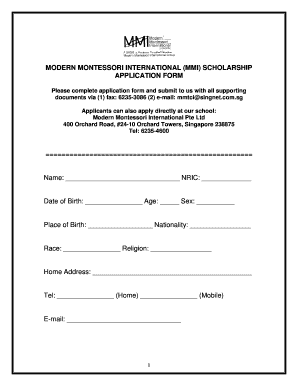

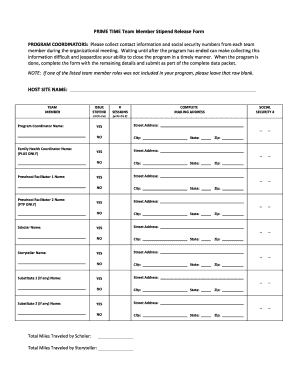

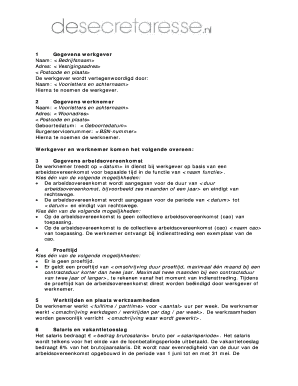

Get the free Donation Value Guide

Show details

Donation Value Guide Category Bedding Bedding Bedding Books/Tapes/Videos Books/Tapes/Videos Books/Tapes/Videos Books/Tapes/Videos Books/Tapes/Videos Clothing Clothing Clothing Item Name Bath Towel

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donation value guide

Edit your donation value guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donation value guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing donation value guide online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit donation value guide. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donation value guide

Step-by-step guide on how to fill out a donation value guide:

01

Start by gathering all the necessary information about the donated items. This includes the name of the item, its description, condition, and the estimated value.

02

Use reputable online resources or valuation guides to determine the fair market value of the items. These guides can provide you with a general idea of how much the items are worth.

03

Keep in mind that the value of donated items should be based on their current condition, not their original cost. Consider factors such as wear and tear or any damage when determining their value.

04

Consult the IRS guidelines or speak to a tax professional to understand the specific rules and regulations for claiming deductions on donated items. The rules can vary depending on the country and jurisdiction.

05

Make sure to properly document each item and its corresponding value on the donation value guide. This documentation will be essential when reporting your donations for tax purposes.

06

If you're unsure about the value of any particular item, it's always a good idea to seek professional appraisal or consult an expert in the field. Their expertise can help ensure accurate valuation and avoid any discrepancies.

07

Double-check all the information you have entered on the donation value guide for accuracy. Mistakes or omissions could lead to discrepancies during tax filing, so it's crucial to be thorough and precise.

08

Keep a copy of the completed donation value guide for your own records, along with any supporting documentation, such as receipts or appraisals.

09

Finally, submit the donation value guide and any other relevant documents to the appropriate tax authority or organization responsible for processing your donation.

Who needs a donation value guide?

01

Individuals or households who make charitable donations and wish to claim tax deductions for those donations.

02

Nonprofit organizations that receive donated items and need to accurately document the value of those items for tax or accounting purposes.

03

Tax professionals or accountants who assist clients with their tax filings and need to accurately report the value of donated items.

04

Anyone interested in keeping organized records of their charitable giving and the value of items donated.

Remember, it's always advisable to consult with a tax professional or seek guidance from the relevant tax authority to ensure compliance with the specific rules and regulations governing donations and tax deductions in your jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send donation value guide for eSignature?

Once your donation value guide is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit donation value guide straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing donation value guide.

How do I complete donation value guide on an Android device?

Complete your donation value guide and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is donation value guide?

The donation value guide is a resource that provides estimated values for donated items to help individuals and organizations determine the fair market value of their donations for tax purposes.

Who is required to file donation value guide?

Individuals and organizations who make non-cash donations exceeding $500 in value are required to file a donation value guide when claiming a deduction on their tax return.

How to fill out donation value guide?

To fill out a donation value guide, individuals and organizations need to list the donated items, their estimated values, the date of donation, and the recipient organization's information.

What is the purpose of donation value guide?

The purpose of a donation value guide is to help individuals and organizations determine the fair market value of their donated items in order to claim tax deductions.

What information must be reported on donation value guide?

The donation value guide should include details such as the donated items, their estimated values, the date of donation, and the recipient organization's information.

Fill out your donation value guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donation Value Guide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.