Get the free maryland executor of estate form - registers maryland

Show details

Small Estate RW1103. Page 1 of 2 with Schedule B (RW1137). Will of No Estate RW1135. Page 1 of 2. Limited Order — RW1147. Page 1 of 2 with Schedule C ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign maryland executor of estate

Edit your maryland executor of estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maryland executor of estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing maryland executor of estate online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit maryland executor of estate. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out maryland executor of estate

How to fill out Maryland executor of estate:

01

Gather necessary documents: Collect important documents such as the original will, death certificate, and any relevant financial or legal records.

02

Understand the responsibilities: Familiarize yourself with the duties of an executor, such as inventorying assets, paying creditors, and distributing property according to the will.

03

Determine if probate is necessary: In Maryland, probate is generally required for estates with assets over $50,000. If the estate meets this threshold, you will need to initiate the probate process.

04

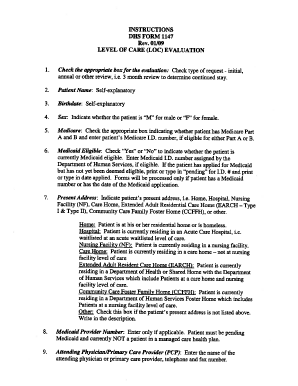

File necessary forms: Obtain the appropriate forms for opening an estate in Maryland, such as the Petition for Administration or the Petition for Probate.

05

Complete the forms accurately: Fill out the forms with accurate information, including details about the deceased, their assets, debts, and any beneficiaries.

06

Submit the forms to the appropriate court: File the completed forms with the Register of Wills in the county where the deceased person resided.

07

Pay any necessary fees: Maryland courts charge filing fees for opening an estate and publishing a notice of the administration in a local newspaper.

08

Follow the court's instructions: After filing, follow any instructions given by the court, such as publishing a notice, providing notice to interested parties, or attending a hearing.

09

Fulfill your duties as executor: Once appointed by the court, fulfill your responsibilities as executor, such as notifying creditors, managing the estate's assets, and distributing property according to the will.

10

Seek legal advice if needed: If you encounter complex legal issues or are unsure about any aspect of the executor process, consider consulting with an attorney experienced in estate administration.

Who needs a Maryland executor of estate?

01

Individuals who have been named as an executor in a deceased person's will.

02

Anyone who is responsible for managing and distributing the assets of a deceased person's estate according to Maryland laws.

03

Those who want to ensure that the deceased person's wishes are carried out and that their assets and debts are properly handled.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify maryland executor of estate without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your maryland executor of estate into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send maryland executor of estate to be eSigned by others?

Once your maryland executor of estate is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make changes in maryland executor of estate?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your maryland executor of estate and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is maryland executor of estate?

The Maryland executor of estate is a person or entity appointed by the court to administer the estate of a deceased individual, managing the distribution of assets and settling debts according to the decedent's wishes and state laws.

Who is required to file maryland executor of estate?

The executor of an estate in Maryland is required to file certain documents with the register of wills, including a petition for probate and the will (if one exists). This filing is necessary for the legal process of estate administration to begin.

How to fill out maryland executor of estate?

To fill out the Maryland executor of estate documents, you will need to gather information about the deceased's assets, debts, beneficiaries, and the will. Then, complete the appropriate forms provided by the local register of wills office, ensuring all information is accurate and complete.

What is the purpose of maryland executor of estate?

The purpose of the Maryland executor of estate is to oversee the administration of the deceased's estate, ensuring that assets are distributed according to the law or the will, debts are paid, and beneficiaries receive their rightful inheritance.

What information must be reported on maryland executor of estate?

The information that must be reported on the Maryland executor of estate includes a list of the deceased's assets, liabilities, a copy of the will (if applicable), the names and addresses of beneficiaries, and any necessary financial account statements.

Fill out your maryland executor of estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maryland Executor Of Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.