Get the free Form N-200V Rev 2015 Individual Income Tax Payment Voucher

Show details

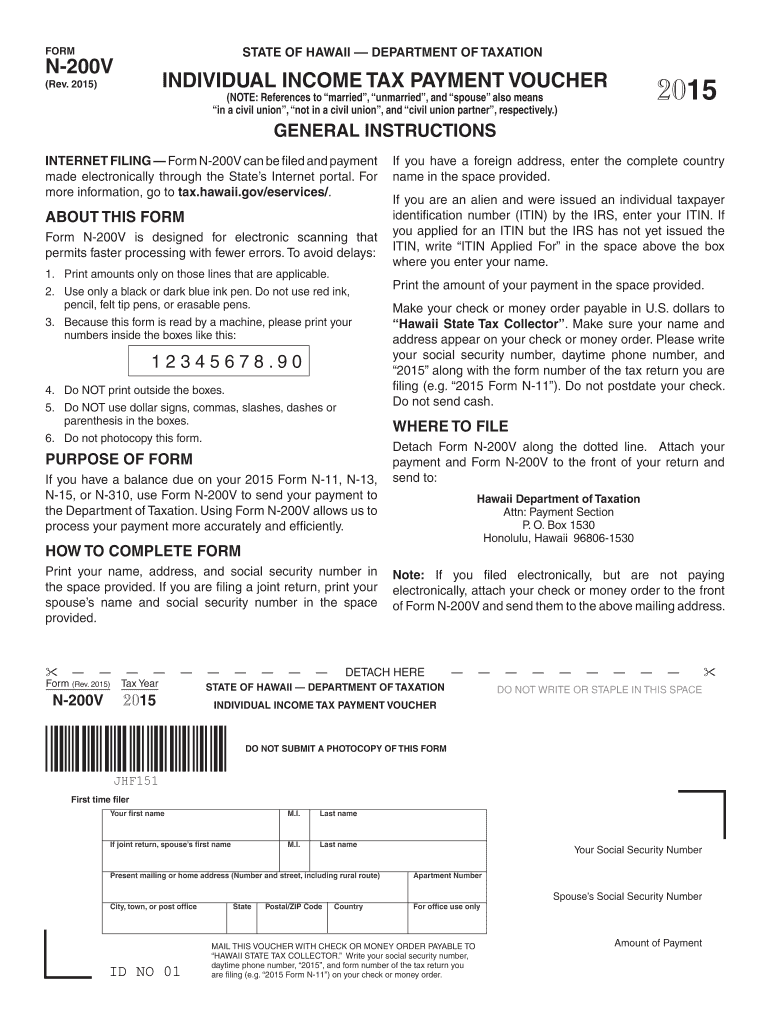

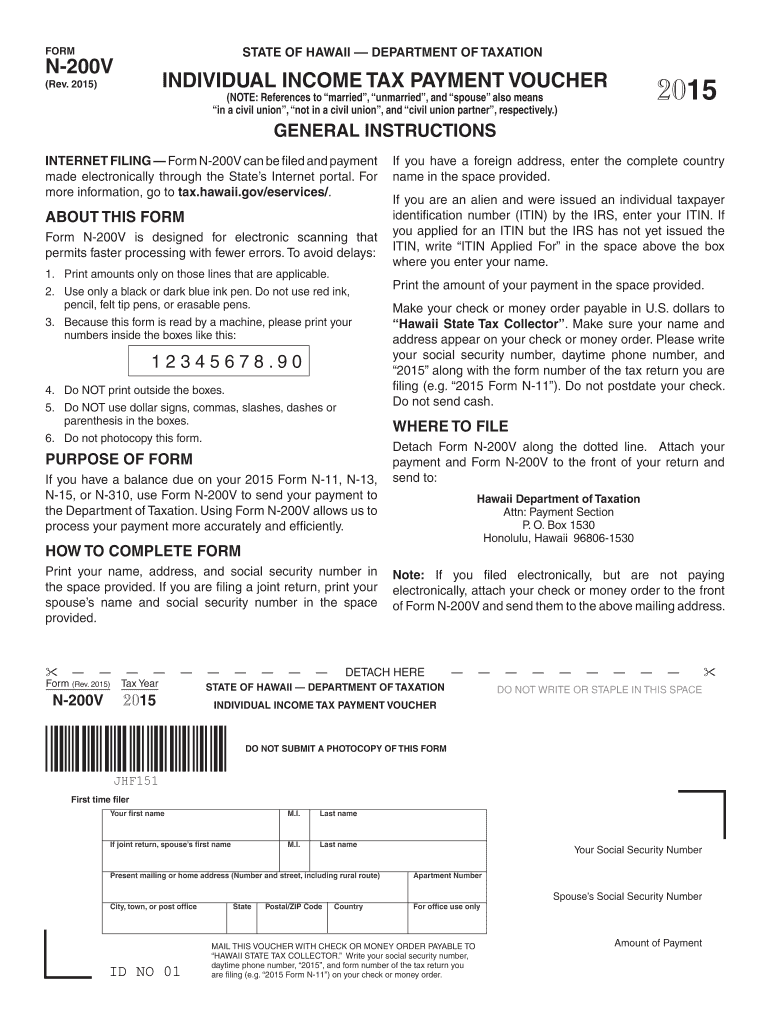

Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION FORM N200V INDIVIDUAL INCOME TAX PAYMENT VOUCHER (NOTE: References to married, unmarried, and spouse also means (Rev. 2015) 2015 in a civil union,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form n-200v rev 2015

Edit your form n-200v rev 2015 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form n-200v rev 2015 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form n-200v rev 2015 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form n-200v rev 2015. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form n-200v rev 2015

How to fill out form n-200v rev 2015?

01

Start by reading the instructions carefully before you begin filling out form n-200v rev 2015. Make sure you understand the purpose of the form and the information that is required.

02

Provide your personal information accurately in the designated sections. This includes your full name, date of birth, and contact information.

03

Indicate your current citizenship or immigration status. Specify whether you are a U.S. citizen, lawful permanent resident, or non-immigrant.

04

If applicable, provide information about your lawful permanent resident status, such as your Alien Registration Number and the date you became a lawful permanent resident.

05

Fill in the details regarding your previous immigration documentation, if any. This may include your Form I-551 or Form I-766.

06

Describe the specific reason you are applying for a transportation letter or a boarding foil. Provide supporting documents as necessary to support your request.

07

If someone is helping you fill out the form or acting as your representative, provide their information in the appropriate section.

08

Review the completed form carefully, ensuring that all the required fields are filled out accurately and any necessary supporting documentation is attached.

09

Sign and date the form.

10

Retain a copy of the completed form for your records.

Who needs form n-200v rev 2015?

01

Individuals who are requesting a transportation letter or a boarding foil from U.S. Citizenship and Immigration Services (USCIS) may need to fill out form n-200v rev 2015.

02

