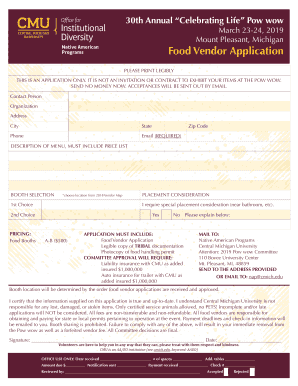

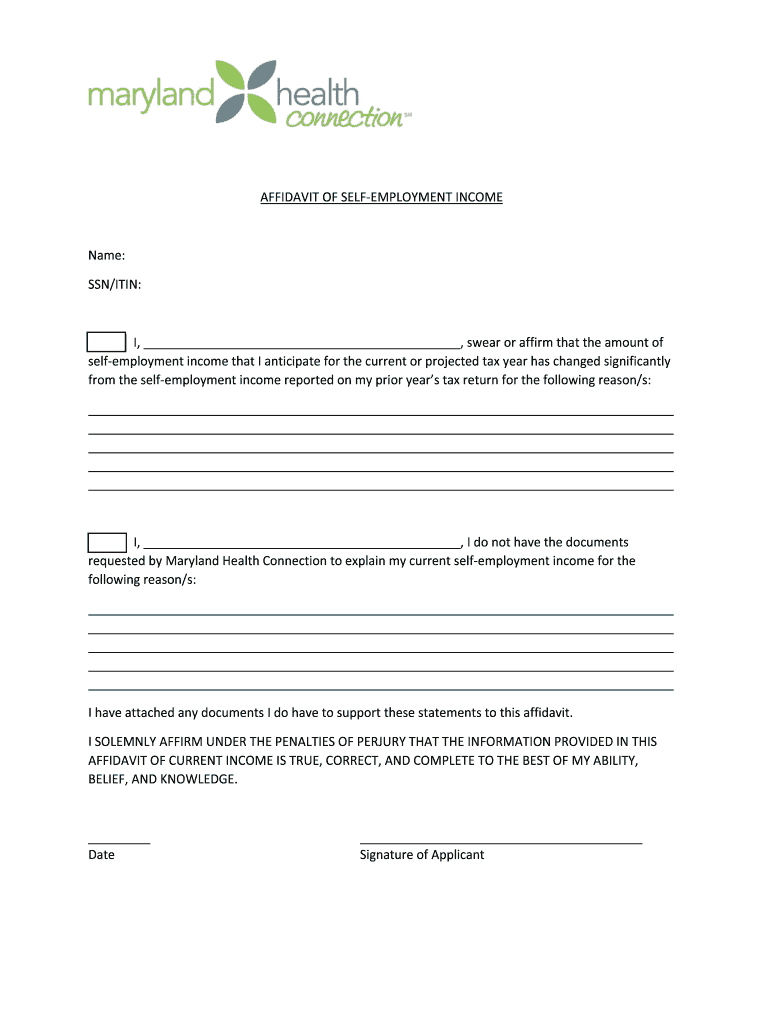

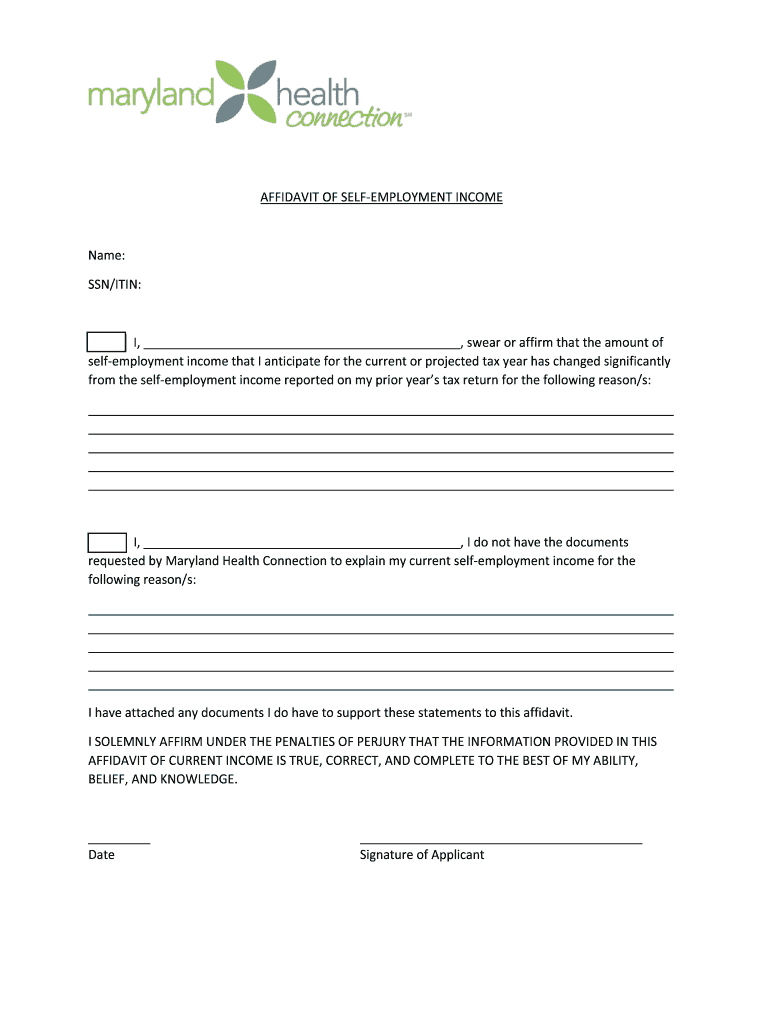

Get the free AFFIDAVIT OF SELF-EMPLOYMENT INCOME Name: SSN/ITIN: I ...

Show details

Self-employment income that I anticipate for the current or projected tax year has ... any documents I do have to support these statements to this affidavit.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign affidavit of self-employment income

Edit your affidavit of self-employment income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your affidavit of self-employment income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing affidavit of self-employment income online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit affidavit of self-employment income. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out affidavit of self-employment income

How to fill out affidavit of self-employment income:

01

Begin by obtaining the affidavit form from the appropriate authority or organization. This form may be available online or at a local government office.

02

Read the instructions on the form carefully to understand the information and documentation required.

03

Start by providing your personal details, such as your full name, address, and contact information, as requested on the form.

04

Indicate your self-employment status by checking the relevant box or providing the necessary information in the designated section.

05

Provide a detailed description of your self-employment activities, including the type of business or services you offer, the number of years you have been self-employed, and any relevant qualifications or licenses.

06

Specify your average monthly or annual income from your self-employment activities. This may require you to calculate and provide accurate figures based on your financial records or tax returns.

07

Depending on the requirements, you may need to attach supporting documents such as bank statements, invoices, receipts, or tax filings to substantiate your income claims.

08

Towards the end of the affidavit, you may be required to sign and date the document to testify that the information provided is true and accurate to the best of your knowledge.

09

Review the completed affidavit for any errors or missing information before submitting it.

Fill

form

: Try Risk Free

People Also Ask about

How do I write an affidavit for EDD?

1:36 6:15 CA EDD: How To Write An Affidavit For PUA Unemployment - YouTube YouTube Start of suggested clip End of suggested clip For example my name is shelley's millions i'm 44. And reside at 1122 future millionaires lane losMoreFor example my name is shelley's millions i'm 44. And reside at 1122 future millionaires lane los angeles california 9002 8. Step 3 is to write a statement of truth.

How do I declare income when self employed?

When you're self-employed, you pay income tax on your trading profits – not your total income. To work out your trading profits, simply deduct your business expenses from your total income. This is the amount you'll pay Income Tax on.

