Get the free RENTAL PROPERTY WORKSHEET - wiesbaden army

Show details

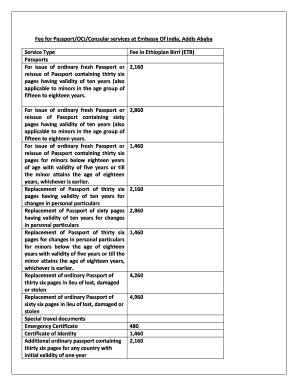

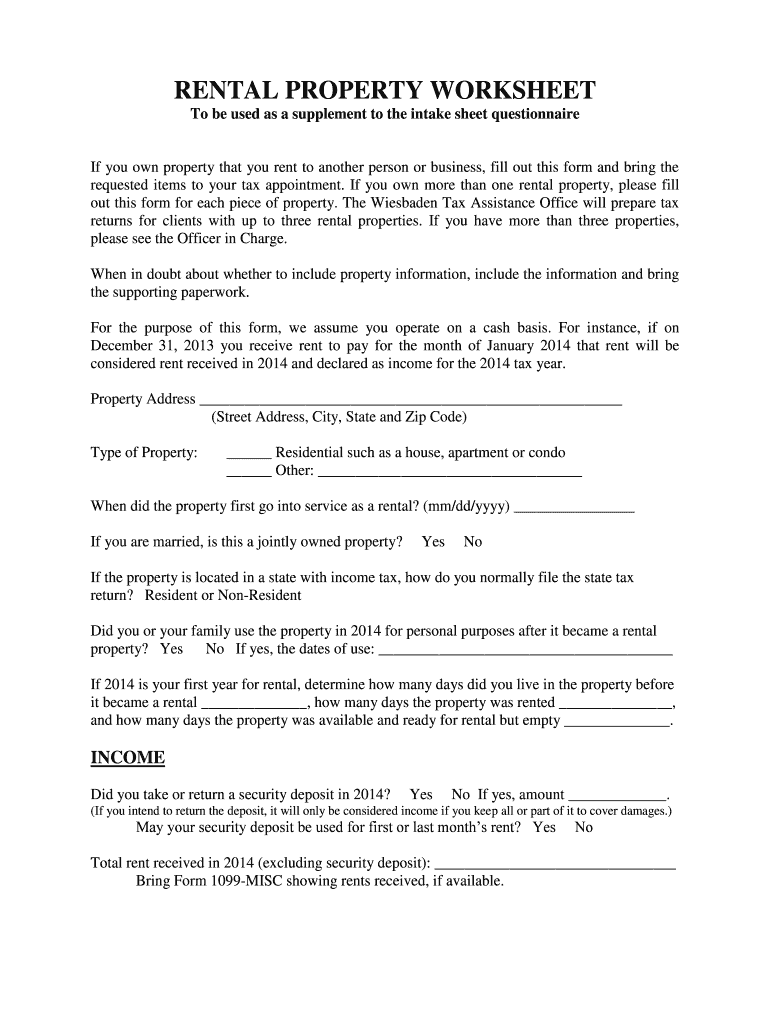

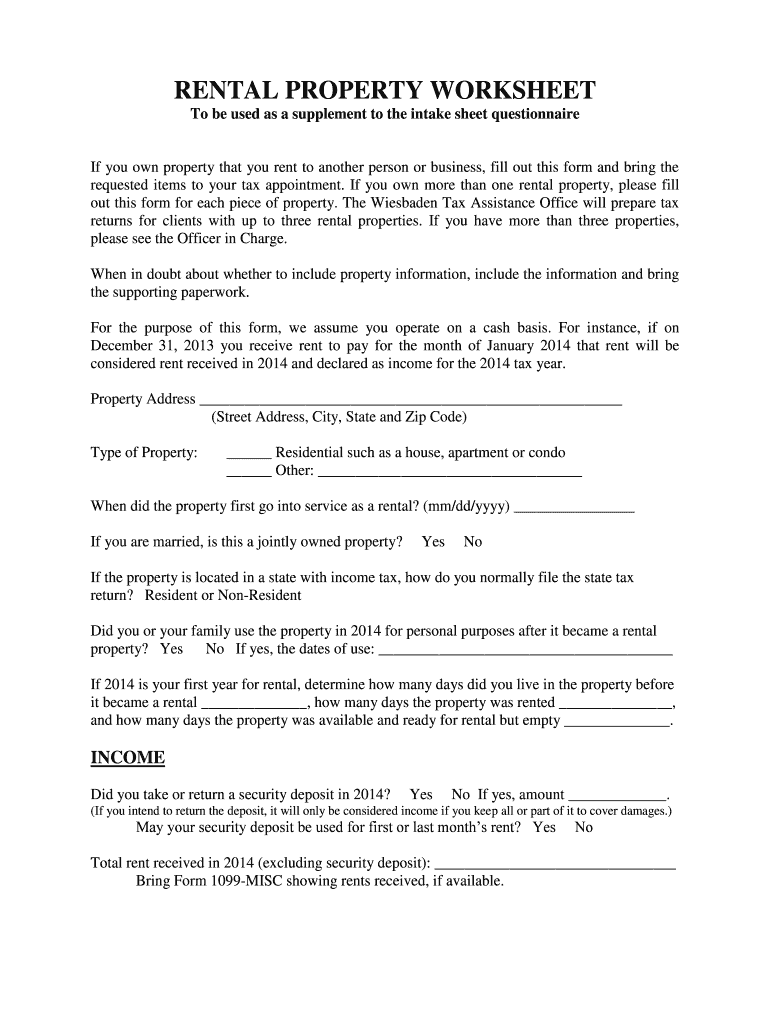

A form used to gather information on rental properties for tax filing purposes, including income and expense details for each property rented.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental property worksheet

Edit your rental property worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental property worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rental property worksheet online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rental property worksheet. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental property worksheet

How to fill out RENTAL PROPERTY WORKSHEET

01

Start by gathering all relevant information about your rental property.

02

Enter the property address and your contact information in the designated fields.

03

List the monthly rent amount in the appropriate section.

04

Document the total square footage of the rental property.

05

Specify the type of rental (e.g., single-family home, apartment, etc.).

06

Include details such as the number of bedrooms and bathrooms.

07

Provide information on any additional amenities (e.g., laundry, parking).

08

Outline any maintenance costs associated with the property.

09

Include the duration of the rental agreement in the designated area.

10

Review all the information for accuracy before submitting the worksheet.

Who needs RENTAL PROPERTY WORKSHEET?

01

Landlords who manage rental properties.

02

Property managers overseeing multiple rentals.

03

Real estate investors assessing property performance.

04

Potential renters evaluating properties.

05

Financial advisors helping clients with property investments.

Fill

form

: Try Risk Free

People Also Ask about

What is the 50% rule in law?

The “Fifty Percent Law” (50% Law), as defined in Education Code Section 84362 and California Code of Regulations Section 59200 et seq., requires each district to spend at least half of its current expense of education each fiscal year for salaries and benefits of classroom instructors.

What is the 50% rule in rental property?

The 50% rule or 50 rule in real estate says that half of the gross income generated by a rental property should be allocated to operating expenses when determining profitability. The rule is designed to help investors avoid the mistake of underestimating expenses and overestimating profits.

What is the 10 rule for rental property?

The 1 and 10 rule is another real estate investment guideline that suggests that investors should aim for a gross monthly rent that is at least 1% of the property's purchase price and a net profit margin of at least 10%.

