Get the free 499R-2CW-2CPR una sola hoja Rev. 08.15. 499R-2CW-2CPR una sola hoja Rev. 08.15 - hac...

Show details

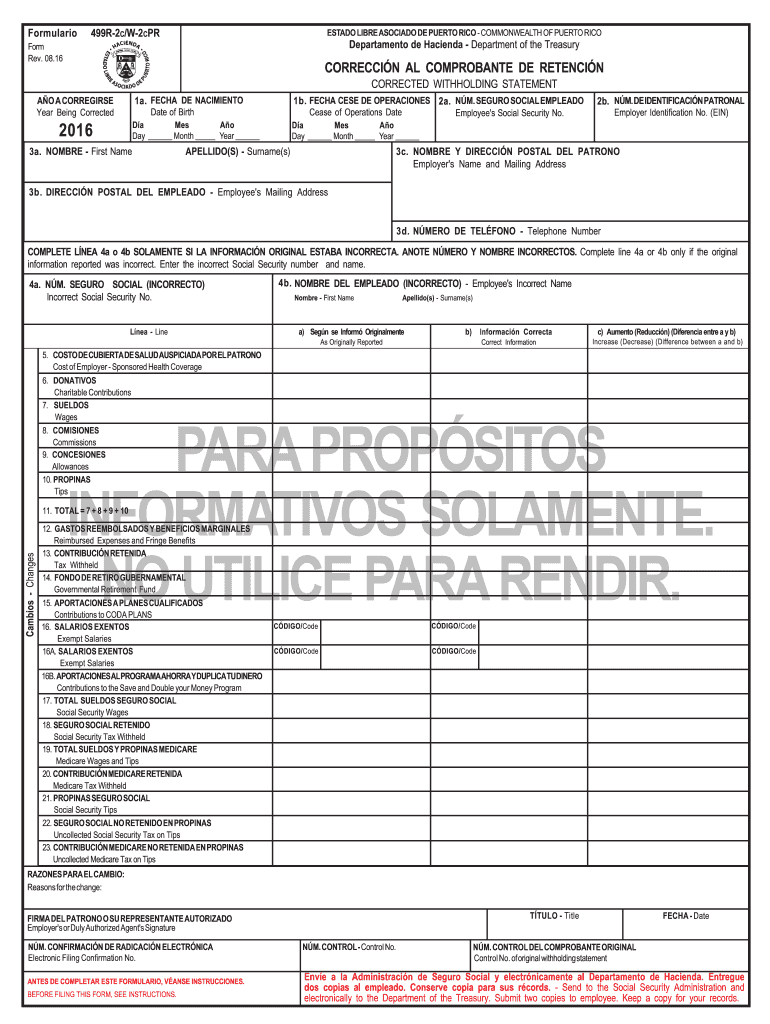

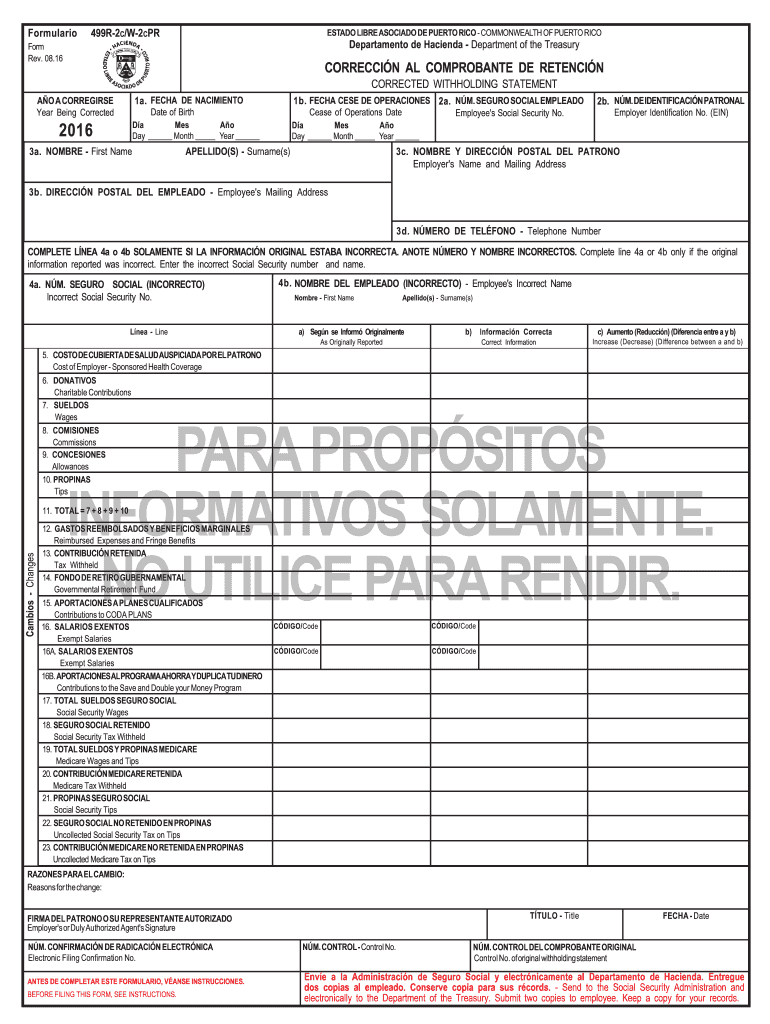

Formulation 499R2C/W2CPR ESTATE LIBRA AVOCADO DE PUERTO RICO COMMONWEALTH OF PUERTO RICO Department DE Hacienda Department of the Treasury Form Rev. 08.16 CORRECTION AL COMPROBANTE DE RETENTION CORRECTED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 499r-2cw-2cpr una sola hoja

Edit your 499r-2cw-2cpr una sola hoja form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 499r-2cw-2cpr una sola hoja form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 499r-2cw-2cpr una sola hoja online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 499r-2cw-2cpr una sola hoja. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 499r-2cw-2cpr una sola hoja

How to fill out 499r-2cw-2cpr una sola hoja:

01

Start by obtaining a copy of the 499r-2cw-2cpr form. This form is typically provided by your employer or tax authority.

