NZ IR330 2021 free printable template

Show details

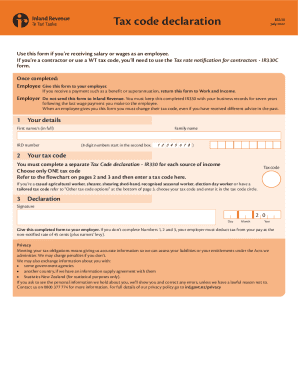

Tax code declarationIR330March 2021Use this form if you're receiving salary or wages as an employee. If you're a contractor or use a WT tax code, you'll need to use the Tax rate notification for contractors

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign NZ IR330

Edit your NZ IR330 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NZ IR330 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NZ IR330 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NZ IR330. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NZ IR330 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NZ IR330

How to fill out NZ IR330

01

Start by downloading the NZ IR330 form from the official Inland Revenue website.

02

Provide your personal details, including your name, address, and IRD number.

03

Indicate your employment status and fill in the relevant tax code based on your situation.

04

Review the contact details and ensure that they are accurate.

05

If applicable, fill in any additional information required by your employer.

06

Sign and date the form to confirm that all information is correct.

07

Submit the completed form to your employer, either in person or electronically.

Who needs NZ IR330?

01

NZ IR330 is required for individuals who are starting new employment and need to determine the correct tax code to use for their salary or wages.

02

It is also needed by employers to calculate the correct amount of tax to withhold from their employees' pay.

Fill

form

: Try Risk Free

What is ir 330?

What is an IR330? If you are an employee earning a salary or wage then you'll need to fill out this form. ... This form specifies what tax code will apply so your employers know what tax rate to apply to your wages.

People Also Ask about

What is me tax code in New Zealand?

ME – a tax concession code for annual earnings from $ 24,000 to $ 48,000. The amount of the concession is $ 10 per week. A prerequisite is the absence of other social benefits.

What is the no notification tax rate in New Zealand?

If you don't complete sections 1 and 3 your payer must deduct tax from your pay at the no-notification rate of 45%, except for non-resident contractor companies where it's 20%.

What is the New Zealand income tax rate for foreigners?

NZ Income Tax Rate Earnings in NZDRate Applicable to Income Level (%)14,001 – 48,00017.5%48,001 – 70,00030%70,001 – 180,00033%Over 180,00039%1 more row

What is the difference between M and ME tax code NZ?

The income tax code for most employees is M. If you are a New Zealand tax resident, and have income between $24,000 and $48,000, then your tax code is ME. If you have a student loan, you're required to use a main tax code that includes "SL" unless you have a repayment deduction exemption.

What is the basic tax rate in New Zealand?

RelatedLastReferencePersonal Income Tax Rate39.00Dec 2023Corporate Tax Rate28.00Dec 2023Sales Tax Rate15.00Dec 2023Social Security Rate11.00Dec 20212 more rows

What is the format of the IRD?

The IRD number is a unique number issued by Inland Revenue. The IRD number format used by Inland Revenue is an eight or nine digit number in the format 99999999 or 999999999 (depending on when it was first issued).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NZ IR330 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including NZ IR330. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit NZ IR330 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing NZ IR330.

How do I complete NZ IR330 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your NZ IR330. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NZ IR330?

NZ IR330 is a tax form in New Zealand used by employees to determine their correct tax code, which helps their employer deduct the right amount of tax from their earnings.

Who is required to file NZ IR330?

Employees who start a new job or change their tax code are required to file NZ IR330.

How to fill out NZ IR330?

To fill out NZ IR330, you need to provide personal details such as your name, address, IRD number, and select the appropriate tax code based on your income situation.

What is the purpose of NZ IR330?

The purpose of NZ IR330 is to ensure that the correct amount of income tax is withheld from an employee's salary or wages.

What information must be reported on NZ IR330?

The information that must be reported on NZ IR330 includes personal details (name, address, IRD number) and the chosen tax code.

Fill out your NZ IR330 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NZ ir330 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.