How do I create a rental property spreadsheet?

Open a spreadsheet tool like Microsoft Excel or Google Sheets. Add property details such as address, unit type, and lease terms. Create income columns for rent, late fees, and vacancy. List expense categories like maintenance, repairs, insurance, taxes, and utilities.

How do you calculate the 50% rule?

Calculating the 50% rule Determine the gross monthly income collected from the property. Multiply the gross income by 0.50. The result estimates the property's monthly operating expenses and cash flow.

What is the 80/20 rule for rental property?

The 80/20 rule highlights that 80% of results often come from 20% of the effort. Applied to rental property maintenance, this approach focuses on high-impact tasks to enhance tenant satisfaction, reduce maintenance costs, and preserve property value.

What is the 50% rule for rental property?

The 50% rule advises investors to estimate a property's operating expenses will amount to roughly half of its gross income. While this estimation proves helpful in projecting rental property cash flow, it is not a flawless measurement and should only ever be used as a starting point for further research and analysis.

How do I avoid 20% down payment on investment property?

Yes, it is possible to purchase an investment property without paying a 20% down payment. By exploring alternative financing options such as seller financing or utilizing lines of credit or home equity through cash-out refinancing or HELOCs, you can reduce or eliminate the need for a large upfront payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RENTAL PROPERTY WORKSHEET?

The RENTAL PROPERTY WORKSHEET is a form used to report income and expenses from rental properties for tax purposes.

Who is required to file RENTAL PROPERTY WORKSHEET?

Individuals or entities that own rental properties and earn rental income are required to file the RENTAL PROPERTY WORKSHEET.

How to fill out RENTAL PROPERTY WORKSHEET?

To fill out the RENTAL PROPERTY WORKSHEET, you must provide information about your rental income, expenses, and depreciation, following the instructions provided on the form.

What is the purpose of RENTAL PROPERTY WORKSHEET?

The purpose of the RENTAL PROPERTY WORKSHEET is to calculate and report the net income or loss from rental properties for accurate tax reporting.

What information must be reported on RENTAL PROPERTY WORKSHEET?

The information that must be reported includes rental income, various expenses (such as repairs, maintenance, and utilities), and any depreciation on the property.

Fill out your rental property worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Property Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.