Get the free w 129g

Show details

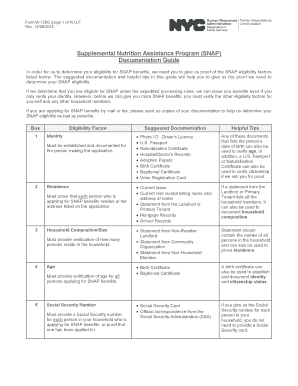

Form W129G (page 1 of 14) ELF Rev. 12/08/15 Supplemental Nutrition Assistance Program (SNAP) Documentation Guide In order for us to determine your eligibility for SNAP benefits, we need you to give

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form w 129g

Edit your w 129g form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w 129g form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w 129g form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit w 129g form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out w 129g form

How to fill out form w 129g:

01

Obtain the form: The form w 129g can be obtained from the official website of the relevant government authority or from authorized agencies.

02

Provide personal information: Fill in the required personal information such as your full name, address, social security number, and date of birth.

03

Specify your immigration status: Indicate your current immigration status, whether it is nonimmigrant, immigrant, or refugee/asylee.

04

State your travel plans: Provide details about your intended travel plans, including the purpose and duration of your trip.

05

Attach supporting documents: Ensure that you attach any necessary supporting documents like copies of your travel itinerary, visa, or approval notice.

06

Complete the declaration: Sign and date the declaration confirming the accuracy of the information you provided and that you understand the penalties for providing false information.

07

Submit the form: Make sure to submit the completed form w 129g to the designated address either by mail or through an online submission process.

Who needs form w 129g:

01

Individuals with pending immigrant visa applications: Form w 129g is typically required for individuals who have applied for an immigrant visa and need to obtain a travel document or reentry permit before traveling internationally.

02

Refugees and asylees: Those who have been granted refugee or asylum status in the United States may require form w 129g to obtain a Refugee Travel Document.

03

Nonimmigrants: In certain circumstances, nonimmigrant individuals may also need to complete form w 129g, such as when applying for a reentry permit or travel document to avoid abandonment of their status.

Please note that the specific requirements and eligibility criteria may vary, so it is advisable to consult the official instructions and guidelines provided with the form or seek guidance from an immigration attorney or advisor.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of household composition?

a person who lives alone. a person who lives with others but purchases food and prepares meals separately; or. a group of people living together who purchase food and prepare meals together.

What is the highest income for food stamps in 2023?

For a family of three, the poverty line used to calculate SNAP benefits in federal fiscal year 2023 is $1,920 a month.

What is Form W 129G?

The Supplemental Nutrition Assistance Program (SNAP) Documentation Guide (W-129G) form is mailed along with the W- 132S form. Note: The Supplemental Nutrition Assistance Program (SNAP) Request for Contact/Missed Interview (LDSS-4753) form is used to request mandatory documentation.

What is the income limit for SNAP in NY?

But, the only way to determine if your household is eligible for SNAP benefits is to apply.Income Guidelines for Households without Earned Income (no elderly or disabled member) Family SizeMonthly Gross Income*Annual Gross Income*1$1,473$17,6762$1,984$23,9403$2,495$29,9404$3,007$36,0845 more rows

What documentation is required for SNAP benefits in Florida?

Full Name, Social Security Number, and Date of Birth. Proof of U.S. Citizenship and Identity [PASSPORT, DRIVERS LICENSE, BIRTH CERTIFICATE, ETC.] Monthly Income Information [FROM A JOB, SOCIAL SECURITY, AND OTHER INCOME SOURCES] Amount of Monthly Expenses [DEDUCTIONS INCLUDING HOUSING, UTILITES, MEDICAL EXPENSES, ETC.]

What is the highest income for food stamps?

For fiscal year 2023 (Oct. 1, 2022 – Sept. 30, 2023), a two-member household with a net monthly income of $1,526 (100% of poverty) might qualify for SNAP. It's important to keep in mind that a variety of allowable deductions, including those for excess medical expenses, can help you meet the net income test.

What is proof of household composition NYC?

If a statement from the Landlord or Primary Tenant lists all the household members, it can also be used to document household composition. Must provide verification of how many persons reside in the household. Statement should contain the names of all persons in the household and can also be used to prove residence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the w 129g form electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your w 129g form in seconds.

Can I edit w 129g form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign w 129g form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How can I fill out w 129g form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your w 129g form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is form w 129g?

Form W-129G is a form used by certain entities to apply for a waiver from the Internal Revenue Service (IRS) for the withholding of taxes on certain types of income.

Who is required to file form w 129g?

Entities that receive income subject to withholding under chapters 3 and 4 of the Internal Revenue Code, and who are eligible to claim a tax exemption or reduced withholding rate, are required to file Form W-129G.

How to fill out form w 129g?

To fill out Form W-129G, provide the requested information in the designated fields, including entity details, tax identification numbers, and applicable reasons for claiming a tax exemption or reduced withholding.

What is the purpose of form w 129g?

The purpose of Form W-129G is to ensure non-resident entities can claim an exemption or reduced withholding rate on income received from U.S. sources, thereby facilitating compliance with U.S. tax laws.

What information must be reported on form w 129g?

Form W-129G requires reporting of the entity's name, address, taxpayer identification number, type of income, and the basis for claiming a withholding exemption or reduced rate.

Fill out your w 129g form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

W 129g Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.