MU Revenue Authority Tenth Schedule Statement of Income Received Forincome Year 2015-2025 free printable template

Show details

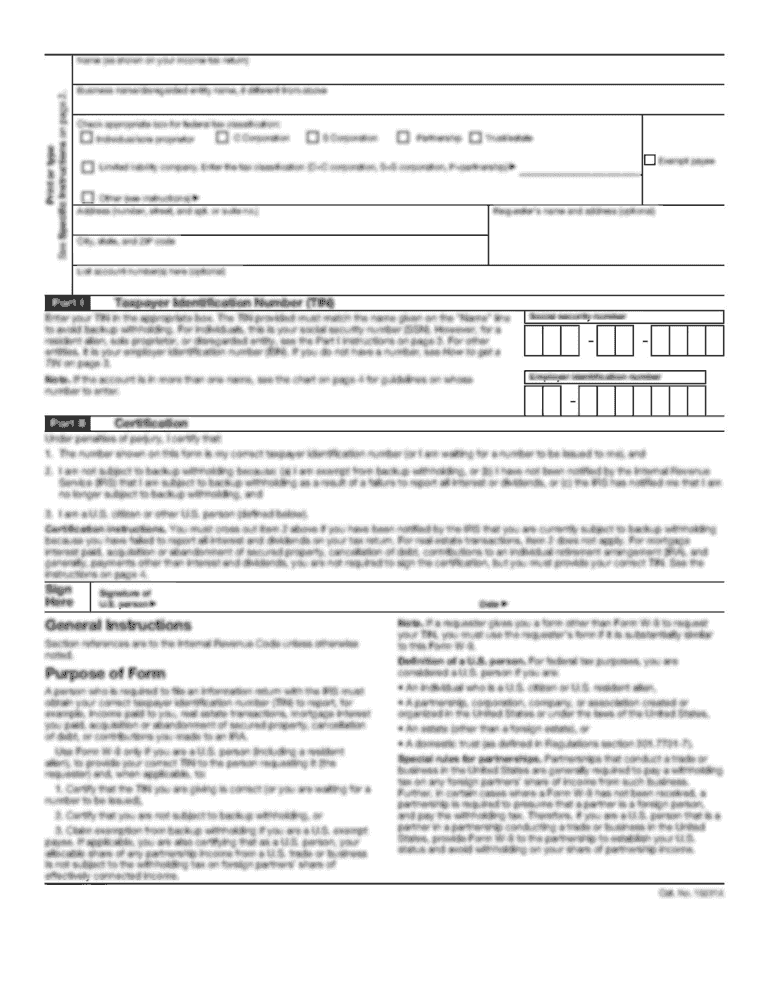

TENTH SCHEDULE (regulation 22B(1)) STATEMENT OF INCOME RECEIVED INCOME YEAR ENDED 30 JUNE. (To be given in duplicate by a payer to a payee not later than 15 August in the year of assessment) 1. IDENTIFICATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mra tenth schedule regulation

Edit your mra tenth schedule regulation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mra tenth schedule regulation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mra tenth schedule regulation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mra tenth schedule regulation. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mra tenth schedule regulation

How to fill out MU Revenue Authority Tenth Schedule Statement of Income

01

Obtain the MU Revenue Authority Tenth Schedule Statement of Income form.

02

Fill in your personal information including your name, address, and tax identification number.

03

Indicate the relevant accounting period for which you are reporting income.

04

List all sources of income, including salaries, business profits, rental income, etc.

05

Provide details of any allowable deductions such as business expenses, operational costs, and other relevant deductions.

06

Calculate your total income by summing all sources of income.

07

Subtract the total deductions from your total income to arrive at your net income.

08

Review all entries for accuracy and ensure all necessary supporting documents are attached.

09

Sign and date the form to certify that the information provided is true and correct.

10

Submit the completed form to the MU Revenue Authority by the specified deadline.

Who needs MU Revenue Authority Tenth Schedule Statement of Income?

01

Individuals and businesses who earn taxable income in the jurisdiction.

02

Self-employed individuals who need to report their earnings.

03

Landlords or property owners receiving rental income.

04

Freelancers and contractors who receive payments for services rendered.

05

Any entity required to report income for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

When should we pay TDS?

What is the due date for depositing the TDS to the government? The Tax Deducted at Source must be deposited to the government by the 7th of the subsequent month. For instance: TDS deducted in the month of June must be paid to the government by the 7th of July.

How can I get TDS certificate?

How to download the TDS certificate? Visit the TRACES website. Login using your user id, password, TAN/PAN. Enter the captcha. Navigate to Downloads> Form 16A. Choose the Financial year and PAN. You can access the information of the authorized person.

