Get the free lifetime income report

Show details

AGO A financial lifetime income report Your Exclusive Dividend Retirement Guide The 3Step Process for Piggybacking the Canada Pension Plan When it comes to creating a simple, dependable and quite

We are not affiliated with any brand or entity on this form

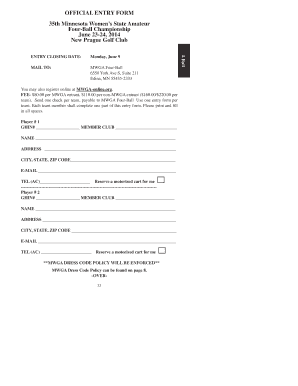

Get, Create, Make and Sign lifetime income report

Edit your lifetime income report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lifetime income report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lifetime income report online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit lifetime income report. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lifetime income report

How to fill out a lifetime income report:

01

Start by gathering all the necessary information. This includes your personal details such as full name, date of birth, and contact information. You will also need to collect financial information like your income sources and expenses.

02

Next, calculate your total income from various sources. This may include salaries, pensions, investments, and any other form of income you receive. Make sure to include all sources to get an accurate picture of your lifetime income.

03

Determine your anticipated expenses for the rest of your life. This may involve estimating your living costs, healthcare expenses, mortgage or rent payments, and any other financial obligations you have. Consider both short-term and long-term expenses.

04

Analyze your current and future financial situation. Look at your income and expenses to determine if you have a surplus or deficit. This will help you understand your financial standing and identify any areas that need adjustment.

05

Consider any life events or changes that may impact your lifetime income. This could include factors such as retirement, inheritance, or changes in employment. Adjust your income report accordingly to reflect these changes.

Who needs a lifetime income report:

01

Individuals who are planning for retirement: A lifetime income report can help individuals plan their finances for their retirement years. It provides a clear picture of their expected income and expenses, allowing them to make informed decisions about savings, investments, and budgeting.

02

Financial advisors: Professionals in the financial industry can use lifetime income reports to assist their clients in creating comprehensive financial plans. These reports can help advisors assess their clients' financial needs and guide them towards suitable investment and retirement strategies.

03

Individuals nearing retirement age: As individuals approach retirement age, it becomes crucial to have a clear understanding of their lifetime income. A lifetime income report can help them evaluate their financial readiness and make adjustments if necessary.

In summary, filling out a lifetime income report involves gathering relevant information, calculating current and future income, determining expenses, and analyzing your financial situation. It is a useful tool for individuals planning for retirement, financial advisors, and those nearing retirement age.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get lifetime income report?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific lifetime income report and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my lifetime income report in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your lifetime income report and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I fill out lifetime income report on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your lifetime income report. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is lifetime income report?

The lifetime income report is a document that details an individual's income over the course of their life.

Who is required to file lifetime income report?

Individuals who have received income in a particular year are required to file a lifetime income report.

How to fill out lifetime income report?

To fill out a lifetime income report, individuals must gather information on all sources of income and report them accurately on the form.

What is the purpose of lifetime income report?

The purpose of the lifetime income report is to provide an overview of an individual's income history for tax or financial planning purposes.

What information must be reported on lifetime income report?

Information such as wages, investment income, rental income, retirement income, and any other sources of income must be reported on the lifetime income report.

Fill out your lifetime income report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lifetime Income Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.