Get the free 2017 Estimated Tax Vouchers Form OQ-2

Show details

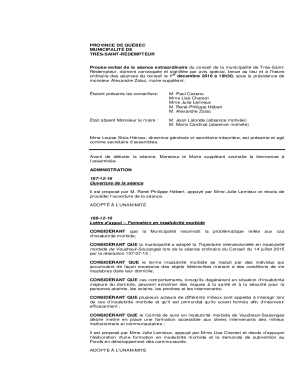

Declaration of Estimated Tax For assistance (937) 2980531Tax Year 2017Second VoucherCity of Oak wood Income Tax Department 30 Park Avenue Oak wood, Ohio 45419Form OQ$2Amount Paid Federal Identification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2017 estimated tax vouchers

Edit your 2017 estimated tax vouchers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2017 estimated tax vouchers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2017 estimated tax vouchers online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2017 estimated tax vouchers. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2017 estimated tax vouchers

How to fill out 2017 estimated tax vouchers:

01

Gather necessary information - To fill out 2017 estimated tax vouchers, collect all the relevant documents and information. This includes your income statements, deductions, and any credits you may be eligible for.

02

Determine estimated tax due - Calculate your estimated tax due for the year by considering your projected income and anticipated deductions. Use Form 1040-ES, which includes a worksheet to help you determine the estimated tax amount.

03

Complete personal information - Fill out the personal information section of Form 1040-ES, including your name, social security number, address, and filing status.

04

Annualize your income - Estimate your total income for the year by annualizing your current income. This involves projecting your income based on the earnings up until the present and extrapolating it to cover the entire year.

05

Calculate estimated tax - Use the provided worksheet on Form 1040-ES to calculate your estimated tax. Determine the amount of tax owed for each estimated payment period.

06

Fill out payment vouchers - Complete the payment vouchers section of Form 1040-ES. Indicate the payment period for which you are making the estimated tax payment, the amount you are paying, and your social security number.

07

Make a payment - Send the payment voucher along with the estimated tax payment to the IRS. You can choose to make the payment electronically or by mail. If mailing, ensure you attach a check or money order payable to the "United States Treasury."

08

Keep a record - Maintain a copy of the completed 2017 estimated tax vouchers and the proof of payment for your records. This will be helpful when reconciling your payments with your tax return for the year.

Who needs 2017 estimated tax vouchers:

01

Self-employed individuals - If you are self-employed and expect to owe $1,000 or more in taxes for the year, you likely need to file estimated tax vouchers. This includes sole proprietors, freelancers, independent contractors, and gig workers.

02

Individuals with significant unearned income - If you receive substantial income from investments, rental properties, or other sources that do not withhold taxes, you may need to file estimated tax vouchers to ensure you are meeting your tax obligations.

03

Individuals with multiple sources of income - If you have multiple jobs or receive income from various sources, estimating and paying your taxes with vouchers can help you avoid underpayment penalties.

04

Retirees not subject to withholding - Retirees who do not have income tax withheld from their pension or social security payments may need to use estimated tax vouchers to pay their taxes throughout the year.

05

Individuals with irregular income - If your income fluctuates throughout the year, estimated tax vouchers can help you manage your tax payments and avoid a large tax bill at the end of the year.

Remember to consult with a tax professional or refer to the official IRS guidelines for specific eligibility requirements and instructions on filling out the 2017 estimated tax vouchers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2017 estimated tax vouchers in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 2017 estimated tax vouchers and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit 2017 estimated tax vouchers online?

With pdfFiller, it's easy to make changes. Open your 2017 estimated tax vouchers in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete 2017 estimated tax vouchers on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your 2017 estimated tax vouchers, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is estimated tax vouchers form?

Estimated tax vouchers form is a form used by individuals to report and pay estimated taxes on income that is not subject to withholding.

Who is required to file estimated tax vouchers form?

Individuals who expect to owe at least $1,000 in taxes after subtracting withholding and credits, or if they expect their withholding and credits to be less than the smaller of 90% of the tax to be shown on their current year's return or 100% of the tax shown on their previous year's return.

How to fill out estimated tax vouchers form?

To fill out the estimated tax vouchers form, individuals must estimate their total income for the year, calculate their expected tax liability, and make quarterly payments based on these estimates.

What is the purpose of estimated tax vouchers form?

The purpose of estimated tax vouchers form is to help taxpayers avoid underpayment penalties by making timely payments throughout the year.

What information must be reported on estimated tax vouchers form?

Individuals must report their estimated total income, deductions, credits, and total tax liability on the estimated tax vouchers form.

Fill out your 2017 estimated tax vouchers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2017 Estimated Tax Vouchers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.