This form is required for those individuals who are in the process of being admitted to the United States but are unable to present valid immigration documentation at the port of entry.

03

It is also necessary for individuals who are in the process of being removed from the United States but are unable to depart due to lack of proper travel documents.

04

Form n-200v rev 2015 allows individuals to request temporary documentation that will enable them to travel to their desired destination until they can obtain proper documentation.

Overall, form n-200v rev 2015 is important for individuals who need temporary travel documentation for specific immigration-related purposes. The form should be filled out accurately and in accordance with the provided instructions to ensure a successful application process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my form n-200v rev 2015 in Gmail?

Create your eSignature using pdfFiller and then eSign your form n-200v rev 2015 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete form n-200v rev 2015 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your form n-200v rev 2015 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit form n-200v rev 2015 on an Android device?

You can make any changes to PDF files, like form n-200v rev 2015, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is form n-200v rev individual?

Form N-200V REV Individual is a tax form used for reporting individual income in the state of Nevada.

Who is required to file form n-200v rev individual?

Individuals who are residents of Nevada or have income from Nevada sources are required to file Form N-200V REV Individual.

How to fill out form n-200v rev individual?

To fill out Form N-200V REV Individual, you will need to provide information about your income, deductions, and credits. Make sure to follow the instructions provided with the form.

What is the purpose of form n-200v rev individual?

The purpose of Form N-200V REV Individual is to report individual income and determine any tax liability owed to the state of Nevada.

What information must be reported on form n-200v rev individual?

Information such as income from all sources, deductions, credits, and any taxes withheld must be reported on Form N-200V REV Individual.

Fill out your form n-200v rev 2015 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form N-200v Rev 2015 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.