Get the free secure life plan - mutcd fhwa dot

Show details

2003 Edition Page 2C1 CHAPTER 2C. WARNING SIGNS Section 2C.01 Function of Warning Signs Support: Warning signs call attention to unexpected conditions on or adjacent to a highway or street and to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign secure life plan

Edit your secure life plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your secure life plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit secure life plan online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit secure life plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out secure life plan

How to fill out a secure life plan:

01

Start by assessing your current financial situation and goals. Determine what you want to achieve with your secure life plan, such as paying off debts, saving for retirement, or protecting your family's financial future.

02

Research and understand the different types of insurance and investment options available for securing your life plan. This may include life insurance, disability insurance, long-term care insurance, and various investment vehicles like stocks, bonds, and mutual funds.

03

Consult with a financial advisor or insurance agent who specializes in secure life planning. They can provide expert guidance and help you create a customized plan based on your unique circumstances and objectives.

04

Evaluate your budget and determine how much you can comfortably allocate towards your secure life plan. Consider your income, expenses, and any existing financial obligations to ensure you can afford the premiums or contributions required.

05

Review and compare different insurance or investment products to find the ones that best align with your goals and preferences. Consider factors such as coverage or investment returns, fees, flexibility, and the company's reputation and financial stability.

06

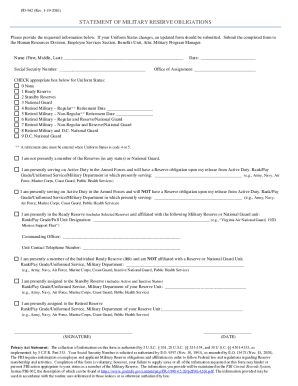

Fill out the necessary paperwork to enroll in the chosen insurance or investment products. This may involve completing applications, providing personal and financial information, and potentially undergoing medical or financial underwriting processes.

07

Review your secure life plan regularly to ensure it remains aligned with your evolving needs and goals. Life events like getting married, having children, or changing jobs may require adjustments to your plan.

Who needs a secure life plan:

01

Individuals seeking financial security and protection for themselves and their loved ones. A secure life plan can provide a sense of reassurance and a safety net in case of unforeseen circumstances like death, disability, or serious illness.

02

Breadwinners or individuals with dependents who rely on their income. A secure life plan can help replace lost income and cover financial obligations, ensuring that loved ones are not burdened financially in the event of the policyholder's death or disability.

03

Those aiming for a comfortable retirement. A secure life plan can include provisions for retirement savings, ensuring a steady stream of income and a financially stable future during retirement.

04

Individuals looking to minimize financial risks and protect their assets. Through various insurance options, a secure life plan can shield individuals from potential financial burdens caused by accidents, natural disasters, or unexpected liability claims.

05

Anyone with financial goals such as purchasing a home, funding education, starting a business, or leaving a legacy. A secure life plan can provide the necessary financial resources and protection to achieve these goals.

Remember, it's always important to consult with a professional financial advisor or insurance agent to tailor a secure life plan that suits your specific needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send secure life plan for eSignature?

Once your secure life plan is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my secure life plan in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your secure life plan and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit secure life plan on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share secure life plan from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

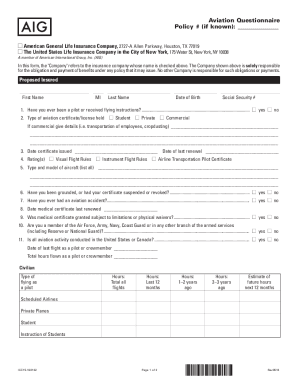

What is secure life plan?

Secure life plan is a document outlining an individual's financial goals, insurance coverage, retirement planning, and overall strategy for achieving financial security.

Who is required to file secure life plan?

Anyone who wants to plan for their financial future and ensure they have adequate insurance coverage is encouraged to create a secure life plan.

How to fill out secure life plan?

To fill out a secure life plan, individuals should gather information on their current financial situation, set goals for the future, evaluate insurance needs, and create a detailed plan for achieving financial security.

What is the purpose of secure life plan?

The purpose of a secure life plan is to help individuals understand their financial situation, set achievable goals, and plan for their financial future.

What information must be reported on secure life plan?

Information such as income, expenses, assets, debts, insurance policies, retirement savings, and financial goals should be reported on a secure life plan.

Fill out your secure life plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Secure Life Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.