Get the free Security Instrument/ Mortgage/Deed of Trust Section 232 Recording ... - portal hud

Show details

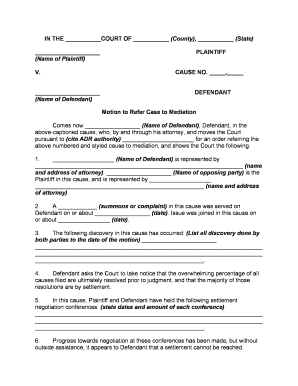

Security Instrument/ Mortgage/Deed of Trust Section 232 U.S. Department of Housing and Urban Development Office of Healthcare Programs OMB Approval No. 99999999 (exp. mm/dd/YYY) Deleted: No.25020598

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign security instrument mortgagedeed of

Edit your security instrument mortgagedeed of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your security instrument mortgagedeed of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit security instrument mortgagedeed of online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit security instrument mortgagedeed of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out security instrument mortgagedeed of

How to fill out a security instrument mortgage deed:

01

Obtain a copy of the security instrument mortgage deed form: Start by acquiring a copy of the specific security instrument mortgage deed form that is required for your jurisdiction. This can typically be obtained from the local county recorder's office or through legal document providers.

02

Identify the parties involved: Clearly identify the parties involved in the transaction—the mortgagor (borrower) and the mortgagee (lender). Include their full legal names, addresses, and any other relevant identifying information required by the form.

03

Describe the property: Provide an accurate and detailed description of the property being mortgaged. This should include the complete address, legal description, and any additional identifying information like parcel numbers or lot numbers.

04

State the amount of the mortgage: Clearly state the principal amount of the mortgage. This is the initial loan amount that the borrower is requesting from the lender.

05

Outline the terms and conditions: Include all the necessary terms and conditions of the mortgage agreement. These may include the interest rate, payment schedule, late payment penalties, and any other important provisions related to the loan.

06

Indicate the repayment terms: Specify the repayment terms agreed upon, such as the duration of the loan and the method of repayment (e.g., monthly installments).

07

Include default provisions: Include provisions that outline the circumstances under which a default may occur and the consequences of defaulting on the mortgage. This can involve foreclosure procedures or other remedies available to the lender.

08

Add signatures and notarization: Ensure that all parties involved (borrower and lender) sign the security instrument mortgage deed. It is important to have the document notarized to verify its authenticity and legality.

Who needs a security instrument mortgage deed:

01

Homebuyers: Individuals or families purchasing a home through a mortgage loan will typically require a security instrument mortgage deed. This document serves as a legal agreement between the borrower and the lender outlining the terms and conditions of the loan.

02

Real estate investors: Investors who acquire properties for investment purposes and finance them through mortgages will also need a security instrument mortgage deed. This protects the lender's interest in the property in case of default.

03

Lenders and financial institutions: Lenders and financial institutions providing mortgage loans to borrowers require a security instrument mortgage deed to secure their interests in the property and ensure repayment.

04

Government entities: Government entities that provide mortgage programs or loan guarantees may also require the use of a security instrument mortgage deed to protect their investment and ensure compliance with program guidelines.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I fill out security instrument mortgagedeed of on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your security instrument mortgagedeed of from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit security instrument mortgagedeed of on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute security instrument mortgagedeed of from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete security instrument mortgagedeed of on an Android device?

Complete your security instrument mortgagedeed of and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is security instrument mortgagedeed of?

Security instrument mortgage deed is a legal document that pledges a real estate property as collateral for a loan.

Who is required to file security instrument mortgagedeed of?

The borrower or homeowner is typically required to file the security instrument mortgage deed.

How to fill out security instrument mortgagedeed of?

The security instrument mortgage deed should be filled out by providing details of the property, the loan amount, and other necessary information as required by the lender.

What is the purpose of security instrument mortgagedeed of?

The purpose of a security instrument mortgage deed is to establish a legal claim on the property in case the borrower fails to repay the loan.

What information must be reported on security instrument mortgagedeed of?

The security instrument mortgage deed must include details of the property, the loan amount, the names of the parties involved, and any other relevant information.

Fill out your security instrument mortgagedeed of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Security Instrument Mortgagedeed Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.