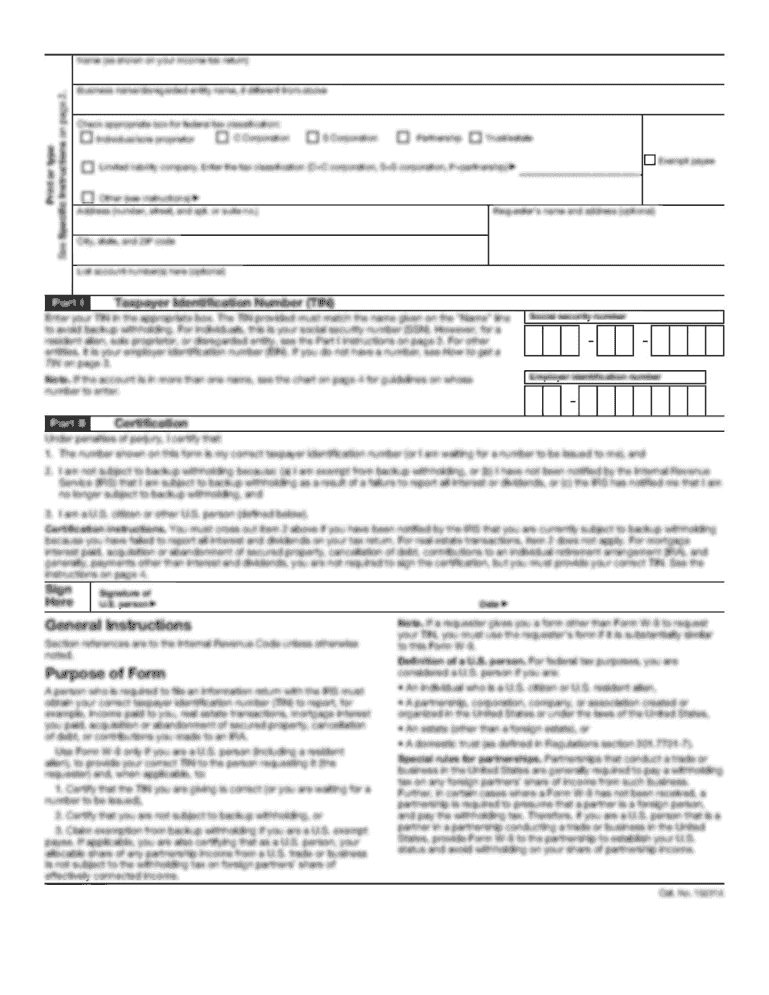

Get the free 2015 MI-1040-V Michigan Individual Income Tax file Payment Voucher

Show details

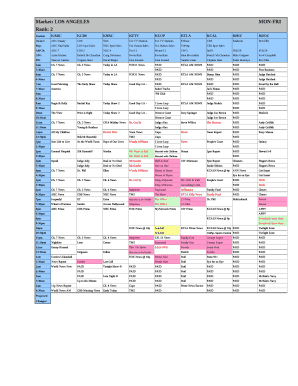

Instructions for Form MI1040V

2015 Michigan Individual Income Tax file Payment Voucher

You may make your individual income tax payment electronically using Michigan's payments service. Payment

options

We are not affiliated with any brand or entity on this form

Instructions and Help about 2015 mi-1040-v michigan individual

How to edit 2015 mi-1040-v michigan individual

How to fill out 2015 mi-1040-v michigan individual

Instructions and Help about 2015 mi-1040-v michigan individual

How to edit 2015 mi-1040-v michigan individual

To edit the 2015 mi-1040-v michigan individual tax form, use pdfFiller’s editing tools. Open the form in pdfFiller's platform, where you can modify text fields, add your signature, and insert date stamps as needed. Ensure all edits are accurate to avoid complications during tax processing.

How to fill out 2015 mi-1040-v michigan individual

Filling out the 2015 mi-1040-v michigan individual tax form involves several steps:

01

Obtain the form online or through the Michigan Department of Treasury.

02

Enter your personal information, including name, address, and Social Security number.

03

Provide details about your tax due, including the total amount you owe or expect to receive as a refund.

04

Sign and date the form at the designated places.

For detailed instructions, refer to the guidelines provided on the Michigan Department of Treasury website.

Latest updates to 2015 mi-1040-v michigan individual

Latest updates to 2015 mi-1040-v michigan individual

As of now, there have been no significant updates to the 2015 mi-1040-v michigan individual tax form. However, tax regulations frequently change, so it is essential to check the Michigan Department of Treasury for any recent announcements or revisions.

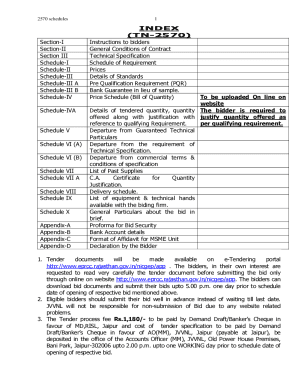

All You Need to Know About 2015 mi-1040-v michigan individual

What is 2015 mi-1040-v michigan individual?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2015 mi-1040-v michigan individual

What is 2015 mi-1040-v michigan individual?

The 2015 mi-1040-v michigan individual tax form is a payment voucher used by Michigan taxpayers. This form allows individuals to remit their tax payments towards their individual income tax liabilities. It serves to ensure that taxpayers can submit their payments efficiently and in an organized manner.

What is the purpose of this form?

The primary purpose of the 2015 mi-1040-v michigan individual form is to facilitate the payment of taxes owed to the State of Michigan. It helps both the taxpayer and the state accounting system track payments and maintain accurate records of tax submissions.

Who needs the form?

Taxpayers who owe income tax for the year 2015 must complete the 2015 mi-1040-v michigan individual form. This includes individuals who may have underpaid their taxes through withholding or estimated payments during the tax year.

When am I exempt from filling out this form?

You are exempt from filing the 2015 mi-1040-v michigan individual form if you do not owe any taxes for 2015. Additionally, if you are eligible for a full refund of your taxes and do not need to remit any payment, this form is not required.

Components of the form

The 2015 mi-1040-v michigan individual form consists of several key components:

01

Taxpayer identification information (name, address, Social Security number).

02

Details regarding the amount owed.

03

Payment options and instructions.

04

Signature section for the taxpayer to validate their submission.

What are the penalties for not issuing the form?

Failure to file the 2015 mi-1040-v michigan individual form, when required, can result in significant penalties. Taxpayers may incur interest charges on unpaid taxes, along with potential fines from the Michigan Department of Treasury for late payment. It is crucial to file this form to avoid these financial repercussions.

What information do you need when you file the form?

When filing the 2015 mi-1040-v michigan individual form, you need the following information:

01

Your name and address.

02

Your Social Security number.

03

The amount of tax you owe for the year 2015.

04

Payment method details, if applicable.

Is the form accompanied by other forms?

The 2015 mi-1040-v michigan individual form may accompany other relevant tax forms. While it is primarily used for tax payments, it is often submitted alongside the 2015 Michigan Individual Income Tax Return (Form MI-1040) to provide a holistic view of your tax situation.

Where do I send the form?

The completed 2015 mi-1040-v michigan individual form should be sent to the address provided in the form's instructions, typically to the Michigan Department of Treasury. Ensure to verify the submission address based on your specific situation, as it may vary depending on payment methods or regional requirements.

See what our users say