Get the free Bequests, Inter Vivos Transfers, and

Show details

Technical Paper Series

Congressional Budget OFCE

Washington, D.C. Bequests, Inter Vivos Transfers, and

Wealth DistributionShinichi Nishiyama

Congressional Budget OfceDecember 2000

20008Technical papers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bequests inter vivos transfers

Edit your bequests inter vivos transfers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bequests inter vivos transfers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bequests inter vivos transfers online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bequests inter vivos transfers. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bequests inter vivos transfers

How to fill out bequests inter vivos transfers:

01

First, gather all the necessary legal documents related to the transfer. These may include the last will and testament of the donor, any trust agreements, and relevant property ownership documents.

02

Identify and list all the assets that are to be transferred through the bequests inter vivos. These can include real estate, financial accounts, personal belongings, and any other valuable possessions.

03

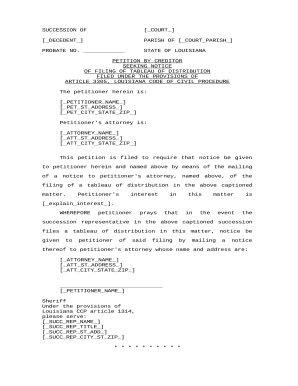

Determine the beneficiaries who will receive the assets. It is important to have a clear understanding of who the recipients are and specify their names and relationship to the donor.

04

Consult with an attorney who specializes in estate planning or probate to ensure that the bequests inter vivos transfers are being executed correctly and in accordance with the applicable laws and regulations.

05

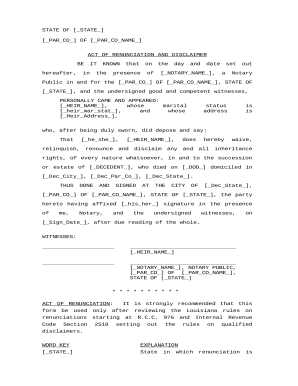

Complete the necessary paperwork to officially document the transfer. This may include filling out specific forms provided by the relevant jurisdiction or drafting legal instruments such as deeds of gift or trust agreements.

06

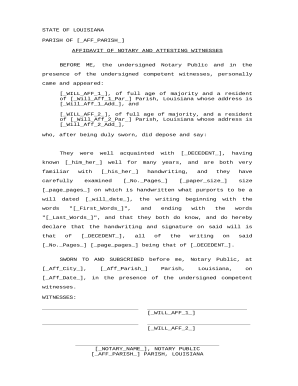

Have the completed documents reviewed and signed by all involved parties, including the donor, the beneficiaries, and any required witnesses or notaries.

07

Keep copies of all the executed documents in a safe and easily accessible place for future reference. It is also advisable to inform the beneficiaries about the bequests inter vivos transfers and provide them with copies of the relevant documents.

Who needs bequests inter vivos transfers:

01

Individuals who want to transfer their assets while they are still alive but want to maintain control over the assets until a specified timeframe or event occurs.

02

People who wish to minimize probate costs and delays by transferring their assets outside of the traditional probate process.

03

Families or individuals who want to establish a trust as a part of their estate planning strategy to protect and manage their assets for the benefit of future generations.

In conclusion, anyone who desires to transfer assets while they are alive and has specific intentions for the distribution of their wealth can benefit from bequests inter vivos transfers. It is recommended to seek professional legal advice to ensure the process is carried out properly and in accordance with the law.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my bequests inter vivos transfers directly from Gmail?

bequests inter vivos transfers and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I execute bequests inter vivos transfers online?

Easy online bequests inter vivos transfers completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make edits in bequests inter vivos transfers without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing bequests inter vivos transfers and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

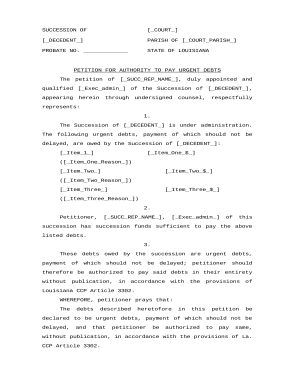

What is bequests inter vivos transfers?

Bequests inter vivos transfers refer to the transfer of property or assets from one person to another during their lifetime, typically through a will or trust.

Who is required to file bequests inter vivos transfers?

The person who is transferring the property or assets, also known as the donor or testator, is responsible for filing bequests inter vivos transfers.

How to fill out bequests inter vivos transfers?

To fill out bequests inter vivos transfers, the donor or testator must provide relevant details about the transferred property or assets, including their value, description, and any applicable documentation such as a will or trust agreement.

What is the purpose of bequests inter vivos transfers?

The purpose of bequests inter vivos transfers is to transfer property or assets to the intended recipient during the donor's lifetime, ensuring a smooth transfer of ownership and potentially minimizing estate taxes.

What information must be reported on bequests inter vivos transfers?

Bequests inter vivos transfers typically require reporting of the transferred property or assets' value, description, and any relevant documentation, such as a will or trust agreement.

Fill out your bequests inter vivos transfers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bequests Inter Vivos Transfers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.