Get the free Declaration of Non-Profit Status for OE v313 - sccgov

Show details

County of Santa Clara Department of Environmental Health 1555 Berger Drive, Suite 300, San Jose, CA 951122716 Phone 4089183400 Fax 4082585891 www.EHinfo.org DECLARATION OF NONPROFIT STATUS FOR OCCASIONAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign declaration of non-profit status

Edit your declaration of non-profit status form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your declaration of non-profit status form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing declaration of non-profit status online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit declaration of non-profit status. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out declaration of non-profit status

How to fill out a declaration of non-profit status:

01

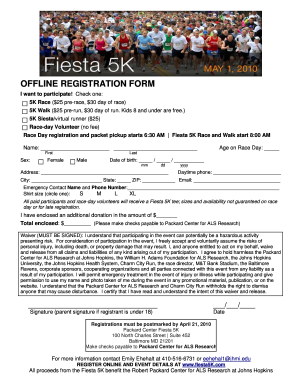

Gather the necessary information: Before starting the process, ensure that you have all the required information on hand. This may include details about your organization, such as its name, address, mission statement, and purpose.

02

Download the declaration form: Visit the official website of the government agency responsible for non-profit organizations and locate the declaration of non-profit status form. Download and save it to your computer for easy access.

03

Review the instructions: Take the time to carefully read through the instructions provided with the form. This will give you a clear understanding of the information required and any specific guidelines to follow.

04

Complete the organizational information: Begin by filling out the organizational details section, which typically asks for your organization's name, address, and contact information. Double-check that all the information is accurate and up-to-date.

05

Provide the mission statement: In this section, provide a concise and clear statement that describes the mission and purpose of your non-profit organization. Make sure to communicate the primary goals and objectives your organization aims to achieve.

06

Declare the non-profit status: State the legal status of your organization as a non-profit entity. This may require you to provide details about the specific laws or regulations under which your organization qualifies for non-profit status.

07

Attach supporting documents: Some declaration forms may require you to attach supporting documents as evidence of your non-profit status. These may include copies of your organization's articles of incorporation, bylaws, or any other pertinent legal documents.

08

Sign and date the declaration: Once you have carefully filled out the form and attached any necessary documents, sign and date the declaration. By doing so, you are confirming that the information provided is accurate and complete.

09

Review and submit: Before submitting your declaration, review the entire form one last time to ensure that there are no errors or missing information. Make any necessary corrections and submit the form to the designated government agency by the specified deadline.

Who needs a declaration of non-profit status?

01

Non-profit organizations: Any organization that operates with a primary purpose of benefiting the public or a specific cause and is seeking legal recognition as a non-profit entity will need to file a declaration of non-profit status.

02

Charitable organizations: Charities, which engage in activities or programs that promote the public welfare, relief of poverty, advancement of education, or any other charitable purposes, will typically require a declaration of non-profit status.

03

Religious organizations: Religious organizations, including churches, mosques, synagogues, temples, and other faith-based institutions, may need to file a declaration of non-profit status to gain legal recognition and avail themselves of certain tax benefits.

04

Social welfare organizations: Organizations dedicated to promoting social welfare, such as community development groups, educational or recreational associations, and civic leagues, often need to submit a declaration of non-profit status.

05

Professional associations: Non-profit professional associations representing specific occupations or industries, such as medical societies or industry trade groups, may need to file a declaration to obtain non-profit status.

Overall, any organization that meets the criteria and intends to operate as a non-profit entity should consult the appropriate government agency to determine whether they need to complete a declaration of non-profit status.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is declaration of non-profit status?

The declaration of non-profit status is a formal document that confirms an organization's status as a non-profit entity.

Who is required to file declaration of non-profit status?

Non-profit organizations are required to file a declaration of non-profit status.

How to fill out declaration of non-profit status?

The declaration of non-profit status can be filled out by providing the necessary information about the organization's mission, activities, and financial details.

What is the purpose of declaration of non-profit status?

The purpose of the declaration of non-profit status is to officially recognize an organization as a non-profit entity and allow it to receive tax-exempt status.

What information must be reported on declaration of non-profit status?

The declaration of non-profit status must include information such as the organization's name, address, mission statement, activities, and financial information.

How do I modify my declaration of non-profit status in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your declaration of non-profit status and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit declaration of non-profit status online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your declaration of non-profit status and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit declaration of non-profit status on an Android device?

The pdfFiller app for Android allows you to edit PDF files like declaration of non-profit status. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your declaration of non-profit status online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Declaration Of Non-Profit Status is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.