02

Gather all the necessary information required to complete the form. This may include your personal details, employment information, earnings, and tax withholdings.

03

Carefully read the instructions provided with the form. These instructions will guide you through each section and help you understand the information you need to provide.

04

Begin filling out the form by entering your personal information, such as your name, address, and social security number. Make sure to double-check the accuracy of the information before proceeding.

05

Move on to the employment section of the form. Here, you will need to input your employer's information, including their name, address, and employer identification number (EIN).

06

Provide the details of your earnings and tax withholdings. This may include information such as your gross wages, federal income tax withheld, and any other deductions or credits applicable to your situation.

07

Complete any additional sections or schedules that are relevant to your specific circumstances. This may include reporting retirement plan contributions, health insurance coverage, or other taxable benefits.

08

Review the completed form for any errors or omissions. Make sure all the information provided is accurate and up to date.

09

Once you are satisfied with the accuracy of the form, sign and date it. If you are filing jointly, your spouse may also need to sign the form.

10

Retain a copy of the completed form for your records and submit the original to the appropriate entity, such as your employer or tax authority.

Who needs 499r-2cw-2cpr una sola hoja?

The 499r-2cw-2cpr una sola hoja form is typically required for employees who receive wages or salaries in Mexico. It is necessary for reporting income and ensuring correct tax withholdings. Depending on your specific employment situation, your employer or tax authority may request you to fill out this form. It is essential to consult with your employer or tax advisor to determine if and when you need to complete the 499r-2cw-2cpr una sola hoja form.

Fill

form

: Try Risk Free

People Also Ask about

¿Qué es el Formulario 499R 2 W 2PR?

El comprobante de Puerto Rico, 499R-2/W-2PR es un documento de información de contribuciones para propósitos del IRS federal. Los informes son procesados para lectura electrónica (scanning). Los que no se pueden "leer" electrónicamente, se separan para ser procesados manualmente.

¿Cómo puedo obtener mi W 2?

Si no recibes su W2 antes del 14 de febrero, puedes llamar al IRS al 1-800-829-1040. Cuando llames, se te pedirá que brindes información detallada para verificar tu identidad y recibir tu W2. Esta información incluye: Tu nombre, domicilio, ciudad, estado y código postal.

¿Qué es w2pr?

¿Qué es un W2-PR? La declaración de retención más común es la W2-PR. Todo patrono que haya pagado salarios con contribución sobre ingresos retenida en Puerto Rico deberá someter este formulario al Departamento de Hacienda ya la Administración del Seguro Social. Este formulario resume sus ingresos y retenciones para el año contributivo.

¿Qué es la 499R 2 W 2PR?

El comprobante de Puerto Rico, 499R-2/W-2PR es un documento de información de contribuciones para propósitos del IRS federal. Los informes son procesados para lectura electrónica (scanning). Los que no se pueden "leer" electrónicamente, se separan para ser procesados manualmente.

¿Qué es un PR w2?

¿Qué es un W2-PR? La declaración de retención más común es la W2-PR. Todo patrono que haya pagado salarios con contribución sobre ingresos retenida en Puerto Rico deberá someter este formulario al Departamento de Hacienda ya la Administración del Seguro Social. Este formulario resume sus ingresos y retenciones para el año contributivo .

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 499r-2cw-2cpr una sola hoja from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your 499r-2cw-2cpr una sola hoja into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute 499r-2cw-2cpr una sola hoja online?

pdfFiller has made it easy to fill out and sign 499r-2cw-2cpr una sola hoja. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for signing my 499r-2cw-2cpr una sola hoja in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your 499r-2cw-2cpr una sola hoja right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is 499r-2cw-2cpr una sola hoja?

499r-2cw-2cpr una sola hoja is a specific tax form used for reporting certain income and withholding amounts.

Who is required to file 499r-2cw-2cpr una sola hoja?

Employers who have paid wages subject to withholding must file 499r-2cw-2cpr una sola hoja.

How to fill out 499r-2cw-2cpr una sola hoja?

You can fill out 499r-2cw-2cpr una sola hoja manually or electronically, following the instructions provided on the form.

What is the purpose of 499r-2cw-2cpr una sola hoja?

The purpose of 499r-2cw-2cpr una sola hoja is to report wage and withholding information to the IRS.

What information must be reported on 499r-2cw-2cpr una sola hoja?

Information such as employee wages, withholding amounts, and employer identification must be reported on 499r-2cw-2cpr una sola hoja.

Fill out your 499r-2cw-2cpr una sola hoja online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

499r-2cw-2cpr Una Sola Hoja is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.