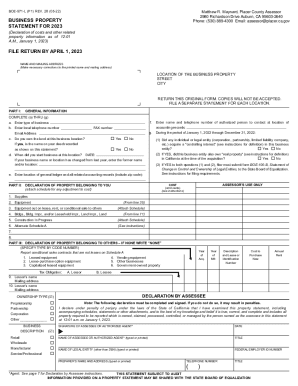

CA BOE-571-L (P1) 2017 free printable template

Get, Create, Make and Sign form boe 571 l

How to edit form boe 571 l online

Uncompromising security for your PDF editing and eSignature needs

CA BOE-571-L (P1) Form Versions

How to fill out form boe 571 l

How to fill out CA BOE-571-L (P1)

Who needs CA BOE-571-L (P1)?

Instructions and Help about form boe 571 l

Welcome to the office of the Assessor reporters new YouTube channel the purpose of these videos is to provide an online training to demonstrate how to fill out the 571 l form this new channel is designed to complement our existing services and to enhance our customer service if you received a 571 L form it is because you do or have done business in San Francisco we receive phone calls on a regular basis asking hey I closed my business on January 7th why did I get this form the lien date for the state of California is 12:01 a.m. on January 1st you received this form because your business was in operation as of January 1st you're required to report business fix assets as of 12:01 a.m. on January 1st I thought your business was already closed you're still required to file unfortunately the filing due date is April 1st please modify your name and mailing address if necessary for instance a name is misspelled or a mailing address that's incorrect on your pre-printed form so how do you correct it simply draw a single line through it and write in the correct name or mailing address San Francisco has a sizable workforce that works from home consultants web designers and meeting planners so how do you report a home office you report the amount determined by the percent used for your business we often have business owners ask us what if I'm a contractor and all my tools are in my truck and I don't live in San Francisco, but I have clients in San Francisco once the form is filled out please state the information in the remarks section sign date and return the form we will note this in your account for the future what if you're a painter and all you have our paintbrushes where do you report this well small as they may seem those are your tools you report this under tools part one is where you fill out your general information it is very important to file your contact information in case we have any questions regarding your filing if you own the land please check yes under part one see and answer the next question if you do not own the land at your business location, and you are renting check no you don't need to indicate that you are a tenant part two is where you declare that property that belongs to you first our supplies report what you have on hand by taking a physical inventory or by estimating the average of 12 months of all your operating supply accounts take your annual office supplies expense and divide by 12 to get a trended average this is the amount you should report because it's assumed that you have one month's worth of supplies for example if I bought 500 glossy window envelopes this year and 10 boxes of self-stick labels the total cost including sales tax is 224 dollars if you divided that by 12 it's 18 dollars and 67 cents, so I will report 19 dollars as supplies the second item is your equipment please flip to the backside of the form here in schedule a will declare your assets in the proper categories in year of acquisition once you...

People Also Ask about

What is the supplemental property tax bill in Santa Clara County?

What is a 571L in San Francisco County?

What is the property tax exemption in Santa Clara CA?

What is Form 571 L California property tax?

What is the due date for 571L?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form boe 571 l?

Can I create an eSignature for the form boe 571 l in Gmail?

How do I fill out form boe 571 l using my mobile device?

What is CA BOE-571-L (P1)?

Who is required to file CA BOE-571-L (P1)?

How to fill out CA BOE-571-L (P1)?

What is the purpose of CA BOE-571-L (P1)?

What information must be reported on CA BOE-571-L (P1)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.