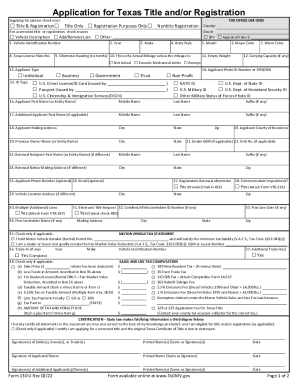

Do you need seller signature on Texas title application?

Completed Application for Texas Title and/or Registration (Form 130-U) (seller signature is not required, and may be a copy) Applicant's current driver license or government-issued photo identification.

What forms do I need to change ownership of a car?

Forms to complete Notice of change of particulars (NCP) Application for registration and licensing (RLV) Notice of change of ownership/sale of motor vehicle (NCO) Notice in respect of traffic register number (ANR)

Who fills out Form 130 Texas?

Buyer/Seller: Carefully fill out and complete the Application for Texas Certificate of Title (VTR Form 130-U). Buyer will fill out most of the form but Seller MUST fill in the vehicle sales price and sign the form.

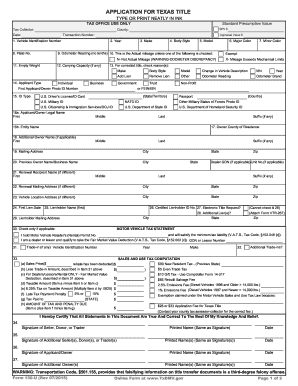

What is Form 130-U Texas?

Form 130-U The application is used by the County Tax Assessor-Collector (CTAC) and the Comptroller's office to calculate the amount of motor vehicle tax due. The application includes a motor vehicle tax statement section to document the following: the motor vehicle sales tax due on a Texas sale of a motor vehicle.

What documents do I need for Texas vehicle registration?

Registration You will need your insurance card, proof of vehicle inspection (the Vehicle Inspection Report from the inspection station), and proof you own the vehicle, such as the registration or title from your previous state.

Does Texas title transfer require notary?

While some states require the signatures to be notarized, Texas doesn't. You can have your signatures notarized if you wish, but this isn't a required step to legally transfer a title in your state.

How to fill out a Texas title transfer form?

1:20 4:13 Then you'll print the buyers name and complete address then fill in the odometer reading in theMoreThen you'll print the buyers name and complete address then fill in the odometer reading in the space provided enter your mileage exactly as it appears on your odometer.

How do I get a registration form in Texas?

For title or registration information, contact your county tax assessor-collector or the Texas Department of Motor Vehicles at 1-888-368-4689 or 512-465-3000.

Can I get a copy of my Texas registration online?

Duplicate Registration Certificate In Texas To replace your vehicle registration certificate or receipt you will need to go in person to a Texas DMV Regional Service Center or County Tax Office.

Do both parties have to be present to transfer a car title in Texas?

The Donor and Recipient must both sign the affidavit and title application. Either the donor or recipient must submit all forms and documents in person to the county tax office.

What do I do if I lost my registration renewal form in Texas?

If yours has been lost or destroyed, you can obtain a replacement vehicle registration from a Texas DMV Regional Service Center or from your county tax assessor/collector's office that issued the original registration. You will need to fill out a Request for Texas Motor Vehicle Information form (VTR-275).

How do I get a Texas vehicle registration form?

To get your Texas license plates and registration sticker, visit your local county tax-assessor collector office. You will need your insurance card, the Vehicle Inspection Report issued by the inspection station, and proof that you own the vehicle such as the registration or title from your previous state.

What is a Texas form 130-U?

Form 130-U The application is used by the County Tax Assessor-Collector (CTAC) and the Comptroller's office to calculate the amount of motor vehicle tax due. The application includes a motor vehicle tax statement section to document the following: the motor vehicle sales tax due on a Texas sale of a motor vehicle.

How to fill out a Texas title transfer form?

1:20 4:13 Texas Title Transfer SELLER Instructions - YouTube YouTube Start of suggested clip End of suggested clip Then you'll print the buyers name and complete address then fill in the odometer reading in theMoreThen you'll print the buyers name and complete address then fill in the odometer reading in the space provided enter your mileage exactly as it appears on your odometer.

What form do I need for a title transfer in Texas?

Form 130-U (Application for Texas Title and/or Registration), signed and dated by the seller(s) and buyer(s). If seller is unable to sign the Form 130-U, a Bill of Sale from the out of state seller can be provided instead. The Form 130-U can be found under the Forms tab on the TxDMV website.

How much does it cost to transfer a car title in Texas as a gift?

A $10 tax is due on a gift of a motor vehicle to an eligible party. The gift tax is the responsibility of the eligible person receiving the motor vehicle, and the person pays the gift tax to the county tax assessor-collector (CTAC) at the time the person titles and registers the motor vehicle.

Can I do a title transfer online in Texas?

1. TO COMPLETE THE TX MOTOR VEHICLE TRANSFER NOTIFICATION ONLINE: *PREFERRED METHOD* If possible, we highly recommend completing forms online instead of by mail, so you may easily save and print out a copy for your records that includes a date/timestamp.

What form is needed to transfer a car title in Texas?

Form 130-U (Application for Texas Title and/or Registration), signed and dated by the seller(s) and buyer(s). If seller is unable to sign the Form 130-U, a Bill of Sale from the out of state seller can be provided instead. The Form 130-U can be found under the Forms tab on the TxDMV website.