Who is eligible to TDS?

The concept of TDS was introduced with an aim to collect tax from the very source of income. As per this concept, a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government.

Can I download TDS certificate?

You cannot download Form 16A on your own. You should request your deductor to provide you with Form 16A since he has deducted the TDS and filed TDS Return. He can download Form 16A at the end of each quarter from TRACES. However, you can download the tax credit statement from your account on the income tax website.

Who is eligible for TDS and TCS?

Under Section 194Q, TDS is applicable on the purchase of goods, if the amount exceeds Rs. 50 lakhs. Under Section 206C (1H), TCS is applicable on the sale of goods, if the amount exceeds Rs. 50 lakhs.

What is TDS Mauritius?

Tax deduction at source (TDS) has come into effect as from 1st October 2006. Under this system, the payer is required to deduct tax at the time the payment is received by or credited to the account of the payee.

Is TDS deducted every month?

Yes, TDS on salary is deducted every month. As per Section 192, the employer will deduct TDS on salary at the time of making the payment to the employee. Since the employee gets a salary every month, the employer will make a deduction for TDS on salary every month.

What is the TDS applicability?

TDS or Tax Deducted at Source is income tax reduced from the money paid at the time of making specified payments such as rent, commission, professional fees, salary, interest etc. by the persons making such payments. Usually, the person receiving income is liable to pay income tax.

What is the last day to pay TDS?

On or before 7 days from the end of the month in which tax is deducted. When TDS is deducted by a person (other than an office of the Government) and Assessing Officer has permitted quarterly deposit of tax deducted under section 192, 194A, 194D and 194H.

Who pays TDS Mauritius?

Tax Deduction at Source (TDS) A company is required to deduct tax at the time of payment or at the time money is credited to the payee's account, whichever is earlier. Tax is deducted usually over a range of 0.75% to 15%. If tax to be deducted is less than Rs 500, no amount shall be deducted.

When should be TDS deducted?

Introduction The concept of TDS was introduced with an aim to collect tax from the very source of income. As per this concept, a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government.

What is the TDS certificate?

Form 16/ 16A is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. These certificates provide details of TDS / TCS for various transactions between deductor and deductee.

Is it mandatory to download TDS certificate?

So it is mandatory for all diductor's to issue TDS certificates after generating and downloading the same from “TDS Reconciliation Analysis and Correction Enabling System” or TRACES Portal.

What is TDS and how does it work?

The concept of TDS was introduced with an aim to collect tax from the very source of income. As per this concept, a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government.

Who is eligible for TDS?

TDS is deducted only if your total income is taxable. However, TDS will not be deducted in case your total income is Rs. 2,50,000 and this amount is applicable for men and women below the age of 60 years. Note: TDS deduction rate on salary ranges from 5% to 30% which is equivalent to the applicable income tax slabs.

How is TDS calculated on rent in Mauritius?

The rate of tax deduction at source (TDS) on services provided by professionals will be increased from 3% to 5% and on rent paid to a resident will be increased from 5% to 7.5%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the mra tenth schedule regulation in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your mra tenth schedule regulation in minutes.

How do I fill out mra tenth schedule regulation using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign mra tenth schedule regulation and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit mra tenth schedule regulation on an Android device?

With the pdfFiller Android app, you can edit, sign, and share mra tenth schedule regulation on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is MU Revenue Authority Tenth Schedule Statement of Income?

The MU Revenue Authority Tenth Schedule Statement of Income is a financial statement required by the MU Revenue Authority that summarizes the income earned by individuals or businesses during a specific fiscal period.

Who is required to file MU Revenue Authority Tenth Schedule Statement of Income?

Individuals or entities earning income that exceeds a certain threshold, as defined by the MU Revenue Authority, are required to file the Tenth Schedule Statement of Income.

How to fill out MU Revenue Authority Tenth Schedule Statement of Income?

To fill out the MU Revenue Authority Tenth Schedule Statement of Income, gather all income records, complete the form by accurately reporting all incomes, ensuring that deductions and allowances are applied correctly, and submit it by the deadline set by the authority.

What is the purpose of MU Revenue Authority Tenth Schedule Statement of Income?

The purpose of the MU Revenue Authority Tenth Schedule Statement of Income is to provide a comprehensive overview of income earned for taxation purposes, ensuring compliance with tax regulations and facilitating accurate tax assessments.

What information must be reported on MU Revenue Authority Tenth Schedule Statement of Income?

The information that must be reported includes total income earned, details of different income sources, allowable deductions, taxable income, and any other relevant financial data as specified by the MU Revenue Authority.

Fill out your mra tenth schedule regulation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mra Tenth Schedule Regulation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.