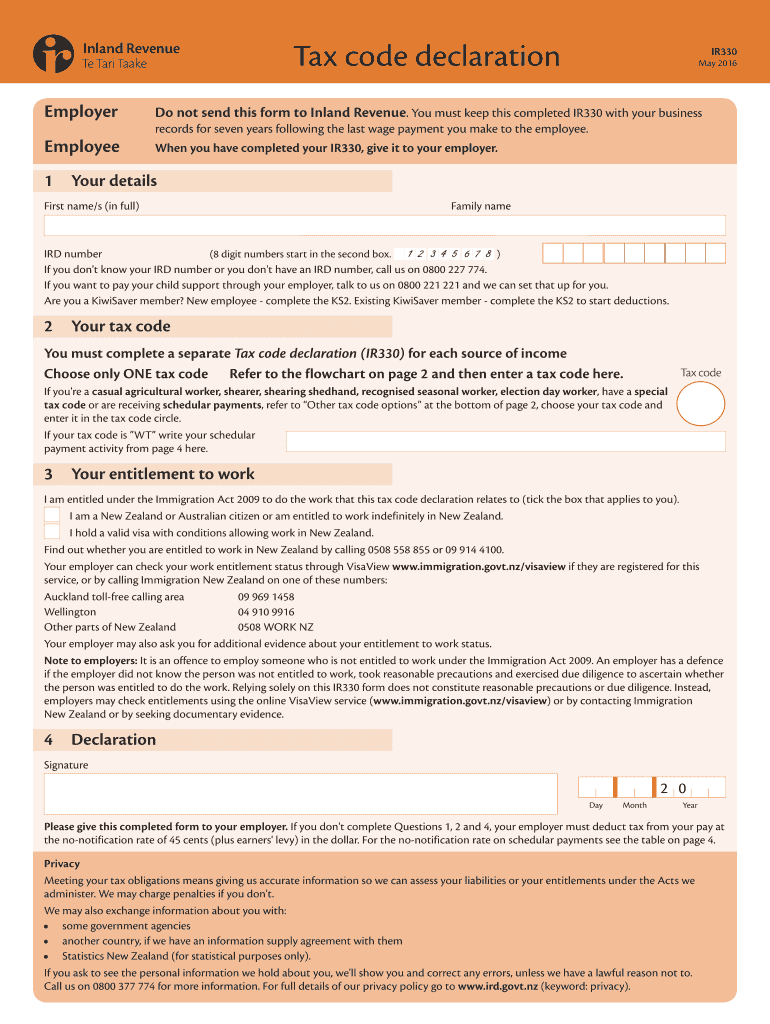

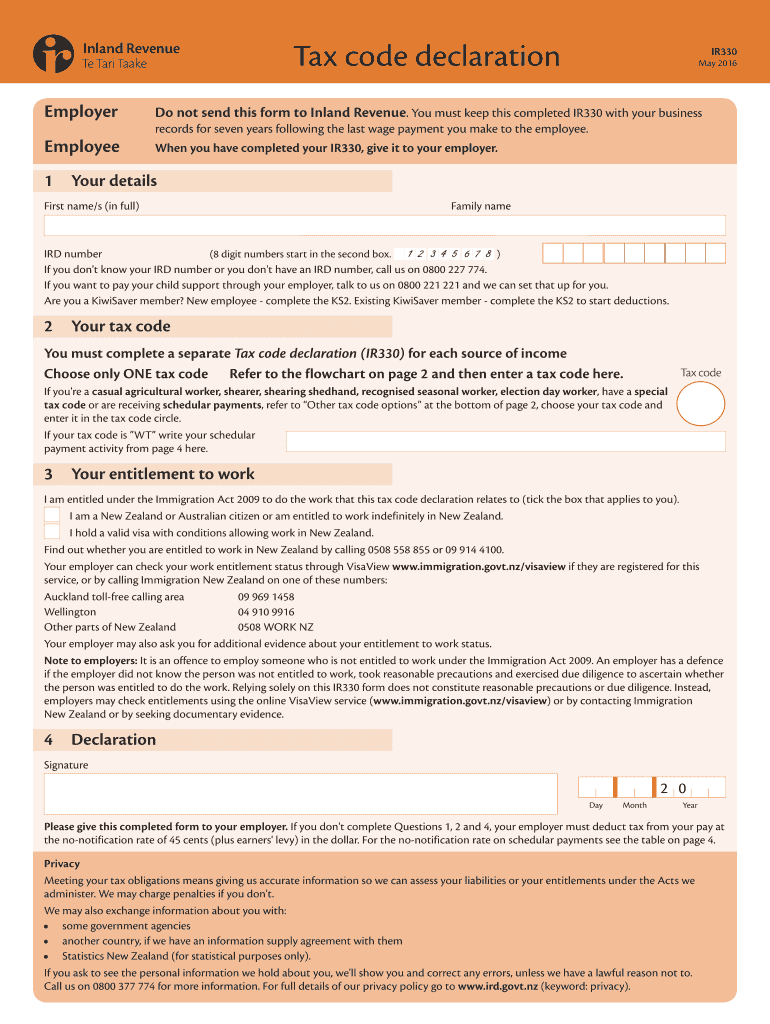

NZ IR330 2016 free printable template

Show details

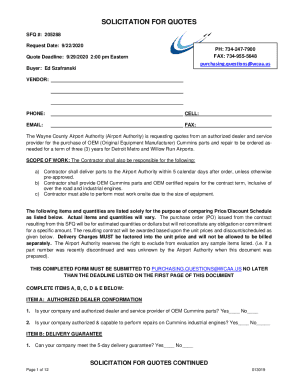

Complete the IR330 Tax code declaration form if you are an employee starting ... Click to go to Inland Revenue homepage ... Do not use this form if your contractor receiving scheduler payments. ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NZ IR330

