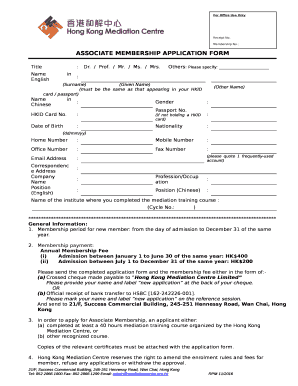

Get the free Australian Tax Law - utas edu

Show details

BFA714 Australian Tax Law Semester 1, 2014 THIS UNIT IS BEING OFFERED IN HOBART Teaching Team: Sonia Shield John Mines CRICKS Provider Code: 00586B 1 Contents Contact Details ........................................................................................................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign australian tax law

Edit your australian tax law form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your australian tax law form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit australian tax law online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit australian tax law. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out australian tax law

How to fill out Australian tax law?

01

Familiarize yourself with the different tax forms: Start by understanding the various tax forms used in Australia, such as the Income Tax Return for individuals, Company Tax Return for businesses, and Goods and Services Tax (GST) returns, depending on your specific circumstances.

02

Gather necessary documents: Collect all relevant financial records, such as income statements, receipts, invoices, and bank statements. Ensure you have documentation to support any deductions or claims you plan to make.

03

Determine your tax obligations: Understand your tax obligations based on your residency status and income sources. Whether you are a resident, non-resident, or temporary resident, your tax liabilities may differ.

04

Identify applicable deductions and tax offsets: Take advantage of eligible deductions and tax offsets to minimize your taxable income. Some common deductions may include work-related expenses, charitable donations, and investment expenses.

05

Calculate your taxable income: Summarize your total income and deduct applicable deductions and offsets. This will give you your taxable income figure, which will be used to determine the amount of tax you owe.

06

Report your income and deductions: Complete the relevant tax forms accurately, ensuring that you correctly report all sources of income and applicable deductions. Double-check your entries to avoid errors or inconsistencies.

07

Lodge your tax return: Once you have completed all the necessary forms and calculations, you need to lodge your tax return. This can be done electronically using the Australian Taxation Office's online services or by mail.

Who needs Australian tax law?

01

Individuals: All individuals earning income in Australia are subject to Australian tax law. This includes Australian residents, non-residents, and temporary residents who have earned income within the country.

02

Businesses: Australian tax law applies to businesses operating within the country. This includes companies, partnerships, trusts, and sole traders who generate income from their activities.

03

Investors: Individuals or businesses who earn income from investments, such as rental properties, shares, or capital gains, are subject to Australian tax law.

04

Employees: Individuals who earn income as employees, whether through wages, salaries, commissions, or bonuses, need to understand and comply with Australian tax obligations.

05

International entities: Foreign entities conducting business or earning income in Australia may also be subject to Australian tax law, depending on the specific circumstances and agreements in place.

Understanding and fulfilling Australian tax obligations is crucial for individuals, businesses, investors, employees, and international entities operating within the country. Compliance with Australian tax law ensures that taxes are paid correctly and helps to avoid any penalties or legal issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is australian tax law?

Australian tax law refers to the set of rules and regulations that govern the taxation system in Australia, including income tax, goods and services tax (GST), and other tax obligations.

Who is required to file australian tax law?

Individuals and businesses that earn income in Australia are required to file Australian tax law.

How to fill out australian tax law?

To fill out Australian tax law, individuals and businesses must gather all relevant financial information, complete the necessary tax forms, and submit them to the Australian Taxation Office (ATO).

What is the purpose of australian tax law?

The purpose of Australian tax law is to fund government services and programs, redistribute wealth, and regulate economic behavior.

What information must be reported on australian tax law?

Information that must be reported on Australian tax law includes income, deductions, expenses, and other financial transactions.

How do I fill out the australian tax law form on my smartphone?

Use the pdfFiller mobile app to fill out and sign australian tax law on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit australian tax law on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share australian tax law from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Can I edit australian tax law on an Android device?

The pdfFiller app for Android allows you to edit PDF files like australian tax law. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your australian tax law online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Australian Tax Law is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.