How do I report freelance income without a 1099?

If you did not receive a 1099 form from your employer, you are still required to report your income on your tax return. You can do this by using Form 1040 Schedule C. This form is for self-employment income and expenses. You will need to provide your Social Security number and the EIN of your business if you have one.

What is the IRS form for self-employed people?

In order to report your Social Security and Medicare taxes, you must file Schedule SE (Form 1040 or 1040-SR ), Self-Employment TaxPDF. Use the income or loss calculated on Schedule C to calculate the amount of Social Security and Medicare taxes you should have paid during the year.

How do I prove self-employment income to the IRS?

Self-employed persons, including direct sellers, report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Use Schedule SE (Form 1040), Self-Employment Tax if the net earnings from self-employment are $400 or more.

Can I earn cash in hand?

Being paid cash in hand is not necessarily illegal, but it can be if you do not declare it to HMRC. This is because you are legally obliged to pay Income Tax and National Insurance on your earnings. However, if you are only being paid a small amount, making a declaration to HMRC may not be necessary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in affidavit of self-employment income without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your affidavit of self-employment income, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit affidavit of self-employment income on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign affidavit of self-employment income on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete affidavit of self-employment income on an Android device?

Use the pdfFiller app for Android to finish your affidavit of self-employment income. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is affidavit of self-employment income?

An affidavit of self-employment income is a legal document where a self-employed individual declares their income.

Who is required to file affidavit of self-employment income?

Self-employed individuals are required to file an affidavit of self-employment income.

How to fill out affidavit of self-employment income?

To fill out an affidavit of self-employment income, one must provide accurate details of their income sources and amounts earned.

What is the purpose of affidavit of self-employment income?

The purpose of an affidavit of self-employment income is to report and declare one's self-employment earnings for taxation purposes.

What information must be reported on affidavit of self-employment income?

Information such as sources of income, amounts earned, business expenses, and net income must be reported on an affidavit of self-employment income.

Fill out your affidavit of self-employment income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Affidavit Of Self-Employment Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.