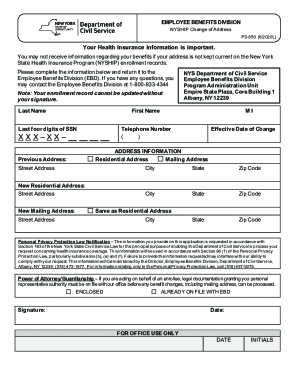

NY PS-850 2013 free printable template

Get, Create, Make and Sign NY PS-850

How to edit NY PS-850 online

Uncompromising security for your PDF editing and eSignature needs

NY PS-850 Form Versions

How to fill out NY PS-850

How to fill out NY PS-850

Who needs NY PS-850?

Instructions and Help about NY PS-850

The following information is provided for educational purposes only and in no way constitutes legal, tax, or financial advice. For legal, tax, or financial advice specific to your business needs, we encourage you to consult with a licensed attorney and/or CPA in your State. The following information is copyright protected. No part of this Lesson may be redistributed, copied, modified or adapted without prior written consent of the author. In this video, we will show you how to change your LLC's office address with the State. If you followed our strategy for the Newspaper Publication Requirement, please make sure you have filed your Certificate of Publication and waited approximately 2 months for the State to process your filing before proceeding with this Lesson. In order to change your LLC's office address with the State, you need to file what's called a Certificate of Change. Your Certificate of Change will contain basic information such as the name of your LLC, the formation date of your LLC, and your new LLC's office address. You can find your LLC's formation date in the Filing Receipt that you received back from the State when your LLC formation was approved. The filing fee for the Certificate of Change is $30. You will find the accepted forms of payment and the address where to send your Certificate of Change to listed below this video. We will now walk you through completing your Certificate of Change. You can download this form below the video. Let'get started. Here we are looking at page 1 of the Certificate of Change. I'm going to use a sample company for demonstration purposes. At the top (it says “CERTIFICATE OF CHANGE OF”), you're going to enter your LLC name in the 1st box. Next (quot;The name of the limited liability company is”), and you're going to enter your LLC name again. Scrolling down (“If the name of the limited liability company has changed the name under which it was organized is”), this is not applicable in most cases unless you change the name of your LLC. If you have not changed name of your LLC, you can just leave this box blank. Second (“The date of filing the articles of organization is”), again you're going to get the approval date from your Filing Receipt. All right, I've entered the formation date for the sample company. Let's scroll down. Third (quot;the changes effected hereby are”), we're going to check off the appropriate statements. Let's look at each of these. Now for this example that I'm showing you here, this is for the majority of our members who have used our strategy for the Newspaper Publication Requirement. They've hired a Registered Agent in Albany County, and now they're revoking that Registered Agent service, and they're going to change back to their original County. So if that's the case, the 1st box here (where it says “The county location within the State in which the office of the LLC is located, is changed to”), so we're changing this from Albany back to our actual LLC county. All right,...

People Also Ask about

What is the rule of 3 in NYS civil service?

What's a good score on a civil service test?

Is the civil service exam hard?

What is on a New York State civil service test?

How does civil service rule of 3 work?

What is a good score on the civil service test NY?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NY PS-850 on an iOS device?

Can I edit NY PS-850 on an Android device?

How do I fill out NY PS-850 on an Android device?

What is NY PS-850?

Who is required to file NY PS-850?

How to fill out NY PS-850?

What is the purpose of NY PS-850?

What information must be reported on NY PS-850?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.