GA T-139 2013-2025 free printable template

Show details

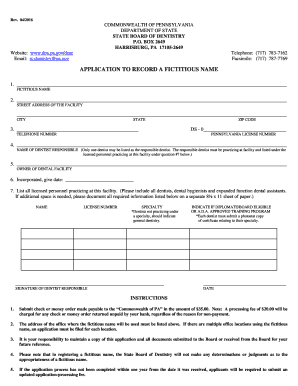

Clear Footprint Form Georgia IRP Mileage Schedule BIRD Form T139 (Revised 42013)Section 1 (1) New Account ? Noyes*(2) 5Digit GA IRP Account #(3) 3Digit GA Fleet #*If yes, attach Schedule G, Form T239

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign irp schedule b form

Edit your georgia mileage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ga mileage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irp instructions form online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit irp instructions form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irp instructions form

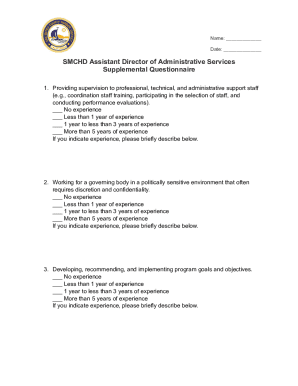

How to fill out GA T-139

01

Gather all necessary personal and financial information.

02

Start by filling out your personal details such as name, address, and Social Security number.

03

Provide information about your income, including wages, tips, and other earnings.

04

List any applicable deductions or credits.

05

Review the form for accuracy and completeness.

06

Sign and date the form before submission.

Who needs GA T-139?

01

Individuals who have taxable income and are required to report it to the state.

02

Residents of Georgia who need to file their state income taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is a mileage expense form?

A Mileage Reimbursement Form is a document that is given to the accounting department for reimbursement of the traveling costs.

What is proof of mileage for IRS?

If you're keeping a mileage log for IRS purposes, your log must be able to prove the amount of miles driven for each business-related trip, the date and time each trip took place, the destination for each trip, and the business-related purpose for traveling to this destination.

What form do I fill out for mileage reimbursement?

You can fill out Schedule C in paper form or online by using an IRS e-file or a professional tax service. If you are deducting mileage for medical purposes, the mileage deduction will be deducted as part of your total unreimbursed medical expenses on Schedule A, line 1.

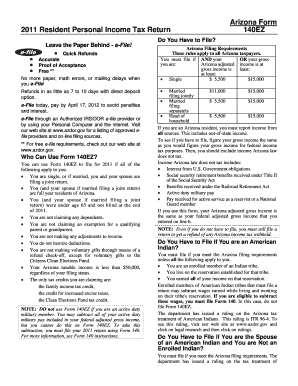

What is the mileage rate for business?

The current, 2023 federal mileage rate: 65.5 cents per mile for business purposes. 22 cents per mile for medical and moving purposes.

What is the current mileage rate?

New IRS Mileage Rates The new mileage rates are up from 58.5 cents per mile for business purposes and 18 cents per mile for medical or moving purposes in early 2022 and 62.5 cents per mile for business purposes in the second half of 2022.

How do you fix odometer discrepancy in GA?

If the title issued reflects an incorrect odometer reading as a result of a keying error and the Department's title record supports the correct information, submit: Completed and signed Form MV-18A Affidavit of Correction. Issued valid title. No fees when Department's records reflect the correct odometer reading.

What is the state of GA mileage rate?

The mileage reimbursement rate for the use of private vehicles on official Institute business, has been increased to $0.655 cents per mile, and is applicable to travel that occurred on or after January 1, 2023.

What can you do about mileage discrepancy?

If there is a discrepancy, you may either: Allow DMV to hold your title while you collect evidence of the vehicle's actual mileage. Evidence may include inspection records, maintenance records, and work orders. You may bring your evidence to the nearest DMV customer service center.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send irp instructions form to be eSigned by others?

When you're ready to share your irp instructions form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get irp instructions form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the irp instructions form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I edit irp instructions form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share irp instructions form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is GA T-139?

GA T-139 is a tax form used in Georgia for reporting specific financial information related to business activities.

Who is required to file GA T-139?

Businesses operating in Georgia that meet certain criteria, such as reaching a specific income threshold or engaging in particular types of business activities, are required to file GA T-139.

How to fill out GA T-139?

To fill out GA T-139, gather the necessary financial documents, complete the form with accurate business information, and ensure all calculations are correct before submitting it to the Georgia Department of Revenue.

What is the purpose of GA T-139?

The purpose of GA T-139 is to collect information about business activities in Georgia for tax assessment and compliance purposes.

What information must be reported on GA T-139?

GA T-139 must report information including business name, address, revenue, expenses, and other financial data pertinent to the assessment of state taxes.

Fill out your irp instructions form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irp Instructions Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.