received, or credited to him, including income that is reinvested to him during such year or period of residency.

Who must file Philadelphia NPT?

Who pays the tax. The Net Profits Tax (NPT) is imposed on the net profits from the operation of a trade, business, profession, enterprise, or other activity by: Philadelphia residents, even if their business is conducted outside of Philadelphia. Non-residents who conduct business in Philadelphia.

How do I get a BIRT number in Philadelphia?

The application for the Commercial Activity License (CAL) and Business Tax Account number (BIRT) is a combination application. You can apply online or in person in the basement of the Municipal Services building. If you apply online, it will take time for the city to process your application.

What is the nexus for PA income tax?

Pennsylvania recently codified the state's corporate income tax economic nexus threshold, making corporations with no physical presence in Pennsylvania responsible for corporate income tax if they have sales of $500,000 or more per year sourced to Pennsylvania for tax years beginning after December 31, 2022.

What is the Nexus in Philadelphia income tax?

Under this standard, a remote business with no physical presence in Philadelphia has nexus in the city if it generates at least $100,000 in Philadelphia gross receipts during any 12-month period ending in the current year. There are two components to the BIRT: tax on net income and tax on gross receipts.

What triggers nexus in Pennsylvania?

Generally, a business has nexus in Pennsylvania when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives.

What is a birt tax return?

Business Income & Receipts Tax (BIRT)

Do I need to file Philadelphia birt?

Every individual, partnership, association, limited liability company (LLC), and corporation engaged in a business, profession, or other activity for profit within the City of Philadelphia must file a Business Income & Receipts Tax (BIRT) return.

Do I have to file a Philadelphia Wage Tax return?

All employed Philadelphia residents owe the Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

How to file Philadelphia wage tax return?

Wage Tax refund requests must be submitted through the Philadelphia Tax Center. This includes all income-based and Covid-EZ (non-residents only) refunds. You don't need a username and password to request a refund on the Philadelphia Tax Center. The employer-requested bulk template isn't available for tax year 2022.

Who is exempt from Philadelphia Wage Tax?

All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax. Effective July 1, 2021, the rate for residents is 3.8398 percent, and the rate for non-residents is 3.4481 percent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2015 birt tax return for eSignature?

Once your 2015 birt tax return is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I fill out 2015 birt tax return using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 2015 birt tax return and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How can I fill out 2015 birt tax return on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 2015 birt tax return. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is birt tax return?

BIRT tax return stands for Business Income and Receipts Tax return. It is a tax return form that businesses in Philadelphia must file to report their income and receipts.

Who is required to file birt tax return?

All businesses operating in Philadelphia, including corporations, partnerships, and sole proprietorships, are required to file BIRT tax returns.

How to fill out birt tax return?

BIRT tax return can be filled out online or by paper form. Businesses need to provide information on their income, receipts, deductions, and tax credits.

What is the purpose of birt tax return?

The purpose of BIRT tax return is to calculate and report the business income and receipts tax owed to the City of Philadelphia.

What information must be reported on birt tax return?

Businesses must report their gross receipts, net income, and tax credits on the BIRT tax return.

Fill out your 2015 birt tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2015 Birt Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.