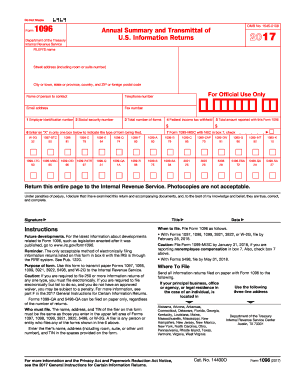

IRS 1098-C 2014 free printable template

Instructions and Help about IRS 1098-C

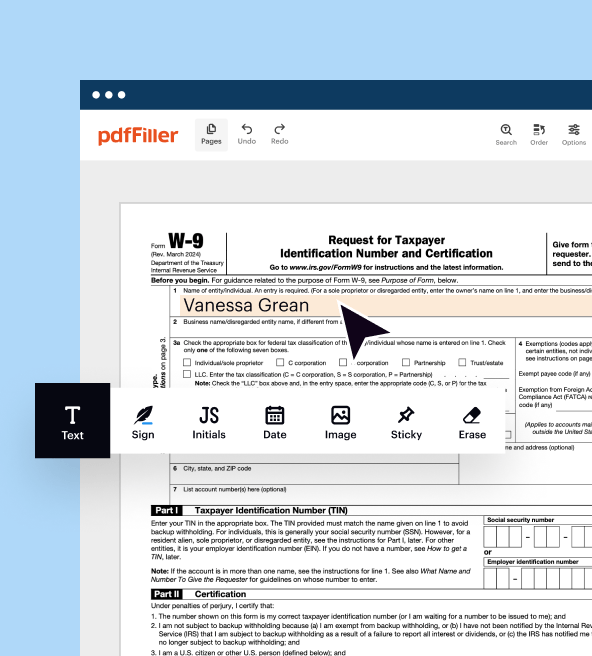

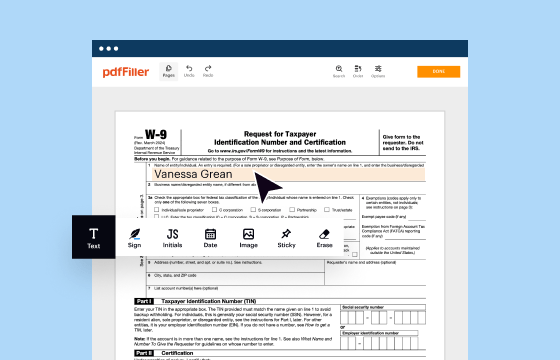

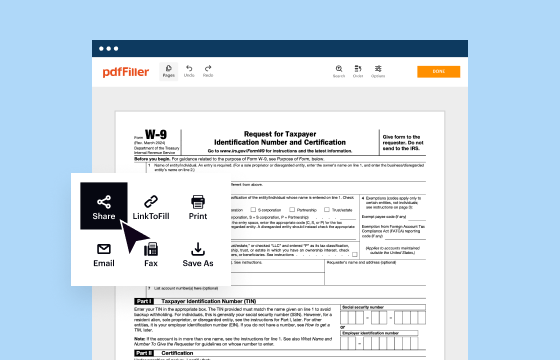

How to edit IRS 1098-C

How to fill out IRS 1098-C

About IRS 1098-C 2014 previous version

What is IRS 1098-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

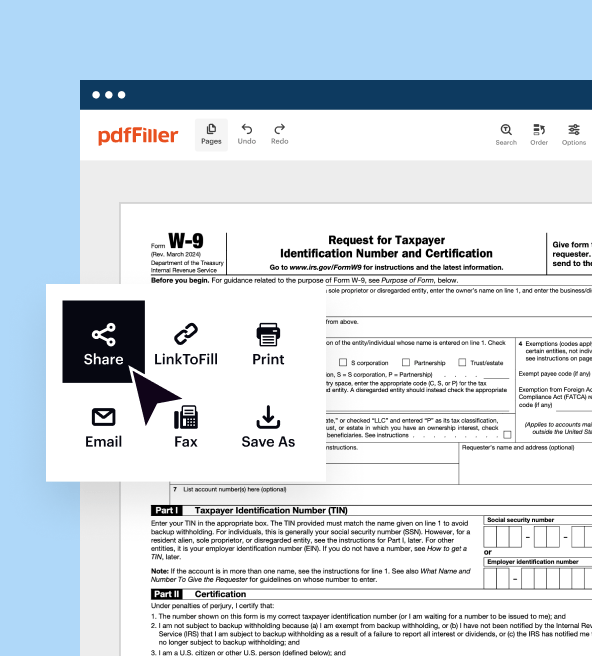

Where do I send the form?

FAQ about IRS 1098-C

What should I do if I realize I made a mistake after filing the 1098 c 2014 form?

If you discover an error after submitting the 1098 c 2014 form, you should file an amended or corrected form to address the mistake. It's important to clarify the nature of the error in the amended filing and include any required documentation to support the correction. Additionally, retain records of both the original and amended forms for your files.

How can I verify that my 1098 c 2014 form has been received and processed by the IRS?

To verify the receipt and processing of your 1098 c 2014 form, you can check the status through the IRS e-file tool if you submitted electronically. For paper forms, consider allowing several weeks for processing, and then call the IRS directly if you still have concerns. Document any correspondence for your own records.

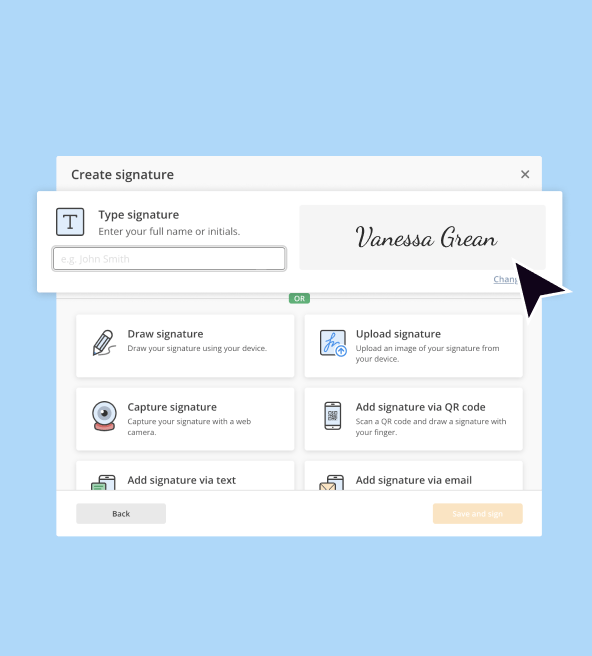

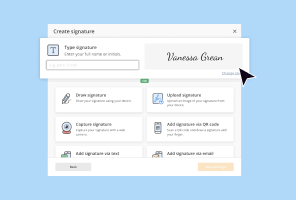

Can I use an e-signature when submitting the 1098 c 2014 form, and what are the data security considerations?

Yes, you can use an e-signature when submitting the 1098 c 2014 form, provided that it complies with IRS e-signature guidelines. When using e-signatures, ensure you are following best practices for data security, such as using secure channels for transmission and being familiar with privacy regulations to protect sensitive information.

What should I do if I receive a notice from the IRS regarding my 1098 c 2014 form submission?

If you receive a notice from the IRS concerning your 1098 c 2014 form, carefully review the details of the communication. Respond promptly according to the instructions provided, ensuring you gather and submit any necessary documentation to support your position or clarify any issues noted by the IRS.

See what our users say