Get the free Form 720 (Rev. October 2010). Quarterly Federal Excise Tax Return

Show details

720Quarterly Federal Excise Tax Returner

(Rev. October 2010)

Department of the Treasury

Internal Revenue ServiceCheck here if:

Final return

Address change OMB No. 15450023

See the Instructions for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 720 rev october

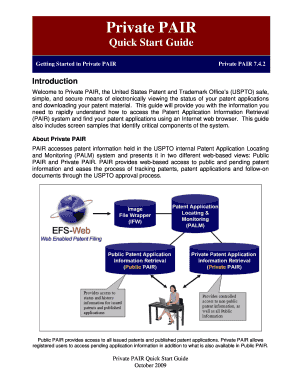

Edit your form 720 rev october form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 720 rev october form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 720 rev october online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 720 rev october. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 720 rev october

How to fill out form 720 rev October:

01

Obtain the form: Start by downloading or obtaining a copy of Form 720 rev October. It can be found on the official website of the Internal Revenue Service (IRS).

02

Provide your information: Fill in your personal details such as name, address, and social security number in the required sections of the form. Ensure that all the information provided is accurate and up to date.

03

Determine the reporting period: Identify the reporting period for which you are filing Form 720. The form is typically filed quarterly, so make sure you select the appropriate quarter and year.

04

Report excise taxes: Form 720 is primarily used to report and pay excise taxes on certain products and activities. Review the excise tax categories listed on the form and check the boxes that apply to your situation. Common categories include fuel tax, environmental tax, and indoor tanning tax.

05

Calculate the tax liability: For each excise tax category that you have checked, calculate the corresponding tax liability based on the instructions provided. You may need to refer to additional documentation or guidance from the IRS to accurately determine the amount owed.

06

Fill in payment details: If you owe any excise taxes based on your calculations, provide your payment details on the form. This may include your bank account information for electronic funds transfer or a check payable to the United States Treasury.

07

Review and submit: Once you have completed filling out the form and double-checked all the information provided, review it one final time for accuracy. Make sure you have included all required attachments and signatures, if applicable. Then, submit the completed form and any required payments to the IRS according to their instructions.

Who needs form 720 rev October?

01

Manufacturers and producers: Businesses involved in the manufacturing or production of goods that are subject to excise taxes may need to use Form 720. This includes industries such as fuel production, tobacco products, and firearms.

02

Importers: Individuals or businesses that import goods into the United States may also be required to file Form 720 if the imported products are subject to excise taxes.

03

Excise tax collectors: Certain organizations or individuals responsible for collecting and remitting excise taxes on behalf of others might need to use Form 720. This can include wholesalers, retailers, or distributors.

04

Service providers: Some service-oriented businesses, such as indoor tanning salons, may also be required to file Form 720 if they provide taxable services subject to excise taxes.

Note: It is important to consult the IRS guidelines or seek professional advice to determine if you specifically need to file Form 720 rev October based on your unique circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 720 rev october from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including form 720 rev october. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete form 720 rev october online?

pdfFiller makes it easy to finish and sign form 720 rev october online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit form 720 rev october on an iOS device?

Use the pdfFiller mobile app to create, edit, and share form 720 rev october from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is form 720 rev october?

Form 720 Rev October is a quarterly federal excise tax return used to report the taxes collected by businesses from the sale of certain goods and services.

Who is required to file form 720 rev october?

Businesses that sell taxable goods or services, such as indoor tanning services, communication services, and air transportation, are required to file Form 720 Rev October.

How to fill out form 720 rev october?

Form 720 Rev October must be filled out with accurate information regarding the taxable goods or services sold, taxes collected, and other required details as instructed in the form.

What is the purpose of form 720 rev october?

The purpose of Form 720 Rev October is to report and pay federal excise taxes collected on specific goods and services.

What information must be reported on form 720 rev october?

Information such as the taxable goods or services sold, the amount of taxes collected, and other relevant details must be reported on Form 720 Rev October.

Fill out your form 720 rev october online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 720 Rev October is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.