Get the free AML Policy.doc

Show details

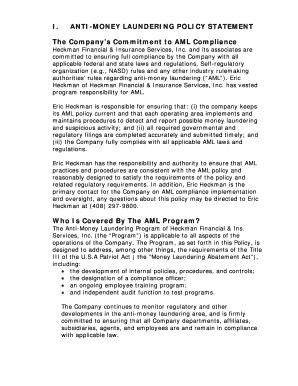

ANTIMONY LAUNDERING POLICY

Effective Date: May 2, 2006,

Revision Date: 7/01/2006

Policy:

Money laundering is the act of converting money or other monetary instruments gained from

illegal activity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aml policydoc

Edit your aml policydoc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aml policydoc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit aml policydoc online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit aml policydoc. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aml policydoc

How to fill out AML policydoc:

01

Start by gathering all necessary information, such as company details and relevant legal requirements.

02

Clearly define your company's risk assessment process and procedures for identifying and verifying customers.

03

Include a detailed description of your company's monitoring and reporting processes for suspicious activities.

04

Document your company's processes for training employees on AML policies and procedures.

05

Specify the measures taken to ensure ongoing compliance with AML regulations and any updates made to the policydoc.

06

Lastly, review and finalize the AML policydoc, making sure that it is consistent with industry best practices and regulatory requirements.

Who needs AML policydoc:

01

Financial institutions such as banks, credit unions, and insurance companies are required to have AML policydocs in place to comply with regulations and prevent money laundering.

02

Non-banking businesses involved in financial transactions, such as money services businesses, casinos, and precious metals dealers, may also need to create and follow AML policydocs.

03

Additionally, businesses in industries with higher risk factors, such as real estate, may choose to have an AML policydoc to mitigate potential money laundering risks and demonstrate their commitment to transparency and compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is aml policydoc?

AML Policydoc refers to an Anti-Money Laundering Policy document that outlines a company's procedures for preventing and detecting money laundering activities.

Who is required to file aml policydoc?

Financial institutions, banks, money transmitters, and other regulated entities are required to file an AML Policydoc.

How to fill out aml policydoc?

To fill out an AML Policydoc, you must include information on customer due diligence procedures, suspicious activity reporting, employee training, and compliance monitoring.

What is the purpose of aml policydoc?

The purpose of an AML Policydoc is to establish controls and procedures to prevent and detect money laundering, terrorist financing, and other illegal activities.

What information must be reported on aml policydoc?

Information such as customer identification procedures, transaction monitoring, risk assessment, and record-keeping requirements must be reported on an AML Policydoc.

How can I modify aml policydoc without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including aml policydoc, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit aml policydoc in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your aml policydoc, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my aml policydoc in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your aml policydoc and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your aml policydoc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aml Policydoc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.