Get the free SMALL LOAN LENDER LICENSE APPLICATION FORM - nh

Show details

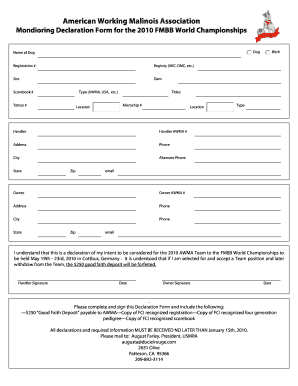

State of New Hampshire Banking Department 53 Regional Drive, Suite 200 Concord, NH 03301 Telephone: (603) 2713561 Fax: (603) 2710750 Licensing: (603) 2718675 www.nh.gov/banking SMALL LOAN LENDER LICENSE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small loan lender license

Edit your small loan lender license form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small loan lender license form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit small loan lender license online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit small loan lender license. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small loan lender license

How to fill out a small loan lender license:

Research the Requirements:

Before filling out the small loan lender license application, it is crucial to research and understand the specific requirements set by your jurisdiction. Contact the relevant regulatory authority or consult the appropriate legal resources to gather accurate and up-to-date information.

Gather the Necessary Documents:

Ensure you have all the required documents on hand before starting the application process. These documents may include personal identification, business incorporation documents, financial statements, surety bonds, background checks, and any other specific documents mandated for obtaining the license.

Complete the Application Form:

Obtain the small loan lender license application form from the regulatory authority or their website. Fill out the form accurately, providing all the required information. Be sure to double-check your entries for accuracy and completeness.

Pay the Application Fee:

Most licensing processes involve payment of an application fee. Check the regulatory authority's guidelines to determine the appropriate fee and the accepted payment methods. Make the payment along with the application to ensure it is processed promptly.

Submit the Application:

Once you have completed the application form and paid the fee, submit your application to the regulatory authority. Carefully follow their instructions regarding submission methods, such as online submission, mail, or in-person delivery.

Await the License Approval:

After submitting the application, the regulatory authority will review it for compliance with all the requirements. The processing time may vary depending on the jurisdiction, so it is essential to be patient during this waiting period. Stay in touch with the regulatory authority for any updates or additional information they may require.

Who needs a small loan lender license:

Businesses Engaged in Small Loan Lending:

Any business or entity that provides loans to consumers and operates within the jurisdiction's definition of a small loan may require a small loan lender license. The specific loan amount threshold and qualifying criteria will vary depending on local laws and regulations.

Financial Institutions and Non-Bank Lenders:

Not only traditional banking institutions but also non-bank lenders, such as credit unions and online lending platforms, may require a small loan lender license to legally offer loans to individuals. Compliance with the licensing requirements ensures that lenders operate within the bounds of consumer protection laws.

Startups and Entrepreneurs:

If you are starting a new business venture with the intent of providing small loans, it is crucial to determine whether your operation falls under the purview of licensing requirements. Even as a small-scale lender, fulfilling the licensing obligations is necessary to build trust with potential borrowers and avoid penalties for operating without a license.

Remember, licensing requirements for small loan lenders differ from one jurisdiction to another. Therefore, it is vital to consult the appropriate regulatory authority or legal counsel to ensure compliance with all local laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit small loan lender license online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your small loan lender license to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit small loan lender license on an Android device?

You can edit, sign, and distribute small loan lender license on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I complete small loan lender license on an Android device?

Use the pdfFiller mobile app to complete your small loan lender license on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is small loan lender license?

Small loan lender license is a permit issued by the state or regulatory authority that allows an individual or business to lend small amounts of money to consumers.

Who is required to file small loan lender license?

Individuals or businesses who wish to lend small amounts of money to consumers are required to file for a small loan lender license.

How to fill out small loan lender license?

To fill out a small loan lender license, applicants must provide detailed information about their business, financial statements, background checks, and other required documents as per regulatory guidelines.

What is the purpose of small loan lender license?

The purpose of a small loan lender license is to regulate and monitor individuals or businesses who lend small amounts of money to consumers, ensuring consumer protection and financial stability.

What information must be reported on small loan lender license?

Information such as business name, address, financial statements, background checks, ownership details, and other relevant information must be reported on a small loan lender license.

Fill out your small loan lender license online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Loan Lender License is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.