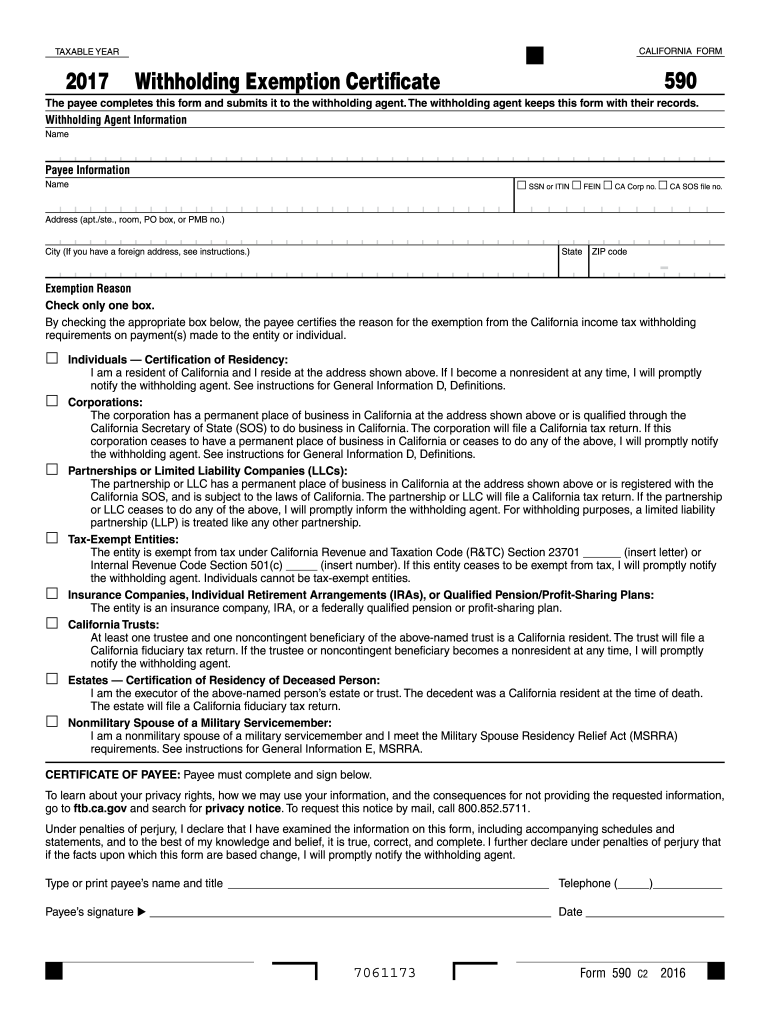

Who Files Form 590?

Form 590 is known as the Withholding Exemption Certificate. This form may be completed by the payees who are the individuals, corporations, partnerships and LCS (Limited Liability Companies), tax-exempt entities, insurance organizations, IRAs (Individual Retirement Arrangements), California trusts, estates or nonmilitary spouses of the military service members.

What is Form 590 for?

This form is used for certifying a nonresident withholding exemption. Backup withholding is another case that has nothing common with this form. This document also is not completed for reporting the employees’ wages and other related payments. The California Employment Development Department (EDD) deals with such type of payments as the employees’ wages.

When is Form 590 Due?

You must file this form before the payment is performed. If the form is completed partially, it will remain invalid. Basically, there is now a special due date regarding this certificate as it will be kept by the withholding agent with other records.

Is Form 590 Accompanied by Other Forms?

This form must be submitted separately. If you are a real estate seller in California, you must file Form 593-C that is known as the Real Estate Withholding Certificate for claiming the exemption from the withholding of the real estate.

What Information do I Include in Form 590?

The biggest part of the form is devoted to the payee information. You indicate the name, address and social security number. The withholding agent’s name must also be provided. After these fields are completed, provide the reasons for exemption. The payee must sign the document and indicate the telephone number. It is also necessary to date the certificate.

Where do I Send the Withholding Exemption Certificate?

Do not send this form to the Franchise Tax Board. Once it is fully completed, send it to your withholding agent who will keep it with other records.