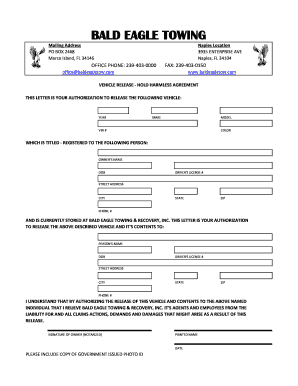

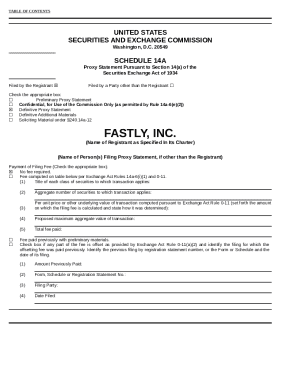

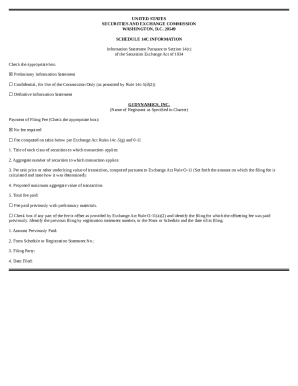

MX GIFP4A15 free printable template

Show details

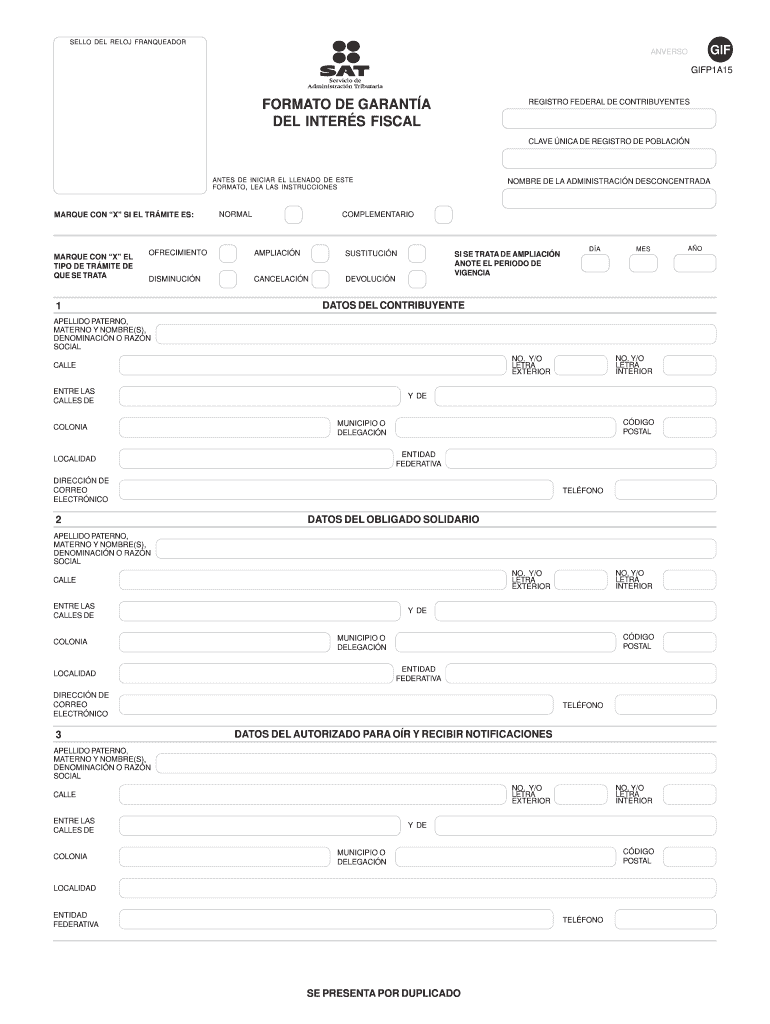

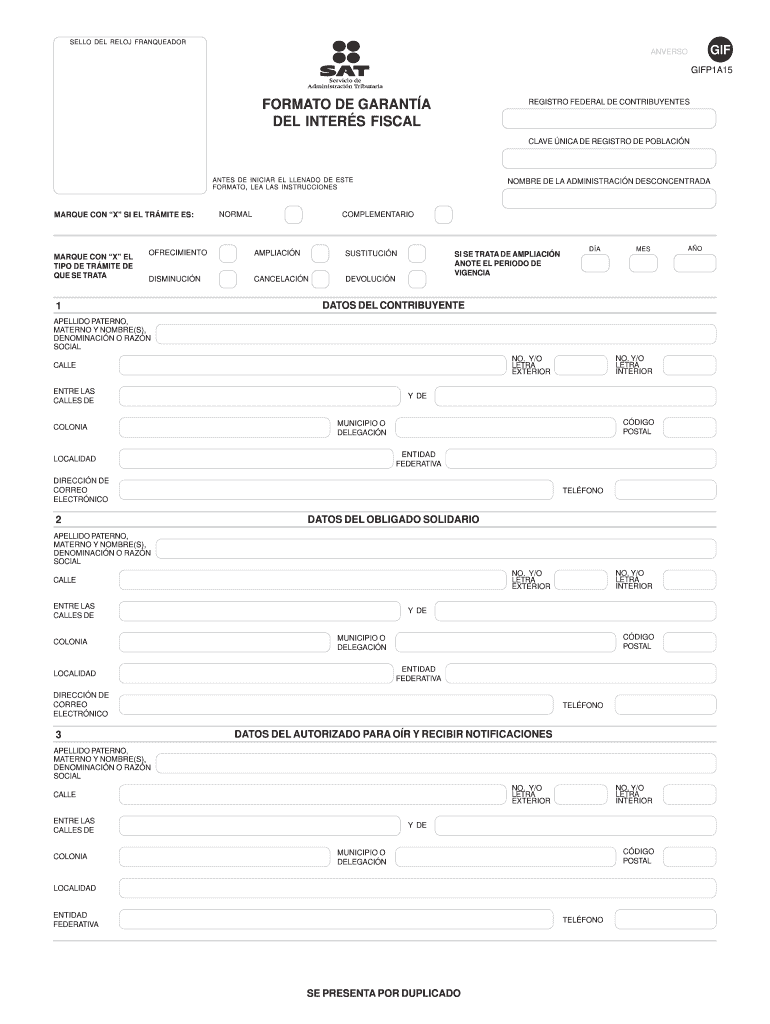

GIFP1A15. SELL DEL REL OJ FRANQUEADOR ... ANDERSON ... content hombre, denomination o ran social Del contribute y SU RFC as Como.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign formato interes fiscal

Edit your formato interes form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your formato garantia interes fiscal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing interes fiscal online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit interes fiscal sample form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out formato interes printable

How to fill out MX GIFP4A15

01

Gather all necessary personal and financial information required for the form.

02

Start filling out the personal details section, including your name, address, and contact information.

03

Provide your tax identification number as requested on the form.

04

Complete the income details section, detailing all sources of income.

05

Fill in the deductions and credits that apply to your situation.

06

Double-check all the information for accuracy and ensure no sections are left blank.

07

Sign and date the form at the designated area before submission.

08

Keep a copy of the completed form for your records.

Who needs MX GIFP4A15?

01

Individuals filing taxes in Mexico who require a formal declaration of income and deductions.

02

Self-employed individuals and businesses that must report their financial activities.

Fill

formato interes blank

: Try Risk Free

People Also Ask about interes fiscal form

Is a 1099-INT the same as a 1099?

The 1099-INT is a common type of IRS Form 1099, which is a record that an entity or person — not your employer — gave or paid you money. You might receive this tax form from your bank because it paid you interest on your savings.

How do I get a 1099-INT form from my bank?

Forms are mailed by the end of January and should arrive by mid-February. If you're enrolled in Online Banking and you meet the IRS guidelines, you can find your 1099-INT form by signing in to Online Banking, selecting your deposit account and then selecting the Statements & Documents tab.

What is the IRS form for interest paid?

Use Form 1098, Mortgage Interest Statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or business from an individual, including a sole proprietor.

How much tax do I pay on a 1099-INT?

Taxpayers who receive Form 1099-INT may be required to report certain income on their Federal tax return. Taxable interest is taxed at the same rate as ordinary income. This means it is taxed at the same rate as an individual's salary or wages.

What is the difference between a 1099 and a 1099-INT?

If you earned more than $10 in interest from a bank, brokerage or other financial institution, you'll receive a 1099-INT. The 1099-INT is a common type of IRS Form 1099, which is a record that an entity or person — not your employer — gave or paid you money.

What do I put for taxable interest?

