Get the free INCOME FROM SELF-EMPLOYMENT - State of Michigan

Show details

BEM 5021 of 9INCOME FROM SELFEMPLOYMENTBPB 2017011

712017DEPARTMENT

POLICY

All Types of Assistance (TO)

This item identifies all the following:

Guidelines for determining if an individuals' income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income from self-employment

Edit your income from self-employment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income from self-employment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income from self-employment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit income from self-employment. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income from self-employment

How to fill out income from self-employment:

01

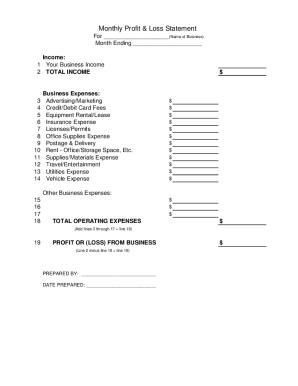

Keep thorough records of all your income sources: As a self-employed individual, it is crucial to maintain detailed records of all the income you generate from your business activities. This includes documentation of sales, client payments, and any other sources of income related to your self-employment.

02

Deduct legitimate business expenses: When filling out your income from self-employment, make sure to deduct any allowed business expenses. These can include office supplies, equipment, marketing costs, or travel expenses directly related to your business activities. Keep track of all your expenses and ensure they are reasonable and necessary for the operation of your business.

03

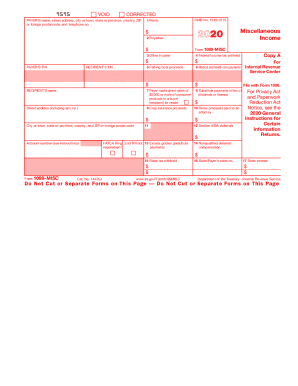

Use the appropriate tax forms: Self-employed individuals typically use Schedule C or Schedule C-EZ to report their business income and deductions. Make sure to carefully review the instructions for these forms to understand how to accurately report your income and claim any applicable deductions.

04

Consider quarterly estimated tax payments: Unlike traditional employees, self-employed individuals are responsible for paying their taxes throughout the year. Consider making quarterly estimated tax payments to avoid penalties and interest charges at tax time.

05

Seek professional help if needed: Filling out income from self-employment can be complex, especially if you are new to self-employment or have unique circumstances. If you have any doubts or questions, it is advisable to seek the assistance of a professional tax preparer or accountant who specializes in self-employment taxes.

Who needs income from self-employment?

01

Freelancers and independent contractors: Individuals who work on a project or contract basis, providing services to clients or companies, often earn income from self-employment. This can include professions such as writers, photographers, graphic designers, or consultants.

02

Small business owners: Entrepreneurs who operate their own business entities, such as sole proprietors or partners, typically have income from self-employment. They are responsible for managing all aspects of their business and may generate income from selling products or providing services.

03

Gig economy workers: With the rise of app-based platforms and on-demand services, many individuals now rely on income from self-employment. This can include people who drive for ride-sharing companies, deliver food or groceries, or perform other tasks through online platforms.

04

Professionals with side hustles: Some individuals who have a full-time job or are employed in traditional roles may also generate income from self-employment through side businesses or freelance work. This additional income can come from various sources, such as renting out properties, offering specialized services, or selling products online.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get income from self-employment?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific income from self-employment and other forms. Find the template you need and change it using powerful tools.

How do I edit income from self-employment straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing income from self-employment, you need to install and log in to the app.

How do I fill out income from self-employment using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign income from self-employment and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is income from self-employment?

Income from self-employment refers to earnings that an individual makes from running their own business or being a freelancer.

Who is required to file income from self-employment?

Individuals who earn income from self-employment are required to file their income taxes, including those who are sole proprietors, freelancers, independent contractors, and small business owners.

How to fill out income from self-employment?

Income from self-employment can be reported on Schedule C of the individual's tax return form (Form 1040). The individual will need to report their gross income, business expenses, and calculate their net income.

What is the purpose of income from self-employment?

The purpose of income from self-employment is to accurately report and pay taxes on the earnings generated from running a business or being self-employed.

What information must be reported on income from self-employment?

Information that must be reported on income from self-employment includes gross income, business expenses, net income, and any applicable deductions or credits.

Fill out your income from self-employment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income From Self-Employment is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.