Get the free Nonprofit Hospitals and Tax Arbitrage - Congressional Budget Office - cbo

Show details

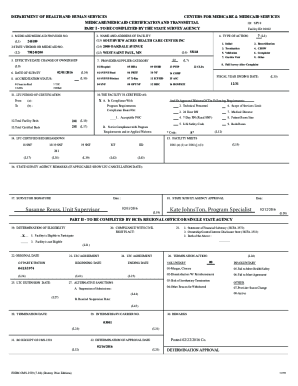

CONGRESSIONAL BUDGET OFFICE U.S. Congress Washington, DC 20515 December 6, 2006, Honorable William Bill M. Thomas Chairman, Committee on Ways and Means U.S. House of Representatives Dear Mr. Chairman:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonprofit hospitals and tax

Edit your nonprofit hospitals and tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonprofit hospitals and tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nonprofit hospitals and tax online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nonprofit hospitals and tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonprofit hospitals and tax

How to fill out nonprofit hospitals and tax:

01

Research the specific guidelines and requirements for filling out nonprofit hospitals and tax forms in your jurisdiction.

02

Gather all relevant financial and organizational documentation, such as income statements, balance sheets, and evidence of tax-exempt status.

03

Fill out the appropriate tax forms, such as Form 990, ensuring accuracy and completeness.

04

Submit the completed forms and any required supporting documentation to the relevant tax authorities.

Who needs nonprofit hospitals and tax:

01

Nonprofit hospitals and healthcare organizations are established to provide medical services to communities and operate for charitable purposes.

02

Nonprofit hospitals and healthcare organizations are generally exempt from federal income tax under section 501(c)(3) of the Internal Revenue Code.

03

Donors to nonprofit hospitals and healthcare organizations may benefit from tax deductions on their contributions, depending on local tax laws.

04

Nonprofit hospitals and healthcare organizations are often subject to certain reporting and compliance requirements to maintain their tax-exempt status. Regularly filing nonprofit hospital and tax forms is essential to ensure compliance with laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nonprofit hospitals and tax to be eSigned by others?

nonprofit hospitals and tax is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute nonprofit hospitals and tax online?

Easy online nonprofit hospitals and tax completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make changes in nonprofit hospitals and tax?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your nonprofit hospitals and tax to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is nonprofit hospitals and tax?

Nonprofit hospitals are medical facilities that operate without the primary goal of making a profit. They provide healthcare services to the community and are exempt from certain taxes. Nonprofit hospitals and tax refer to the tax regulations and reporting requirements that apply to these institutions.

Who is required to file nonprofit hospitals and tax?

Nonprofit hospitals are required to file the appropriate tax forms with the relevant tax authorities. This generally includes filing an annual information return, such as Form 990, with the Internal Revenue Service (IRS) in the United States.

How to fill out nonprofit hospitals and tax?

To fill out nonprofit hospitals and tax forms, the hospital's financial and operational information must be compiled and reported accurately. This may include disclosing details about the hospital's revenue, expenses, executive compensation, and community benefit activities. It is recommended to consult a tax professional or refer to the instructions provided by the tax authorities for specific guidance on filling out these forms.

What is the purpose of nonprofit hospitals and tax?

The purpose of nonprofit hospitals and tax regulations is to ensure transparency, accountability, and compliance with tax laws for these healthcare institutions. By requiring them to file tax forms, the authorities can assess the hospital's financial activities, verify their nonprofit status, and evaluate their community benefit practices.

What information must be reported on nonprofit hospitals and tax?

Nonprofit hospitals must report various financial and operational information on their tax forms. This typically includes details about their revenue sources, expenses, assets, liabilities, executive compensation, community benefit activities, and governance practices. The specific reporting requirements may vary by jurisdiction, so it is essential to refer to the instructions provided by the relevant tax authorities.

Fill out your nonprofit hospitals and tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonprofit Hospitals And Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.