Taxable interest income is simply the money you earn on investments for which you're required to pay taxes. In most cases, your tax rate on earned interest income is the same rate as the rest of your income. Bonds, mutual funds, and interest-bearing accounts are all types of interest income that are taxable.

Do I need to report interest under $10?

Regarding missing form 1099-INT, if you have interest income of at least $10, you'll usually receive a Form 1099-INT. However, if you don't receive the form, you must still report your interest income earned. To get your interest earnings amounts, do one of these: Check your account statements.

Does interest income under $10 need to be reported?

You should receive a Form 1099-INT from banks and financial institutions for interest earned over $10. Even if you did not receive a Form 1099-INT, or if you received interest under $10 for the tax year, you are still required to report any interest earned and credited to your account during the year.

What is the minimum interest to report to IRS?

If a bank, financial institution, or other entity pays you at least $10 of interest during the year, it is required to prepare a Form 1099-INT, send you a copy by January 31, and file a copy with the IRS.

What is the minimum amount for a 1099-INT?

If you receive $10 or more in interest, you will receive a Form 1099-INT. This form shows the amount of interest you received, any taxes withheld, and if any of the interest is tax-exempt. You will report this income on your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete interes fiscal make online?

Easy online formato interes online completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I sign the interes fiscal print electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your formato interes download and you'll be done in minutes.

How can I edit gifp4a15 formato online on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing formato interes fillable.

What is MX GIFP4A15?

MX GIFP4A15 is a tax form used in Mexico for reporting financial information related to foreign entities.

Who is required to file MX GIFP4A15?

Foreign entities and residents in Mexico that engage in transactions with foreign trusts or receive income from foreign sources are required to file MX GIFP4A15.

How to fill out MX GIFP4A15?

To fill out MX GIFP4A15, you must provide accurate financial data, including income details, foreign account information, and relevant identifying information of the entities involved.

What is the purpose of MX GIFP4A15?

The purpose of MX GIFP4A15 is to ensure compliance with tax regulations and to report foreign income for the correct assessment of tax liabilities.

What information must be reported on MX GIFP4A15?

The information that must be reported includes details of foreign income, financial transactions, foreign accounts, and the identification of relevant entities.

Fill out your formato interes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Garantia Interes is not the form you're looking for?Search for another form here.

Keywords relevant to formato garantia fiscal

Related to formato interes create

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.