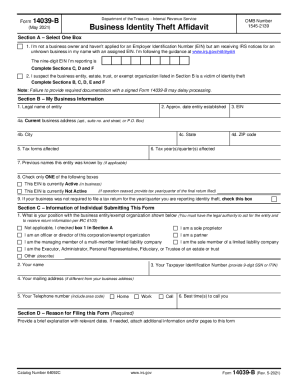

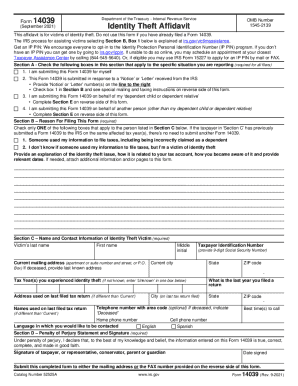

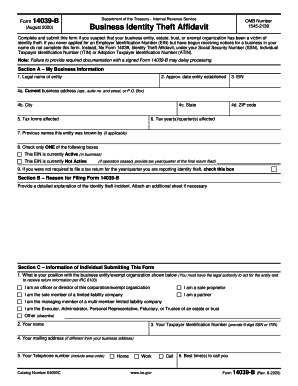

IRS 14039-B 2014 free printable template

Show details

Complete and submit this form if you suspect that your business entity, estate, trust or ... Attach an additional sheet if necessary to fully explain your identity theft.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 14039-B

Edit your IRS 14039-B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 14039-B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 14039-B online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 14039-B. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 14039-B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 14039-B

How to fill out IRS 14039-B

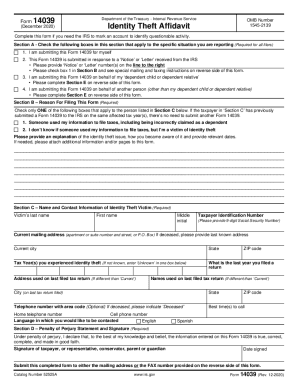

01

Obtain IRS Form 14039-B from the IRS website.

02

Review the instructions provided with the form to ensure you understand the information required.

03

Fill out your personal information in the designated fields, including your name, address, and Social Security number.

04

Answer questions regarding your identity theft experience, providing details as necessary.

05

Sign and date the form at the bottom to certify that the information is accurate.

06

Submit the completed form to the appropriate IRS address as instructed.

Who needs IRS 14039-B?

01

Individuals who have been victims of identity theft and need to report it to the IRS.

02

Taxpayers who have experienced issues with their tax return due to fraudulent activity using their Social Security number.

03

Anyone who receives a notice from the IRS indicating that their identity has been compromised.

Fill

form

: Try Risk Free

People Also Ask about

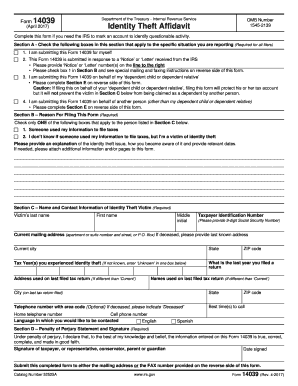

What happens when you file 14039?

The IRS will send you a notice. First, the IRS will acknowledge your reported tax identity theft. Within 30 days after the IRS gets your Form 14039, you'll get a letter telling you that the IRS received your affidavit. During this time, the IRS may ask you to prove your identity, typically with letter 5071C.

Where do I send my identity theft affidavit to the IRS?

Mail Form 14039 to this address: Internal Revenue Service, Stop C2003, Fresno, CA 93888.

Why did I get a letter from the IRS asking to verify my identity?

In some instances, you will need to verify your identity and tax return information with the IRS. This helps prevent an identity thief from getting your refund.

What letter do I get from the IRS about possible identity theft?

You may receive a Letter 4883C from the IRS asking you to verify your identity within 30 days. Follow the letter's instructions to verify your identity. Call the toll-free number provided in the letter. You must have the letter with you when you call the Taxpayer Protection Program.

What does IRS form 14039 do?

When a taxpayer believes their personal information is being used to file fraudulent tax returns, they should submit a Form 14039, Identity Theft AffidavitPDF, to the IRS.

Will the IRS email or call you to alert you to possible identity theft?

The IRS doesn't initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. Recognize the telltale signs of a scam. See also: How to know it's really the IRS calling or knocking on your door.

How long does it take IRS to investigate identity theft?

The IRS says that it resolves tax identity theft cases in 120 to 180 days, depending on your circumstances. But in many instances, victims of complex tax identity theft have experienced resolution times of more than one year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 14039-B on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing IRS 14039-B.

How do I fill out IRS 14039-B using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign IRS 14039-B and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit IRS 14039-B on an iOS device?

Use the pdfFiller mobile app to create, edit, and share IRS 14039-B from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is IRS 14039-B?

IRS 14039-B is a form used by taxpayers to report suspected identity theft and authenticate their identity with the IRS.

Who is required to file IRS 14039-B?

Taxpayers who believe that their personal information has been compromised, and that someone else is using it to file a tax return, are required to file IRS 14039-B.

How to fill out IRS 14039-B?

To fill out IRS 14039-B, taxpayers must provide personal identification information, details about the suspected identity theft, and any relevant information that can help the IRS in verifying their identity.

What is the purpose of IRS 14039-B?

The purpose of IRS 14039-B is to help the IRS identify and resolve cases of identity theft, ensuring the rightful taxpayer can file their tax return without issues.

What information must be reported on IRS 14039-B?

The information that must be reported on IRS 14039-B includes the taxpayer's name, address, Social Security number, the name of the person suspected of committing identity theft, details of the fraudulent activity, and any supporting documentation.

Fill out your IRS 14039-B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 14039-B is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.