Edit your NZ IR330 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NZ IR330 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NZ IR330 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NZ IR330. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NZ IR330 Form Versions

Version

Form Popularity

Fillable & printabley

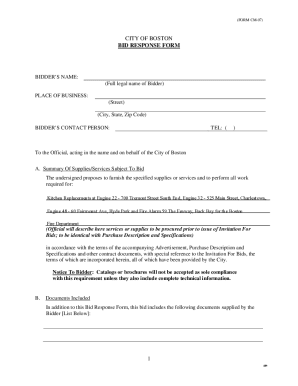

How to fill out NZ IR330

How to fill out NZ IR330

01

Obtain a copy of the NZ IR330 form from the New Zealand Inland Revenue website.

02

Fill in your personal details, including your name, IRD number, and contact information.

03

Specify your taxation residency status, indicating if you are a New Zealand resident or a non-resident.

04

Choose the appropriate tax code that applies to your situation (e.g., salary or wages, bonus, or commission).

05

Indicate any other relevant information required for your tax code assignment.

06

Review the completed form for accuracy before submission.

07

Submit the form to your employer or the relevant tax authority.

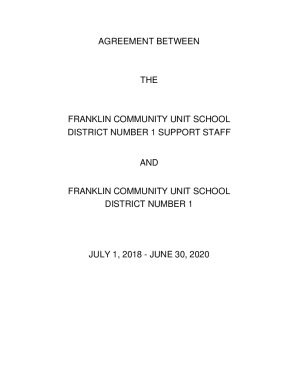

Who needs NZ IR330?

01

Individuals who are employed and need to have the correct tax code for payroll purposes.

02

New employees who are starting a new job in New Zealand.

03

Contractors or freelancers who want to ensure their tax code is correctly assigned.

Fill

form

: Try Risk Free

What is ir 330?

What is an IR330? If you are an employee earning a salary or wage then you'll need to fill out this form. ... This form specifies what tax code will apply so your employers know what tax rate to apply to your wages.

People Also Ask about

What is form and meaning examples?

Form is the physical structure of something, while meaning is the interpretation or concept that is attached to that form. For example, the form of a chair is its physical structure – four legs, a seat, and a back. The meaning of a chair is that it is something you can sit on.

What is example of form?

What are Examples of Forms? Forms are documents that collect information from one's clients, customers, and respondents. Some common examples of forms include forms for purchases, incident reports, hazards, quality control, contact tracing, and feedback gathering.

How do you spell form in English?

form noun (SHAPE)

What do you mean by form in computer?

A form in Access is a database object that you can use to create a user interface for a database application. A "bound" form is one that is directly connected to a data source such as a table or query, and can be used to enter, edit, or display data from that data source.

What do you mean by a form?

Form is the shape, visual appearance, or configuration of an object. In a wider sense, the form is the way something happens. Form may also refer to: Form (document), a document (printed or electronic) with spaces in which to write or enter data.

What does form mean in writing?

FORM - is the name of the text type that the writer uses. For example, scripts, sonnets, novels etc. All of these are different text types that a writer can use. The form of a text is important because it indicates the writer's intentions, characters or key themes.

What is a form example?

What are Examples of Forms? Forms are documents that collect information from one's clients, customers, and respondents. Some common examples of forms include forms for purchases, incident reports, hazards, quality control, contact tracing, and feedback gathering.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NZ IR330 for eSignature?

When you're ready to share your NZ IR330, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I get NZ IR330?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the NZ IR330. Open it immediately and start altering it with sophisticated capabilities.

How do I edit NZ IR330 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your NZ IR330 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is NZ IR330?

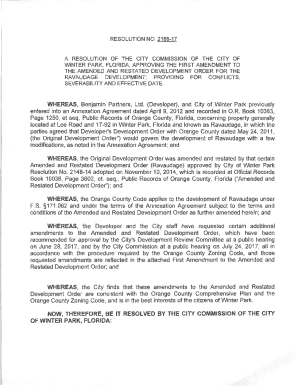

NZ IR330 is a tax code declaration form used in New Zealand for employees to choose the appropriate tax code for their income.

Who is required to file NZ IR330?

Any new employee or those who have changes in their tax circumstances, such as a new job, are required to file NZ IR330.

How to fill out NZ IR330?

To fill out NZ IR330, individuals must provide personal details, including name, address, IRD number, and select the relevant tax code that reflects their situation.

What is the purpose of NZ IR330?

The purpose of NZ IR330 is to ensure that employers withhold the correct amount of tax from an employee's salary or wages based on their chosen tax code.

What information must be reported on NZ IR330?

NZ IR330 requires reporting personal information such as the employee's name, address, IRD number, and selected tax code.

Fill out your NZ IR330 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NZ ir330 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.