Get the free APPENDIX: RISK-BASED CAPITAL MATRIX - occ

Show details

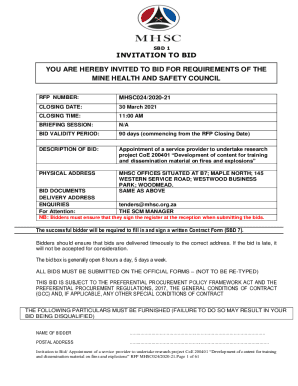

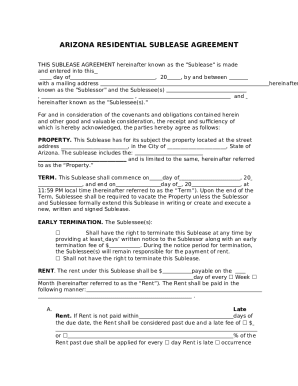

APPENDIX: RISKED CAPITAL MATRIX BANK: CITY, ST: CHARTER: MATRIX FOR DETERMINING RISKED CAPITAL LEVEL IN ENFORCEMENT ACTIONS Add the scores in each numbered category to determine how much tier 1 capital

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign appendix risk-based capital matrix

Edit your appendix risk-based capital matrix form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your appendix risk-based capital matrix form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing appendix risk-based capital matrix online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit appendix risk-based capital matrix. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out appendix risk-based capital matrix

How to fill out appendix risk-based capital matrix:

01

Start by obtaining the necessary information and data regarding your organization's capital requirements and risk exposures. This may include reviewing financial statements, risk assessment reports, and regulatory guidelines.

02

Begin populating the matrix by identifying the specific risk categories that are relevant to your organization. These may include credit risk, market risk, operational risk, and strategic risk, among others.

03

Assign a numerical rating or score to each risk category based on the severity or impact of the risk. This rating should reflect the likelihood of occurrence and its potential consequences on the organization's capital adequacy.

04

Next, assess your organization's capital position for each risk category. This involves determining the available capital, such as equity, retained earnings, and debt, that can be allocated to mitigate the identified risks.

05

Calculate the risk-based capital requirement for each risk category. This is typically done by multiplying the risk rating with the capital allocation for that specific risk.

06

Sum up the risk-based capital requirements for all the identified risk categories to obtain the total capital requirement. This will provide an overall picture of the organization's capital adequacy and its ability to withstand potential risks.

07

Review and validate the filled out matrix to ensure accuracy and completeness. Make any necessary adjustments or revisions based on further analysis or feedback from relevant stakeholders.

Who needs appendix risk-based capital matrix?

The appendix risk-based capital matrix is primarily needed by financial institutions, such as banks, insurance companies, and investment firms. These organizations are mandated by regulatory bodies to assess their capital adequacy in relation to their risk exposure. The matrix helps them evaluate, monitor, and report their risk-based capital requirements, ensuring compliance with regulatory guidelines. Additionally, organizations seeking to enhance their risk management practices and make informed decisions about capital allocation can also benefit from using the appendix risk-based capital matrix.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my appendix risk-based capital matrix in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your appendix risk-based capital matrix right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the appendix risk-based capital matrix form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign appendix risk-based capital matrix. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit appendix risk-based capital matrix on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign appendix risk-based capital matrix right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

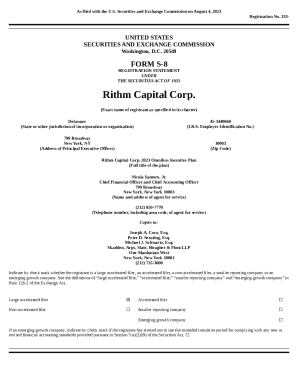

What is appendix risk-based capital matrix?

The appendix risk-based capital matrix is a regulatory tool used by insurance companies to assess their capital adequacy and determine the amount of capital required to support their risk exposures.

Who is required to file appendix risk-based capital matrix?

Insurance companies are required to file the appendix risk-based capital matrix with their regulatory authorities.

How to fill out appendix risk-based capital matrix?

The appendix risk-based capital matrix is typically filled out by assessing the various risk factors that the insurance company is exposed to, calculating the capital needed to cover those risks, and reporting the results to the regulatory authorities.

What is the purpose of appendix risk-based capital matrix?

The purpose of the appendix risk-based capital matrix is to ensure that insurance companies have enough capital to cover their risk exposures and remain financially solvent.

What information must be reported on appendix risk-based capital matrix?

The appendix risk-based capital matrix typically requires information on the insurance company's assets, liabilities, risk exposures, and capital reserves.

Fill out your appendix risk-based capital matrix online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Appendix Risk-Based Capital Matrix is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.