Get the free - boe ca

Show details

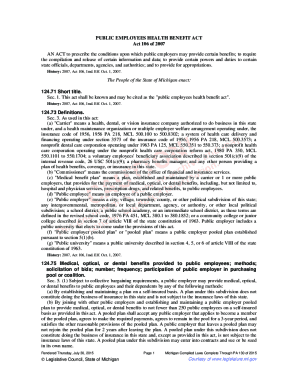

BOE401INST REV. 19 (117)ESTATE DE CALIFORNIABOARD OF EQUALIZATIONInstrucciones para clear El formulation BOE401A:

Declaration Del impasto sober leis vents y sober el USO estate, local y de district

Used

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign boe ca

Edit your boe ca form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your boe ca form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing boe ca online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit boe ca. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out boe ca

How to fill out BOE CA:

01

Start by accessing the BOE CA website or obtaining a physical copy of the form.

02

Carefully read the instructions provided with the form to understand the requirements and any specific guidelines.

03

Begin filling out the basic information section, which usually includes your name, address, contact details, and other personal information.

04

Proceed to the specific sections of the form where you are required to provide detailed information such as income, expenses, assets, liabilities, or any other relevant data.

05

Double-check your entries for accuracy, ensuring that all the necessary fields are completed and that the information provided is clear and understandable.

06

If any supporting documents are requested, gather and attach them properly, ensuring they are legible and appropriate for verification purposes.

07

Sign and date the form where required, acknowledging that the information provided is true and correct to the best of your knowledge.

08

Make a copy of the completed form and any attached documents for your records.

09

Review the submission process outlined in the instructions, which may involve submitting online, mailing, emailing, or physically delivering the form.

10

Follow the specified submission process, making sure to meet any required deadlines and include any necessary fees if applicable.

11

Keep track of your submission, noting any confirmation numbers, acknowledgment receipts, or other documentation for reference.

Who needs BOE CA?

01

Individuals or businesses that are required to report their income, expenses, assets, and liabilities to the California Board of Equalization (BOE) for tax or regulatory purposes.

02

Taxpayers who engage in specific activities such as the sale of tangible personal property, retail sales, or use tax activities, may be required to fill out BOE CA forms.

03

Businesses, including corporations, partnerships, limited liability companies, or sole proprietorships, that operate within California and meet certain thresholds or criteria may need to use BOE CA forms to meet their reporting obligations.

04

Individuals or organizations involved in certain industries such as fuel or tobacco retailers, car dealerships, or sellers of alcoholic beverages may also require BOE CA forms for compliance.

05

Additionally, individuals or businesses that have been notified or instructed by the BOE to provide specific information through BOE CA forms must comply with the requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send boe ca for eSignature?

Once you are ready to share your boe ca, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my boe ca in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your boe ca and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out boe ca on an Android device?

Use the pdfFiller app for Android to finish your boe ca. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is boe ca?

BOE CA stands for Board of Equalization, California. It is the state agency responsible for administering and collecting various taxes in California.

Who is required to file boe ca?

Businesses operating in California that are required to collect and remit sales tax must file BOE CA.

How to fill out boe ca?

The BOE CA form can be filled out online through the Board of Equalization website or by mail. Businesses must report their taxable sales and pay the appropriate amount of sales tax.

What is the purpose of boe ca?

The purpose of BOE CA is to ensure that businesses accurately report and pay their sales tax liabilities to the state of California.

What information must be reported on boe ca?

Businesses must report their total taxable sales, exempt sales, and any deductions or credits they are eligible for.

Fill out your boe ca online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Boe Ca is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.