KS K-BEN 987 2017 free printable template

Show details

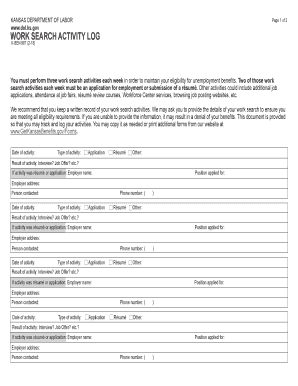

KANSAS DEPARTMENT OF LABOR www. dol.ks. gov Page 1 of 2 WORK SEARCH ACTIVITY LOG K-BEN 987 3-17 You are required to perform three work search activities each week in order to maintain your eligibility for unemployment benefits under State law. Keep all of your work search records throughout the benefit year so that you are able to provide the details when requested. Failure to provide the required details may result in a denial of benefits possible overpayment AND collection of benefits...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS K-BEN 987

Edit your KS K-BEN 987 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS K-BEN 987 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS K-BEN 987 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit KS K-BEN 987. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS K-BEN 987 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS K-BEN 987

How to fill out KS K-BEN 987

01

Gather necessary documentation: Ensure you have all relevant tax documents and identification ready.

02

Block Information: Fill in the block information at the top of the form with your name, address, and taxpayer identification number.

03

Part I - Entity Information: Choose the correct type of entity that you are representing and provide the entity's details.

04

Part II - Beneficial Owner Information: List the beneficial owners and give requested details for each, such as names and addresses.

05

Certifications: Review the certifications section and check the boxes indicating the certifications that apply to your situation.

06

Signature: Sign and date the form to validate it, ensuring that all information is accurate.

07

Submission: Submit the completed form to the appropriate financial institution or IRS as required.

Who needs KS K-BEN 987?

01

Individuals or entities claiming beneficial ownership of income from U.S. sources who are not U.S. citizens or residents.

02

Foreign investors looking to receive income such as dividends or interest without being subject to U.S. withholding tax.

03

Entities conducting business or investment activities that necessitate verification of their foreign status for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

How many months do you need to work to qualify for unemployment in Kansas?

To be eligible for this benefit program, you must a resident of Kansas and meet all of the following: Unemployed, and. Worked in Kansas during the past 12 months (this period may be longer in some cases), and. Earned a minimum amount of wages determined by Kansas guidelines, and.

Can self employed get unemployment in Kansas?

Pandemic Unemployment Assistance (PUA) is a broad program that expands access to unemployment, in addition to what state and federal law already pay. This includes those who traditionally are not able to get unemployment such as: Self-employed. Independent Contractors.

What is a 1099g form from the state of Kansas?

What is the 1099-G form? The Kansas Department of Revenue is required by federal law to issue this form to you as an informational statement for your records. It reports all state income tax overpayments in the previous year. The Internal Revenue Service will also receive the information on the 1099-G form.

What is a KBEN 44 45?

Employer Notice (K-BEN 44/45): When an unemployment claim is filed, an Employer Notice is mailed to all contributing and rated governmental base period employers and to the last employing unit that is an interested party to the claim.

What is the Kansas unemployment tax form?

In the case of unemployment, the 1099-G documents the total benefits paid to the claimant during the previous calendar year. The same information is provided to the Internal Revenue Service.

Who qualifies for Kansas Department of Labor unemployment?

To qualify for benefits you must have been paid wages from insured employment in at least two quarters with the total of your wages being at least 30 times your WBA. Insured work is work performed for employers who are required to pay unemployment insurance tax on your wages.

What is a letter of determination for unemployment in Kansas?

We'll send you a letter of determination that says you've been approved for unemployment benefits or explains why we've denied your claim. If we deny your claim, the letter includes information about how to appeal and where to send your appeal.

What is the Fair Labor Standards Act in Kansas?

The Fair Labor Standards Act: provides minimum standards for both wages and overtime entitlement. specifies administrative procedures by which covered worktime must be compensated. includes provisions related to child labor, equal pay, and travel time issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my KS K-BEN 987 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign KS K-BEN 987 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit KS K-BEN 987 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like KS K-BEN 987. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I complete KS K-BEN 987 on an Android device?

Complete KS K-BEN 987 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is KS K-BEN 987?

KS K-BEN 987 is a tax form used in Kansas for reporting certain financial information by businesses and entities.

Who is required to file KS K-BEN 987?

Businesses and entities operating in Kansas that meet specific criteria related to income and tax obligations are required to file KS K-BEN 987.

How to fill out KS K-BEN 987?

To fill out KS K-BEN 987, gather the required financial information, complete each section accurately, and ensure all necessary signatures are provided before submitting.

What is the purpose of KS K-BEN 987?

The purpose of KS K-BEN 987 is to report income and financial details to the Kansas Department of Revenue for tax assessment and compliance.

What information must be reported on KS K-BEN 987?

KS K-BEN 987 requires reporting of business income, deductions, credits, and other relevant financial information to determine tax liabilities.

Fill out your KS K-BEN 987 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS K-BEN 987 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.