SC ABL-107A 2010 free printable template

Show details

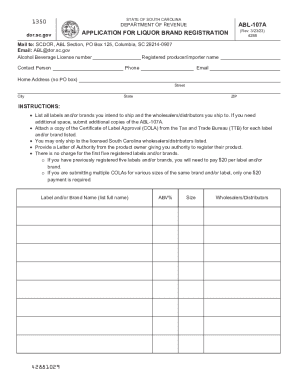

STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE APPLICATION FOR REGISTRATION OF BRANDS/WHOLESALERS OF ALCOHOLIC LIQUORS ABL107A (Rev. 8/31/10) 4288 Mail to: SC Department of Revenue, ABL Section,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC ABL-107A

Edit your SC ABL-107A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC ABL-107A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC ABL-107A online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit SC ABL-107A. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC ABL-107A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC ABL-107A

How to fill out SC ABL-107A

01

Obtain the SC ABL-107A form from the relevant authority or official website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide details regarding the purpose of the application in the designated section.

04

Attach any required supporting documents as specified in the form's instructions.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form at the bottom as required.

07

Submit the form according to the provided instructions, whether by mail or in person.

Who needs SC ABL-107A?

01

Individuals applying for a specific type of assistance related to ABL programs.

02

Organizations or agencies submitting requests for program services or benefits.

03

Residents who meet the eligibility criteria set by the governing body requiring the form.

Fill

form

: Try Risk Free

People Also Ask about

Do you need a license to sell alcohol in South Carolina?

But because alcohol is a regulated product, and one that can lead to severe consequences, the state Department of Alcohol Beverage Control requires all businesses that sell alcohol to be licensed to do so before they serve their first drink.

How long does it take to get a liquor license in SC?

The South Carolina liquor license process typically takes between 30 and 120 days, but if there are issues that come up throughout the process, it can go up to 175 days or longer.

What do you need to sell alcohol in SC?

Your place of business must have a Grade A Restaurant license issued by DHEC. Before your Liquor by the Drink License can be issued, you must furnish to the Department a copy of the inspection form given to you by DHEC showing that the Grade A Restaurant License has been issued.

What are the general regulations for alcohol in South Carolina?

The legal age to possess, purchase or consume alcohol is 21. South Carolina currently does not regulate server training. Violations of the liquor code are administrative and criminal. The minimum administrative penalty for a first offense is a $200 fine.

What is SC tax on alcohol?

What is the tax on liquor by the drink? The liquor by the drink licensee must collect an excise tax equal to 5% of the gross proceeds of the sales of liquor by the drink and remit it to the SCDOR. It does not matter if the liquor is poured from a minibottle or from a big bottle.

What is an alcohol license in SC?

Alcohol Beverage License (ABL) Retail Licenses that authorize the sale of alcoholic beverages to the public. Wholesale Licenses that authorize the purchase of alcoholic beverages from producers for resale to retailers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify SC ABL-107A without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like SC ABL-107A, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete SC ABL-107A online?

Filling out and eSigning SC ABL-107A is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my SC ABL-107A in Gmail?

Create your eSignature using pdfFiller and then eSign your SC ABL-107A immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is SC ABL-107A?

SC ABL-107A is a specific form used for reporting certain business-related information to the South Carolina Department of Revenue.

Who is required to file SC ABL-107A?

Businesses that engage in activities requiring a license or permit under South Carolina law are typically required to file SC ABL-107A.

How to fill out SC ABL-107A?

SC ABL-107A should be filled out by providing the required business information, revenue details, and relevant identification numbers as specified in the form instructions.

What is the purpose of SC ABL-107A?

The purpose of SC ABL-107A is to collect necessary data from businesses for regulatory compliance, tax assessment, and ensuring lawful operation within South Carolina.

What information must be reported on SC ABL-107A?

Information that must be reported on SC ABL-107A includes the business name, address, type of business, revenue figures, and any applicable licenses or permits.

Fill out your SC ABL-107A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC ABL-107a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.