Get the free Visa Credit Card Disclosure. Save this for your files - alliantcreditunion

Show details

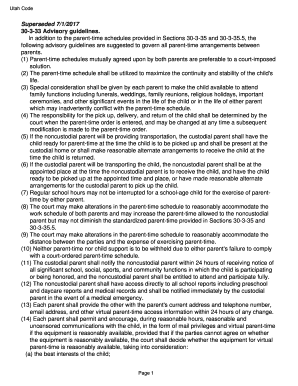

Allianz Credit Union Visa Disclosure Visa Platinum and Visa Platinum Rewards Interest Rates and Interest Charges 0% to 5.99% Annual Percentage Rate (APR) for Purchases introductory APR for 12 billing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign visa credit card disclosure

Edit your visa credit card disclosure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your visa credit card disclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing visa credit card disclosure online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit visa credit card disclosure. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out visa credit card disclosure

Who needs visa credit card disclosure?

01

Any individual or entity that holds a Visa credit card or is applying for one needs to be aware of and understand the visa credit card disclosure. This includes both personal and business cardholders.

02

Existing Visa credit cardholders who have been issued an updated or revised disclosure statement should review the new terms and conditions and ensure they understand any changes.

03

Individuals or organizations considering applying for a Visa credit card should also familiarize themselves with the disclosure to fully understand the terms, fees, interest rates, and other important information associated with the card.

How to fill out visa credit card disclosure:

01

Start by carefully reading the entire disclosure document provided by the issuer of your Visa credit card. This document contains important information about the card's terms and conditions, fees, interest rates, and other relevant details.

02

Pay close attention to the sections highlighting the annual percentage rate (APR) for purchases, balance transfers, and cash advances. Understand how the APR is determined, whether it is variable or fixed, and any introductory rates that may apply.

03

Take note of the fees associated with the card, including the annual fee, late payment fees, over-limit fees, and any other charges that may apply. Ensure you understand when and how these fees may be assessed.

04

Familiarize yourself with the grace period provided by the issuer. The grace period is the amount of time you have to pay your balance in full before interest begins to accrue. Understand whether there is a grace period and how it is calculated.

05

Review the section on rewards programs or cashback offers if applicable. Understand how rewards are earned, redeemed, and any limitations or restrictions that may apply.

06

Ensure you understand the issuer's liability policies for unauthorized use or fraudulent transactions. Take note of the steps you need to take to report any unauthorized use promptly.

07

Look for any sections related to dispute resolution procedures or arbitration agreements. Understand how disputes between you and the issuer will be handled and whether there are any limitations on your rights to take legal action.

08

Consider contacting the issuer directly if you have any questions or need clarification on any aspect of the disclosure. It is important to have a clear understanding of the terms and conditions before using your Visa credit card.

09

Keep a copy of the completed and signed disclosure for your records. This will serve as a reference in case of any future disputes or questions.

Following these steps will ensure that you are well-informed and prepared when it comes to filling out a Visa credit card disclosure. It is vital to fully understand the terms and conditions associated with your credit card to minimize any potential risks and maximize the benefits of your card.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is visa credit card disclosure?

Visa credit card disclosure is a document that outlines the terms and conditions of a Visa credit card, including fees, interest rates, and other important information.

Who is required to file visa credit card disclosure?

Financial institutions and credit card issuers are required to file Visa credit card disclosure.

How to fill out visa credit card disclosure?

Visa credit card disclosure can be filled out by providing all the required information and ensuring that it complies with Visa's regulations.

What is the purpose of visa credit card disclosure?

The purpose of Visa credit card disclosure is to provide transparency to consumers about the terms and conditions of their credit card.

What information must be reported on visa credit card disclosure?

Information such as fees, interest rates, credit limits, and any other important terms and conditions of the credit card must be reported on Visa credit card disclosure.

How can I modify visa credit card disclosure without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including visa credit card disclosure, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit visa credit card disclosure online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your visa credit card disclosure to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit visa credit card disclosure straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing visa credit card disclosure, you need to install and log in to the app.

Fill out your visa credit card disclosure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Visa Credit Card Disclosure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.