Get the free Tax Table (Form 40)- revenue Alabama

Show details

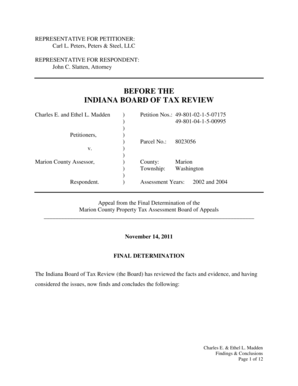

Tax Table EXAMPLE: (Form 40) Based on Taxable Income Mr. and Mrs. Brown are filing a joint return and checked box 2 on their return. Their taxable income on line 16 of Form 40 is $23,360. First, they

We are not affiliated with any brand or entity on this form

Instructions and Help about tax table form 40

How to edit tax table form 40

How to fill out tax table form 40

Instructions and Help about tax table form 40

How to edit tax table form 40

Editing tax table form 40 is straightforward. You can use pdfFiller's tools to modify text, add signatures, or annotate the form. Simply upload your existing form into pdfFiller, utilize the editing features, and save your changes. Ensure that all updated information is accurate before submission.

How to fill out tax table form 40

Filling out tax table form 40 involves several key steps. First, gather all necessary financial documents such as W-2s, 1099s, and prior tax returns. Next, follow these steps to complete the form:

01

Review the form's sections carefully.

02

Input your personal information, including your name, address, and Social Security number.

03

Enter your income details accurately, ensuring to reference the correct tax tables for your filing status.

Make sure to double-check your entries for any errors, as inaccuracies can lead to miscalculations.

Latest updates to tax table form 40

Latest updates to tax table form 40

The latest updates to tax table form 40 may include revisions to tax rate tables or changes in allowable deductions. It's crucial to review the IRS website or official resources for the most current information as tax laws can evolve annually.

All You Need to Know About tax table form 40

What is tax table form 40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About tax table form 40

What is tax table form 40?

Tax table form 40 is an IRS form used by individual taxpayers to report their income and calculate their tax liabilities. This form is essential for identifying how much tax is owed or refunded based on taxable income.

What is the purpose of this form?

The primary purpose of tax table form 40 is to provide a standardized method for individuals to file their annual tax returns. It helps taxpayers report income, claim deductions, and determine eligibility for tax credits.

Who needs the form?

Individuals who earn income in the U.S. and wish to file their tax returns must use tax table form 40. This includes employees, self-employed persons, and others receiving taxable income. Specific brackets may apply based on income level and filing status.

When am I exempt from filling out this form?

Taxpayers may be exempt from filing tax table form 40 if their income falls below a certain threshold set by the IRS, or if they meet specific criteria for dependents or special circumstances such as being a non-resident alien. It is important to verify eligibility through IRS guidelines.

Components of the form

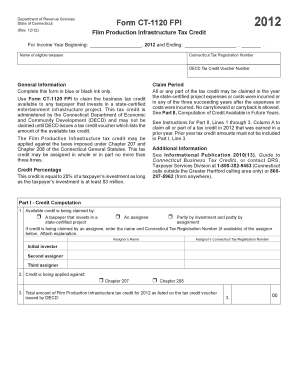

Tax table form 40 consists of various sections including identification information, income reporting sections, adjustments, deductions, and credits. Each component must be filled out accurately to ensure proper tax calculation.

What are the penalties for not issuing the form?

Failing to file tax table form 40 can result in significant penalties. The IRS may impose fines for late filing, underreporting income, or failing to pay taxes owed. Penalties can accrue daily, leading to increased financial burdens.

What information do you need when you file the form?

When filing tax table form 40, you need information including your Social Security number, total income for the year, details of any credits or deductions, and previous year tax return summaries. This comprehensive data is necessary for accurate filing.

Is the form accompanied by other forms?

Tax table form 40 may require supplementary forms, like Schedule A for itemized deductions or Schedule C for self-employment income. Be sure to confirm which additional documents are necessary based on your specific tax situation.

Where do I send the form?

The filing location for tax table form 40 depends on your residential state and whether you are sending it electronically or via mail. If filing by mail, refer to the IRS instructions for the correct address. For e-filing, follow the guidelines provided by your tax software or financial institution.

See what our users say