Get the free Matching Cash and In-kind Worksheet

Show details

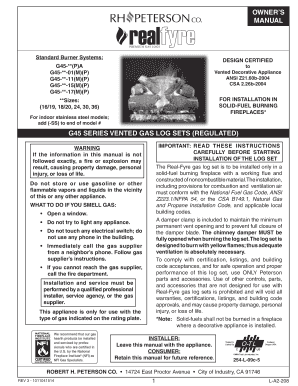

SERVE IDAHO SITE VISIT TESTING GRID Match income and inking donations Document A B C D E Test Legend: A Inking reports are certified by contributor and program official B Inking form delineates the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign matching cash and in-kind

Edit your matching cash and in-kind form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your matching cash and in-kind form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit matching cash and in-kind online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit matching cash and in-kind. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out matching cash and in-kind

How to fill out matching cash and in-kind:

01

Start by gathering all the necessary documentation related to your cash and in-kind contributions. This may include invoices, receipts, or any other proof of expenditure or donation.

02

Determine the total amount of matching cash that you have contributed to the project or cause. This can be in the form of your personal funds or funds raised through fundraising efforts.

03

Record the amount of matching cash in the appropriate section of the form or document provided. Make sure to accurately document the date of the contribution as well.

04

Next, identify the in-kind contributions that you have made. These are non-cash donations such as goods, services, or equipment that have a monetary value. Estimate the fair market value of each in-kind contribution.

05

In the relevant section of the form, detail each in-kind contribution separately, providing a brief description and the estimated value.

06

Ensure that you have all the necessary supporting evidence for your in-kind contributions, such as invoices, appraisals, or agreements, and attach them to the form.

07

Double-check all the information you have provided, making sure everything is accurate and complete.

08

Submit the completed form or document to the appropriate authority or organization as instructed. Retain a copy for your records.

09

If required, follow up with the organization or authority to ensure that your matching cash and in-kind contributions have been properly acknowledged and accounted for.

Who needs matching cash and in-kind:

01

Non-profit organizations or charitable institutions often require matching cash and in-kind donations. These are contributions that help them fund their programs and initiatives.

02

Government agencies or departments may also require individuals or organizations to provide matching cash and in-kind contributions for grant applications or project funding.

03

Corporate social responsibility initiatives often involve matching cash and in-kind donations, where businesses contribute funds or resources to support community development or social causes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my matching cash and in-kind directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your matching cash and in-kind and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit matching cash and in-kind from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like matching cash and in-kind, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I get matching cash and in-kind?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the matching cash and in-kind. Open it immediately and start altering it with sophisticated capabilities.

What is matching cash and in-kind?

Matching cash and in-kind refers to the process of providing funds or goods/services of equivalent value in order to match a certain financial contribution.

Who is required to file matching cash and in-kind?

Nonprofit organizations and other entities receiving grants or funding that require a matching component are typically required to file matching cash and in-kind.

How to fill out matching cash and in-kind?

Matching cash and in-kind should be filled out by providing detailed information about the cash contributions and the value of in-kind donations received.

What is the purpose of matching cash and in-kind?

The purpose of matching cash and in-kind is to ensure that the specified financial contribution is met and to show accountability for the funds or resources received.

What information must be reported on matching cash and in-kind?

Information such as the amount of cash contributions received, description of in-kind donations, and their estimated value must be reported on matching cash and in-kind forms.

Fill out your matching cash and in-kind online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Matching Cash And In-Kind is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.